NEW YORK (CNN/Money) -

Blue chips tumbled Wednesday, dragged down by surging oil prices and weakness in producers of metals and other commodities.

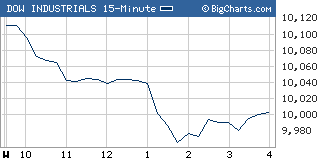

The Dow Jones industrial average (down 74.85 to 10,002.33, Charts) lost 0.7 percent, closing just above the key psychological barrier of 10,000.

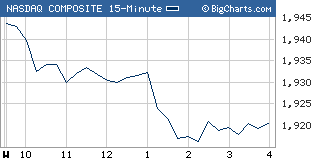

The Standard & Poor's 500 (down 8.19 to 1,113.65, Charts) index lost 0.7 percent, and the Nasdaq composite (down 4.64 to 1,920.53, Charts) lost 0.2 percent.

Stocks started in positive territory, with investors scooping up tech shares in response to results from Intel and Yahoo!. But the optimism withered in late-morning trading as oil prices turned higher and commodities stocks began to fall, said Tom Schrader, managing director of listed trading at Legg Mason.

The sell-off in commodities happened amid new reports that China would be taking measures to slow its rapid economic growth, which would, in turn, hurt demand for copper, steel and aluminum.

"A slowing Chinese economy would put a damper on commodity prices," Schrader added. "People are concerned that slowdown would hurt the global economy."

These concerns sparked a sell-off in the commodities futures markets and in many of the stocks. The selling spread to the broader market, with 24 out of 30 Dow components closing lower.

The one-two punch to blue chips was completed by a surge in crude oil. U.S. light crude for November delivery added $1.13 to settle at $53.64 on the New York Mercantile Exchange.

Investors Thursday will be attuned to the weekly crude inventory data from the U.S. Department of Energy, due out in the morning.

Additionally, Thursday brings the week's first batch of economic news, with the release of weekly jobless claims, the trade balance and import/export prices all expected in the morning.

Wednesday night brings the third and final debate between President Bush and democratic nominee John Kerry. The response to the debate may also influence trading early Thursday.

Finally, earnings continue to pour in, with results due before the bell Thursday from Citigroup (Research), Bank of America (Research) and General Motors (Research).

In other news, after the close Wednesday, Apple Computer (Research) reported fiscal fourth-quarter earnings and revenue that rose from a year ago and surpassed expectations. The company also boosted its sales and earnings forecast for the first quarter. Shares gained after the bell.

Novellus Systems (up $0.34 to $26.88, Research) warned after the close that sales, earnings and orders will all fall in the fourth quarter from the third. That overshadowed the company's in-line third-quarter earnings, and shares fell 5 percent after the close.

Shares of SanDisk (down $0.10 to $28.20, Research) plunged 18 percent in after-hours trade, after the computer-memory-card maker reported quarterly earnings and revenue that rose from a year earlier but were shy of estimates.

What moved?

Among metals and other commodity-related stocks falling, Dow stock Alcoa (down $1.00 to $32.19, Research) fell 3 percent and Exxon Mobil (down $0.89 to $48.48, Research) lost 1.8 percent.

Adding to the pullback, Prudential Equity Group downgraded metals Inco Limited (down $2.24 to $35.26, Research) and Freeport McMoran (down $3.43 to $36.40, Research).

Some upbeat earnings helped protect the tech-fueled Nasdaq from bigger losses.

Chip leader Intel (up $0.71 to $20.99, Research) reported sales and earnings late Tuesday that grew from a year earlier and were roughly in line with Wall Street's reduced expectations. The company also said inventories had declined in the quarter, which was reassuring to investors concerned about excess inventories and slower demand.

However, the company also issued fourth-quarter guidance that is weaker than current estimates.

Investors seemed to take a could-have-been-worse attitude and pushed the shares 3.5 percent higher.

Other chips rose, too, pushing the Philadelphia Semiconductor index, or the SOX, up 1.8 percent.

Yahoo! (up $0.73 to $34.96, Research) also reported results late Wednesday. The Web search provider said it earned 9 cents per share, in line with estimates and up from a year ago. The company also issued a fourth-quarter and full-year revenue forecast that is roughly in line with estimates. Shares rose 2.1 percent.

Also helping temper the negativity: McDonald's (up $1.31 to $28.86, Research), which issued an upbeat preannouncement, saying that quarterly earnings rose more than expected, due to a rise in September sales in the U.S. and internationally. Shares rose 4.75 percent.

Market breadth was negative. On the New York Stock Exchange, decliners topped advancers by more than two to one on volume of 1.54 billion shares. On the Nasdaq, losers beat winners three to two as 1.78 billion shares changed hands.

Treasury prices inched higher, pushing the 10-year note yield down to 4.06 percent from 4.10 percent late Tuesday. Treasury prices and yields move in opposite directions.

In currency trading, the dollar gained versus the yen and euro.

COMEX gold fell $2 to $414.60 an ounce.

|