NEW YORK (CNN/Money) -

The cult of Apple found new life in 2004.

No longer just a company for devotees of its Mac line of computers, Apple was the hot tech stock last year thanks to its wildly successful iPod digital music player. Many users of PCs running on Microsoft's Windows could be spotted wearing the iPod's trademark white headphones.

But there was more to the Apple story than the iPod. Apple's fiscal 2004 sales grew in every one of its product categories, helping the company to consistently blow away earnings per share forecasts.

It's little wonder that Apple (Research) stock gained more than 200 percent last year, making it one of the best performers in the S&P 500.

The buzz doesn't seem to be dying down either. Rumors are starting to percolate about new product launches at the upcoming Macworld Expo to be held next week in San Francisco.

Some Mac watchers think Apple may unveil an iTunes compatible phone from Motorola, a flash-memory based iPod that would cost significantly less than other iPods and a cheaper version of its iMac computer.

And the company's fiscal first-quarter results, which should feature some boffo holiday sales of the iPod, are scheduled for release Jan. 12. Wall Street expects sales to increase 56 percent from the same period a year ago and for earnings to increase by 200 percent.

But Apple's renaissance has pushed the stock toward $70 from just $14 in April 2003. So is it too late for investors to grab a piece of the Apple pie?

We all scream for iPod

The sleek-looking iPod defined digital music in 2004.

According to data from market research firm NPD Group, the iPod recently captured more than 90 percent of the U.S. market for music players using hard drives. Including cheaper flash-memory based products, iPod accounted for nearly 60 percent of the entire digital music player market.

Sales of the iPod surged 279 percent in fiscal 2004 and as a result, revenue from the iPod and other music products, such as online music store iTunes, accounted for nearly 20 percent of Apple's overall top line in 2004.

But analysts say the company can't depend indefinitely on just music for growth as some think consumers will eventually crave a single device that does it all -- plays music, takes photos, makes phone calls and sends e-mail.

Apple did add photo storage capability to the iPod late last year though. And bullish analysts say that Apple, a notably innovative company, should stay ahead of the curve.

So don't rule out future versions of an iPod with even more multimedia features.

Big Mac?

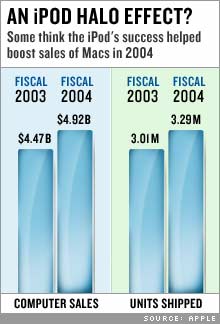

Despite all the iPod hype, the Mac is still Apple's bread and butter. So no matter how popular the iPod gets, Apple will need to post solid sales and profit gains from its computer business. But some analysts think the iPod could be the best advertisement for the Mac.

In a recent survey conducted by Piper Jaffray, 6 percent of iPod users said they'd switched from PCs to Macs after buying the music player, and another 7 percent said they would make the switch in the next 12 months.

Overwhelmingly positive reviews of iPod, according to Piper Jaffray, have made the Apple name synonymous with customer satisfaction and reliability. And Apple bulls are banking on this so-called halo effect to lift sales of not only Macs but Apple's iTunes, iMovie, iPhoto and iDVD software as well.

Some Mac watchers also say mounting security problems that have hit computers running on Windows hard will leave consumers eager to purchase Macs, which have been relatively immune to worms and viruses.

Buyer beware

Despite the stock's strong performance in 2004, Wall Street analysts still have a mixed opinion on the stock. According to Thomson/First Call, eleven analysts have Apple rated a "buy" or "strong buy" while 12 have it rated a "hold."

Shares are trading at nearly 44 times fiscal 2005 earnings estimates of $1.49 so they are not cheap. Then again, earnings are expected to more than double this year and grow at an average rate of 20 percent annually for the next few years.

And the company does have nearly $14 a share in cash on its balance sheet. If you subtract that, the company's underlying business is trading at about 33 times estimates. That's still pricey but it's more in line with the P/E ratios of hardware companies Dell and Gateway.

So if you're a long-term investor, it's hard to find any worms in the Apple story. But investors should realize that the stock could be volatile in the near-term. Expectations for hot new products coming out of Macworld and strong earnings are so high that the slightest disappointment could trigger a violent sell off.

|