|

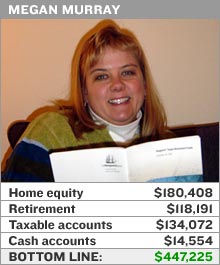

| Note: Her outstanding mortgage principal is excluded. |

|

|

|

|

|

|

|

|

|

NEW YORK (CNN/Money) - Is it possible to get rich in the army? Megan Murray thinks so.

Murray, 38, joined the military on an ROTC scholarship at Northern Illinois University. She became an officer after graduation and spent three years in active duty before transferring to the reserves.

Financially, Megan is in good shape, with a net worth totaling $447,225. It isn't just the paycheck that got her there -- a keen interest in personal finance played a big role.

A near 17-year veteran, Megan intends to stay, at the very least, another six years in order to qualify for a military retirement. (Service personnel need 20 years of service, but Megan spent three years on inactive status training for her civilian career, in civil aviation security.)

Two years ago, Megan was called up for active duty. She's bringing home nearly $68,000 annually during the deployment, plus an estimated $2,600 each month from her non-taxable food and housing per diem.

The math works out to be about $16,000 less than the $115,000 she makes when working and doing reserves part-time, but she doesn't seem to mind.

"I intend to go as long as possible," she said. "We don't make huge salaries in terms of what can be made in America. But our work is so important that I want to make my life out of it."

Assets in reserve

Megan's military pension is based on the number of years she spends in the reserves and the number of points she earns doing active duty. Assuming she's never deployed again, her monthly retirement payout would equal some $1,800 in today's dollars by the time she is 60.

That pension isn't her only means of retirement income, either. Megan maximizes her contributions to a thrift savings plan, or TSP, which she defines as the federal equivalent to a 401(k).

"There are three parts to our retirement savings program: TSP, Social Security, and the pension," she explains. "The TSP has the biggest potential."

Megan qualifies for two different TSP plans because she is a federal employee and reservist. She receives a 5 percent match from her civilian plan -- the army plan doesn't have a match -- but she can't make contributions to her civilian plan while deployed.

She also stashes the maximum allowed in her Roth IRA, bringing her total retirement savings to $118,191. The core of her portfolios is invested in mutual funds, mostly Vanguard.

Megan has a separate stock account, worth $14,554, but plans on moving her money into a fund. "With the amount of time it takes me to research it, it's better for me to invest in mutual funds," she says.

She links all her accounts through Vanguard so that she can track them and review her allocations each month. She earmarks her mid-month paycheck for investing and has it automatically deducted from her checking account.

Her next move may be in real estate. Her Las Vegas-area home has appreciated considerably in the past couple of years, but she is looking at different prospects across the country.

Megan owes about $119,590 on her 15-year mortgage, but with a 5.25 percent interest rate she sees no need to pay it off early.

Drilling it home

Megan has no debt outside her mortgage and never carries a balance on her Discover card. Student loans aren't a problem either, as the army is also picking up the tab for her MBA at the University of Illinois at Chicago, where she is studying part-time.

When she leaves the army Megan wants to be a financial adviser or counselor, in part because of all the fun she's had managing her own money.

"People should have as much fun with their investments -- shopping for investments -- as shopping at the mall," Megan stated.

It's a habit that builds net worth. That's one of the reasons why the sale-only shopper frequents Wal-Mart and Kohl's rather than higher-priced boutiques.

One of her savvier purchases was a 2003 Honda hybrid that allowed her to take a $2,000 tax deduction the year she bought it. She doesn't budget for gas anymore, although it will take her a couple of years to recoup the difference between the higher sticker price and gas savings.

Megan also takes full advantage of many of the discounts military life has to offer, such as free dental and medical care as well as discounted insurance through USAA.

Holding onto her earnings is her No. 1 priority, but stresses that investing early is just as important.

"Make wise decisions now, and it will pay off," she said. Good lesson.

|