|

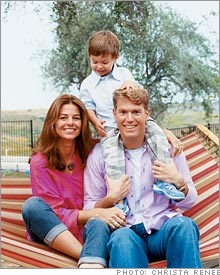

| Laura, Aiden and Ryan Rothschild |

|

|

|

|

|

|

|

|

|

NEW YORK (MONEY Magazine) -

Twenty-four-year-old Kelly Pearson says the $580,000 ranch-style house she bought near downtown San Diego last August is a dream come true.

It is nice: 1,450 square feet, four bedrooms, two baths, crown molding, a big kitchen with an island and -- quick! duck! -- a 737 jet descending upon her roof with what feels like 10 feet to spare.

Pearson barely flinches. You see, her half-million-dollar-plus house sits just 1,000 yards from the airport's single runway. She's grown accustomed to the near-constant flybys, even if visitors must resist the urge to dive for cover when a plane thunders down. The low, barreling boom of the FedEx jets, biggest of the bunch, rattles the windows. "Every morning," she says, "10:45 on the dot."

With no savings, and a college loan to repay, Pearson took out a mortgage for 100 percent of the price of the house. Closing costs were paid for by a $10,000 gift from her parents (money first earmarked for her wedding).

But if Pearson has any doubt about being leveraged up to the eyeballs on a house next door to a major airport, she's not showing it. The rent she's getting on three of her bedrooms covers most of her monthly mortgage nut. Besides, a smaller house across the street just sold for $740,000, so Pearson figures her place is already worth $200,000 more than she paid.

Her plan: to borrow more soon and invest in a condo. "Where else can you turn a huge profit on a house in eight months?" she asks. "The possibilities in San Diego are unreal."

Unreal, indeed. Across the country, talk of whether home values will continue soaring or begin to level off or even tank is starting to drown out every other topic.

Whatever happens, it's clear that something big and basic in the way Americans think about housing has changed. Used to be you'd start with something modest, then move up as your family (and income) grew. And that was pretty much the end of it. A house was a home first and an investment second, if at all.

No more. For many of us a house has become a way to pay for retirement or the kids' education, or simply a way to get rich.

This new definition of house and home is on particular display in San Diego, where home values -- up 138 percent over the past five years -- have risen faster than in any other big-city area.

It's always been a nice place to live. But now families move every few years to ever-grander and larger homes. It's a new land of his-and-hers walk-in closets, flat-panel TVs and backyard patios with outdoor fireplaces and built-in grills.

There's little apparent anxiety about prices. Even amid recent hints of a slowdown -- houses are taking longer to sell, for instance -- most residents that MONEY spoke with expect prices to continue rising at a nice clip (see price forecasts for San Diego and other areas across the nation by clicking here).

Actually, the cocktail-party conversations in San Diego about rising real estate values are similar to what you might hear in New Jersey or Florida or Illinois. Every market is different, of course, but as Americans rely more and more on real estate for their wealth, in some ways we are all San Diegans now.

Move. Profit. Move. Profit...

North Torrey Pines Road runs up the coast just north of San Diego, descending from a cliff to the ocean. It offers a beautiful view of the Carmel Valley.

Much of the valley used to be flower farms and riding trails, but since even a small bungalow in the area's beach communities can now command $2 million, San Diego is rapidly expanding east. Freshly baked stucco homes line Carmel Valley Road far into the desert.

Manuel Altamirano is a 32-year-old software salesman who grew up in Chula Vista, a largely Hispanic neighborhood near the Mexican border. That's where he bought his first house in 1998: a one-story, 1,200-square-footer with three bedrooms and one bath, for $150,000. He and his wife Eva, 33, put $10,000 down, nearly everything they had. Two years ago they sold it for $320,000, netting $150,000 after commissions and fees.

Most of that windfall went into a down payment and upgrades for their current 2,400-square-foot home in Rancho Bernardo, just north of Carmel Valley. The house cost $533,000, but real estate agents tell the Altamiranos it is now worth as much as $800,000 -- meaning their initial $10,000 investment has grown in seven years to about $294,000.

After just two years in their new house, the Altamiranos are looking to move again. This time, Manuel says, he wants something with 3,000 square feet, and he figures he can spend as much as $875,000.

"We got that equity the first time and have been able to roll it over and over," he marvels. "We've been fortunate."

Ryan and Laura Rothschild have also succeeded in San Diego real estate without really trying. As newlyweds, they rented in Carmel Valley. Then in October 2001, looking for a bargain, they moved to San Marcos, one of greater San Diego's northernmost towns, buying a 4,000-square-foot house for $576,000.

Two years later, Ryan, 31, who owns a costume-making company, and Laura, 36, a professional photographer, sold it for $800,000 and moved into a newly constructed 5,600-square-foot house in Santaluz that cost $1.35 million.

But new houses -- even multimillion-dollar ones -- come with few frills in San Diego. The Rothschilds spent another $850,000 upgrading their home, adding wood flooring and granite countertops, installing beams across the ceilings and turning mounds of dirt into a lovely garden.

Did they ever feel nervous about spending so much? Not a chance. Brokers tell them their house would now sell for $2.8 million, or $600,000 more than they've spent after renovations.

"It's a merry-go-round in San Diego," says Ryan. "You've got to get on the ride. One house parlays into the next."

A $400,000 fixer-upper

La Mesa, about 10 miles east of downtown, is in the midst of a massive upgrade. It's one of San Diego's oldest communities, and many of its signature ranch houses were built in the 1930s and '40s. Now two-story stucco digs are popping up, and renovated homes start at $700,000. Owners new and old are sprucing up their properties, and investors are snapping up run-down houses in hopes of making a killing.

Occupational therapist Angie Carter-Donovan, 31, persuaded her husband Ted, 42, to buy a 1,900-square-foot mess in La Mesa last May for $396,000. It's her fourth real estate investment in seven years, even though the previous one (a new downtown condo she planned to flip) took six months longer to sell than expected. Still, the couple netted nearly $95,000 from that deal and have been pouring money into the La Mesa house ever since.

It's on three-quarters of an acre, one of the biggest lots in the neighborhood, but it needs work. A lot of work. The front door doesn't open. The pipes make loud noises and shake when the water runs. It has -- how to put it? -- that old-house smell.

Carter-Donovan doesn't mind one bit. She believes it'll cost about $100,000 to gut the place and re-landscape. She's pregnant now and hopes the major improvements will be completed by October, when her baby is due. It'll be well worth the muss and fuss, she says, since the house should be able to sell for $750,000 when everything is done.

Meantime, she and her husband are already thinking about the next property: As soon as the renovated La Mesa house can be reappraised for more, they plan to borrow against it and invest again.

"It's hard for me to think of a house as anything other than an investment," she says. "There is just so much money to be made in this market, it's hard to pass up."

Near the limit?

These days, everybody knows someone who has made money in real estate, and rising prices have become a national preoccupation. We are a wealthier country than we have ever been, so it makes sense that we would spend more on real estate, pushing prices to new highs. But there has to be a limit somewhere. Right?

There are hints that San Diego might be finding the answer. For instance, it took 60 days for the average detached home to sell during February -- the latest month for which such statistics are available -- up from 39 days in February 2004. (January's days-on-the-market numbers also were higher this year than last.)

In addition, the number of homes sold in San Diego in March fell compared with the number sold in March 2004, the eighth monthly year-over-year decline in nine months. And that didn't happen because fewer people wanted to sell their houses. The number of San Diego listings swelled 27 percent in March, to 7,062 houses for sale, up from 5,555 for sale in March 2004.

It may be that housing prices here have just raced ahead of buyers' ability to pay. In 2004, the City of San Diego estimates, local incomes grew just 1 percent. But housing prices leaped 24 percent, reports the Office of Federal Housing Enterprise Oversight. Now, according to the California Association of Realtors, only 11 percent of families in San Diego using a standard mortgage (30 years at a fixed rate, with a 20 percent down payment) can afford a median-priced home here, which in March was $588,000.

The rub is that fewer and fewer San Diegans have a standard mortgage. According to PMI Mortgage Insurance Co., more than two-thirds of the loans to buy homes here last year were interest-only mortgages, which have much lower monthly payments but much bigger bills to pay down the road. (See "The Miracle Mortgage.")

What's more, 40 percent of the 18,400 net new jobs (jobs created minus jobs lost) in San Diego last year were in construction and real estate, reports the State of California.

This raises the risk that any downturn in housing prices could cascade through the economy. Falling prices would translate into lower incomes for all those people working in real estate, which means less for them to spend on homes, which would depress prices further. A nasty cycle.

Rising home prices are now straining the ability to move up in San Diego, a process that has long greased the wheels of the area's housing market.

Even at the higher end, where people move into mansions near the beach and make room for others lower on the housing chain, families are struggling to afford the space they want.

Michael and Cheryl Roberts, 39 and 37, have been house hunting for six months. They bought their current home, a four-bedroom, 2.5-bath ranch house that sprawls for 2,650 square feet, for $883,000 in the middle of 2001. At the time, Michael, who owns a flag-making company, and Cheryl had two sons. But the addition of a baby girl last year is starting to make their home -- now worth $2.3 million, they believe -- feel cramped.

The Robertses want to remain in La Jolla, where Cheryl has lived for most of her life and where their children go to school. But it's hard to find anything larger that they can afford.

The Robertses recently saw a $6 million spread that required too much work. The kitchen was old and small; the house had a poor layout. Michael shakes his head in disbelief. "It's hard," he says, "to swallow $6 million for a teardown."

The open house: Anyone there?

Jerry and Laura Satran's Sunday open house is empty. Their lushly appointed home -- 4,600 square feet in one of Carmel Valley's newest developments -- is the sort of place you'd go out of your way to check out even if you were perfectly happy where you lived.

It has a grand spiral staircase in the front hall. There are five bedrooms and 4.5 baths, formal living and dining rooms, and a game room upstairs that's big enough for a regulation-size pool table. The kitchen has two islands, both with marble countertops.

Jerry, a lawyer, and Laura, a teacher, are asking $1.3 million. But here they are, the second week the house has been on the market, drumming their fingers. The previous Sunday, Jerry says, 40 visitors stopped by. No offers.

Drive down the street and you'll see that their beautiful home is hardly unique. The layout is the same as the house three doors down, and three doors down from that.

High turnover in their development -- four of the 12 houses on their block have been sold in the year and a half it has existed -- almost ensures that a house like theirs will be on the market again soon. Their last place, in Carlsbad, sold for $615,000 -- the full asking price -- the first day it was on the market.

Still, the Satrans are optimistic about this one. They're San Diegans, after all. "We're not in any rush," Jerry insists.

Two weeks later the Satrans receive an offer: $1.2 million. Not the full asking price. No one seems more disappointed than the neighbors. One woman suggests the Satrans would be hurting the entire block if they settled for less than $1.25 million.

"She says she was only going to be here for two years, so don't screw up the comps," says Laura. "She's not being cruel -- everybody who lives here is in it for the investment."

|