|

Time Warner and Icahn reach settlement

Media company says it will increase buyback program, recommend two new independent board members.

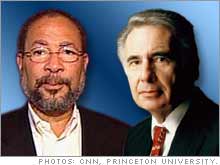

NEW YORK (CNNMoney.com) - Time Warner said Friday that it reached a settlement with Carl Icahn, the activist shareholder who had recommended that the media company be broken up into four separate units. The company did concede, however, to some of Icahn's demands and said it will increase its stock buyback plan and cut up to $1 billion in costs by the end of 2007. Time Warner said that Icahn will no longer contest the company's slate of board directors at Time Warner's next shareholder meeting. Icahn, who proposed the break-up plan in conjunction with investment bank Lazard last week, had been considering nominating a slate of directors to Time Warner's board in order to take control of the company.

But many large institutional investors did not back Icahn's plan and as a result, Icahn scaled back his efforts for a major change at Time Warner. "We are very pleased to have reached an understanding with Mr. Icahn. We appreciate his role as a significant shareholder as well as his constructive suggestions. As we've said, our board and management are committed to building value for all of our shareholders." said Time Warner CEO Dick Parsons in a written statement. The company said that as part of its settlement with Icahn, it has agreed to boost the size of its stock buyback program to $20 billion and extend the length of the program until the end of next year. Previously, Time Warner had said it would only repurchase $12.5 billion of its stock by the end of this year but Icahn had called for the company to buy back $20 billion in order to boost shareholder value. In addition, Time Warner said it will recommend the election or appointment of two new independent directors to its board and will consult with major shareholders, including Icahn, during this process. The company also said it has a plan in place to cut costs by $500 million this year and is reviewing ways to lower expenses by another $500 million in 2007. Finally, Time Warner said it will review the findings of the report issued by Icahn's investment bank Lazard last week and did not rule out a different structure for a spin-off of its cable business. Icahn had recommended that the company spin off all of the cable business. In a separate statement, Icahn praised Parsons for the settlement. He also pointed out that Time Warner has already taken positive steps to increase the value of the company, including new strategic initiatives to enhance its AOL unit, the recent announcement that it will sell its book publishing division, and the planned merger this fall of Time Warner's struggling WB network with the UPN network, which is owned by CBS. "By agreeing to implement the critical corporate reforms we have supported for several months, Dick Parsons is making great strides toward enhancing shareholder value," said Icahn. "He has also agreed to work with us to identify other initiatives we believe will unlock further value in the company." One analyst who asked not to be named said the settlement was a clear victory for Parsons. "The Street was underwhelmed by the Lazard presentation and never thought Icahn had much of a shot. You have to know when to hold them and when to fold them and Icahn's folding them," the analyst said. "Parsons won the war." Still, the analyst said that Parsons will have to make sure that he follows through on the promises made in the settlement since Icahn is likely to linger around like "Big Brother looking over his shoulder." Shares of Time Warner (Research) fell about 1 percent in regular trading on the New York Stock Exchange Friday but rallied more than 1 percent in after-hours trading. Time Warner is the parent company of CNNMoney.com. Time Warner, like many of its big media rivals, has underperformed the broader market during the past year due to concerns about slowing growth as more and more consumers flee traditional forms of media for newer technologies such as the Internet and satellite radio. For reaction to Icahn's backing away from a Time Warner fight, click here.

For a look at why big investors objected to the breakup plan, click here. |

|