|

Daytona 500 stock curse still running strong

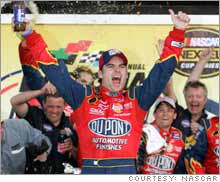

Beware, shareholders of the winning car's sponsor, those stocks have badly trailed the market over the last 20 years; DuPont was latest victim.

NEW YORK (CNNMoney.com) - Investors probably shouldn't cheer if they see the name of one of their companies in victory lane at Sunday's Daytona 500. That's because over the last 20 years, the stock of the winning driver's sponsor at Nascar's premier race has badly trailed the stock market throughout the year.

It happened again in 2005, when Jeff Gordon took the checkered flag, with help of his sponsor, DuPont Automotive Finishes. But while marketing executives at DuPont (Research) might have been smiling about Gordon's win, maybe the investor-relations staff should have been cringing. The stock ended the year down 13 percent, while the S&P 500 index was up 3 percent on the year. It wasn't the first time DuPont has been bitten by the curse. In 1997, the year Gordon got the first of his three Daytona 500 wins, DuPont stock lost 36 percent, while the S&P gained 31 percent, the biggest gap between the S&P and the sponsor's stock performance during the history of the curse. Overall, in the 15 years since 1986 that the winning sponsor was a publicly traded company, the company stock has trailed the market by an average of just under 20 percent. That average even includes the three years during that period when the sponsor's stock beat the market. The curse doesn't say that the winner's stock will lose ground this year. There were three years that stocks posted gains but trailed the broader market. But there were six years, including 2005, when the stock lost ground despite gains in the S&P and another three years when the stock lost more ground than did a bear market overall. Of course it is probably safer to stand in the middle of the Daytona race track during Sunday's race than it is to base investment decisions on which company sponsored the winning driver. But that doesn't mean things like the Daytona 500 stock curse or the Super Bowl stock market indicator aren't fun to follow. And while the Super Bowl indicator has had a very uneven record predicting the market direction in recent years, the Daytona curse seems to be going as strong as ever. DuPont, not surprisingly didn't have a comment on the curse when contacted. But if there's any sponsor who shouldn't worry about the curse, it might well be DuPont or Anheuser Busch (Research), the sponsor of 2004 winner Dale Earnhardt Jr. Two of the three companies that have beat the curse since 1986 were making repeat trips down victory lane within two years of an earlier win - DuPont's win with Gordon in 1999 and in 1995, when Sterling Marlin won his second consecutive race with Eastman Kodak (Research) as a sponsor. But repeat wins aren't enough to guarantee the stock will beat the market. Bill Elliott won with Coors (Research) as his sponsor in both 1985 and 1987, but the Colorado brewer lost 30 percent in 1987, while the S&P gained 2 percent. Nascar officials laughed when told about the curse's track record. But they also pointed out that a far more academically rigorous study by University of Missouri professor Stephen Pruitt that found that sponsors' stocks see a short-term bump when their Nascar sponsorships are announced. The sport is famous in the world of sports marketing for having fans who loyally buy the products made by their favorite drivers' sponsors. "I would say most people would expect the effect on the stock from winning Daytona to be the opposite," said Roger VanDerSnick, vice president of marketing for Nascar. "We know companies can drive their business from participation in the sport." But then again, maybe the relation between Daytona and shareholder performance isn't quite as random as it seems. After all, the "sc" in Nascar stands for "stock car." For a look at the Super Bowl stock market indicator, click here. For more news from the lighter side of business, click here.

For a more serious look at news about sports sponsors and the business of sports, click here. |

|