|

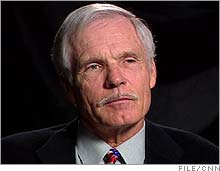

Ted Turner opens up on Time Warner

'You need to be taking some risks,' billionaire tells Atlanta newspaper; calls sales of company assets 'heart wrenching.'

NEW YORK (CNNMoney.com) - In his first media interview since announcing that he's leaving the Time Warner board, Ted Turner said he's disappointed to see the company selling some of its assets and not taking enough risks but that he supports management in its fight with financier Carl Icahn. Turner, speaking to the Atlanta Journal-Constitution as well as at Emory University on Monday, said it's "heart wrenching" to see the company sell assets such as the Turner South regional cable network as well as putting the Atlanta Braves baseball team up for sale.

And the newspaper reports that during a question and answer period at Emory, he criticized moves to sell units such as the music and book publishing division, saying that the world's largest media conglomerate has been "selling everything, divesting everything that was the least bit difficult to manage. "You need to be taking some risks," said Turner, who was at Emory to accept the school's inaugural Global Innovation Award. "I was always buying and expanding." The company announced last week that Turner and fellow board member Carla Hills will not stand for re-election to the company's board. Turner had given up his post as vice chairman of the company in 2003, a move he said foreshadowed his decision to leave the board. "It's not like this came as a surprise to anyone," he said. But he said he wanted to help the company through a host of problems, including an investigation by the Securities and Exchange Commission and, most recently, the assault by Icahn. "I didn't want to leave them in the lurch," he told the newspaper. Despite his criticism of some recent moves, Turner had kind words about Time Warner Chairman and CEO Richard Parsons in his interview with the Atlanta newspaper. Parsons was the subject of repeated attacks by Icahn as the investor sought to win control of the company and break it into four separate entities. "You notice I stayed until the Icahn thing was behind us," Turner said. Turner also told the paper he's not interested in buying the Braves. "Been there, done that," he said. "What would I do for an encore? The main thing is that I couldn't afford it." Forbes magazine estimates Turner's net worth at $2 billion, and it values the Braves, which Turner bought in 1976 for $12 million, at $382 million. The Braves were one of the assets that came to Time Warner when it purchased Turner Broadcasting in 1996, a purchase that made Turner the company's largest individual shareholder. Turner said Turner Broadcasting remains a special place for him, even though he no longer has a role in running the company, which includes CNN, TBS and TNT as well as CNNMoney.com. "I like to think of it as kind of a little Camelot," Turner told the newspaper, then breaking into a recitation of Broadway show tune "Camelot." ________________

For more on Turner's decision to leave the Time Warner board, click here. |

|