|

Big fight brewing over small cars

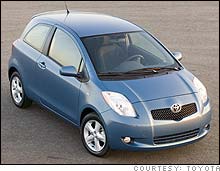

Toyota's top European seller Yaris hits U.S. showrooms as Japanese automakers prepare to flood the market here with new subcompact offerings.

NEW YORK (CNNMoney.com) - This could be the year that Japanese automakers rediscover their roots in the U.S. market. And that could mean more trouble ahead for U.S. automakers such as General Motors.

Toyota starts to roll out its Yaris subcompact car to dealerships this spring. It will be closely followed by the Honda Fit and Nissan Versa, as all three of the big Japanese automakers begin their first major push in years to sell extra-small, very fuel efficient cars in the United States. The cars generally have base prices between $12,000 and $13,000. The low-priced segment was where the Japanese made inroads into the U.S. market after the oil shocks of the 1970s and 80s. But as gas prices stabilized, the Japanese moved away from the segment, as did American car buyers and automakers, to concentrate on larger, more profitable light trucks such as SUV's. Even the compact cars offered by the Japanese grew in size and price; the Toyota Corolla can now have a list price of $19,000 if upper-end options are included. The segment has been left mainly to the Koreans and to GM's Chevrolet, which used its own Korean-built vehicle, the Aveo, to become a leader in the low-priced part of the subcompact market over the last two years. But GM has put relatively little marketing push behind the Aveo, even as U.S. sales of the car grew 20 percent last year to just over 68,000. The low-priced segment overall grew between 6 and 10 percent last year, to about 200,000 U.S. sales, depending on how it's counted, and Toyota sees the segment growing by another third this year due to all the new entries. "We got our start in the U.S. with small cars," said Ed LaRocque, national marketing and planning manager for Toyota USA. Higher gasoline prices are an important, but only partial, factor driving the interest in smaller cars, he said. "Buyers are being more practical with what might be their second or third car," he said. Even more conservative growth estimates put expected U.S. sales growth in the segment at about 25 percent this year. But even that might not be enough to absorb all the new entries. "I don't think the segment is growing fast enough for everyone to win," said Mark McCready, director of market analysis for on-line auto retailer CarsDirect. "The Koreans are going to take the biggest hit. But I think only two of the three Japanese offerings will be a success. Or one will be a success and the other two will see average sales." Toyota has competed here with the Echo, but it did not sell well and Toyota pulled the car off the market for the 2005 model year. The Yaris has been very successful overseas -- it is Toyota's best-selling model in Europe, where gas is far more expensive, and streets and parking places can be much tighter than in most of the United States. It's also been a success in Japan, where it goes by the name Vitz. Honda's and Nissan's new entries into the U.S. market also are models with strong overseas sales. Meanwhile Ford and DaimlerChrysler have chosen to stay out of the market, at least for now, despite having some offerings in their overseas brands. Ed Hellwig, senior editor for Edmunds.com, who has test-driven both the Yaris and Aveo, said that the Toyota offering is a noticeable step up from both its GM competition as well as Toyota's old Echo. Edmunds.com provides automotive data and content for CNN.com's automotive Websites. "Aveo is still a basic utilitarian interior," he said. "The Yaris does a much better job presenting a look and feel of being more upscale. You don't get in and immediately think that you're in one of the cheapest cars on the market." Experts say the segment is being helped by the look of the new subcompacts. While the Mini Cooper is priced well above these entry-level economy vehicles, it helped open American car buyers' eyes that small cars could be attractive, and the new models build on that. "The new sub-compacts are a lot more easy on the eyes than the Toyota Echo and the Ford Fiesta," said Jesse Toprak, executive director of industry analysis for Edmunds. Chevy says that it's ready for the new Japanese assault, with a newly designed version of the Aveo due out in July as well. It says the Aveo is already being sold in more than 100 countries and the new version will eventually reach 140. "We have experience competing with those players, and we've competed successfully," said Chevy spokeswoman Maru Santiago. "We're certainly coming from a position of strength." But experts say that GM's lack of marketing support for Aveo won't cut it in the face of the new competition. "I think Chevy will not be able to leave Aveo unsupported in the market place," said McCready For a look at Toyota's domination of the list of hottest U.S. cars, click here.

For a look at seven worries and seven answers about hybrid cars, click here. |

|