|

Palm beats expectations; plans to deal new hand

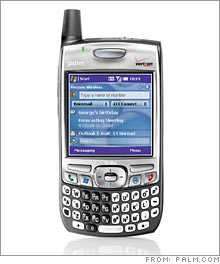

Ten years after the PalmPilot appeared on store shelves, Palm is still pioneering new categories of electronic gadgets -- and battling tough rivals in the smartphone market.

SAN FRANCISCO (Business 2.0) - SAN FRANCISCO (Business 2.0) - Palm beat analyst expectations today on strong smartphone sales, posting $19.8 million in earnings on $388 million in revenues for its third fiscal quarter ended in February. Shares surged 7 percent in after-hours trading to $21.50, as Wall Street cheered Palm's competitive success against Research In Motion and other smartphone makers. But for a better clue as to the company's long-term prospects, investors may want to look at the company's past successes rolling out breakout products.

Over the long term analysts remain worried that price competition will squeeze profit margins on Palm's flagship line of Treo smartphones. While the company is set to launch three new smartphones this year -- including a rumored "700p" model with high-speed Internet access for Sprint (Research) -- it may not be able to rely on them to drive profits higher. That's likely why, even as the company celebrates the tenth anniversary this month of its original PalmPilot personal digital assistant as well as the success of its Treo smartphone line, it's looking ahead to inventing new mobile computing devices. Indeed, lately co-founder Jeff Hawkins has been referring to Palm's secret third product category, in addition to its PDA and smartphone lines, which features advanced multimedia capabilities. He has, however, steadfastly refused to elaborate beyond that. Ten years ago, it would have been hard to imagine Palm (Research) one day standing up against the likes of RIMM (Research) and Nokia (Research). Hawkins and cofounder Donna Dubinsky sold the young company to modem maker U.S. Robotics in 1995, gaining access to enough cash to launch the company's first product, the Pilot 1000 PDA. But in 1996, the startup found itself racing to develop its own handheld electronic organizer after a deal to design one for Casio fell through. "The Pilot was born in desperation," says Hawkins, who still works at the company as a part-time consultant on new products. "When all your other options are closed, you might as well try to do the right thing." In the Pilot's case, that meant creating a very simple organizer that carried contacts and calendar events, and synched its data with a PC. At the time, AT&T (Research), Sony and others were creating sophisticated handhelds with wireless data capabilities. "Venture capitalists wouldn't fund us because it wasn't wireless," recalls Dubinsky, now a member of Palm's board of directors. As it turns out, AT&T and Sony's devices were flops, but Palm's Pilot took off, selling 1 million units in 18 months. Palm wasn't as lucky in its owners. 3Com, which bought U.S. Robotics, dithered over whether to take the company public. Dubinsky and Hawkins, along with Ed Colligan, an early Palm employee, left Palm in late 1998 to found Handspring, a rival maker of handheld organizers. A year and a half later, 3Com spun off Palm in a blockbuster IPO. But Palm's shares collapsed as the PDA market slowed in 2001, and the company ran through a series of short-term CEOs. Handspring, too, ran into hard times, as an expensive office lease drained the company's cash. Meanwhile, Handspring was developing the solution both to its cash crisis and Palm's dependence on a single organizer: The Treo smartphone, which married the contacts and calendar feature of the Pilot with a cell phone, in one compact package. As he had with the original Pilot, Hawkins carried a model of the Treo around with him to make sure it would slip easily in and out of users' pockets. That attention to detail created a hit product. While Nokia, Qualcomm, and others had introduced smartphones before, they tended to be bulky and worked poorly for making calls. In 2003, Palm acquired Handspring, bringing Dubinsky, Colligan, and Hawkins back into the fold. In April 2005, Palm sold its millionth Treo, and to date, the company has sold more than 3 million of them. Colligan, who initially ran the combined company's smartphone business, is now the company's CEO. The company's most recent product launch, the Treo 700w, broke new ground by running Microsoft's Windows Mobile operating system. Previous Palm products ran the Palm OS. (The Palm OS software is now made by PalmSource, a company Palm spun off in 2003 and which is now owned by Japanese software maker Access.) Offering a smartphone that runs Windows should broaden Palm's appeal among IT buyers who prefer Microsoft (Research) products, analysts believe. The market will be closely watching Treo sales on Thursday. Some companies which had previously used RIM's BlackBerry handhelds took advantage of a free trial offer to test out the Treo, which has led to Palm winning some new corporate accounts such as US Airways. But, having seen sales of the Pilot grow explosively and then trail off over time, Palm's founders are wary of relying on a single product category. (Palm still makes PDAs today, and has sold more than 30 million of them to date.) "One of the missions we have at Palm is to design breakout products," says Hawkins. "It's hard, really hard, to do. Palm's done it twice, you could argue, with the original PalmPilot, and the Treo smartphone. We've got another one in development." Hawkins wouldn't elaborate on the shape of any new models he might be toting around, though he notes that he now makes them out of foam, not the Pilot model's original plywood. But with two successes under his belt, it doesn't seem smart to bet against his ability to carve out a new handheld niche. BlackBerry maker, NTP ink $612 million settlement. Click here.

Cellphones are as powerful as PCs. Click here. |

|