|

Google defends growth plans

The search engine reaches out to Wall Street and tells investors that it plans to diversify beyond search and keep hiring new workers.

NEW YORK (CNNMoney.com) - Google, the world's largest search engine, addressed concerns about the company's strategy and growth prospects during a conference call Wednesday afternoon. During the call, Google's top managers said the company expected to branch out into new markets, such as print and television advertising, and that Google will continue to hire more workers in the San Francisco Bay area where the company is based. Google also ruled out any interest in building a Web browser to compete with Microsoft's Internet Explorer and said that it was making headway in the lucrative local advertising market online.

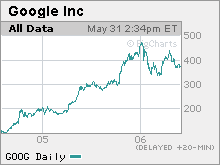

Sasa Zorovic, an analyst with Oppenheimer, said the company provided analysts with more details about its plans than he was expecting and that as a result, he was now more confident in his outlook for Google. "There is more in the plus column than the minus column for Google," he said. But Google's stock, which had been trading higher on the Nasdaq before the call began Wednesday afternoon, lost its gains and headed into negative territory after the call started. The company, which has been criticized for not giving Wall Street enough information about its financials and plans for the future, announced last week that it would hold the call so investors could ask the company's management team questions about Google. Shares of Google (Research) have lost momentum this year following a strong 2005. The stock is down 10 percent so far in 2006 after soaring more than 115 percent last year. Investors have had little reason to worry about Google's fundamentals though. The company reported extremely strong results for the first quarter -- sales grew by 79 percent and earnings rose 60 percent from a year ago. Selling ads based on specific keyword searches is Google's bread and butter business and that business is extremely healthy. Separate reports from Web traffic tracking firms comScore Networks and Nielsen Net//Ratings last week both showed that Google gained market share in search during the month of April. But Google, which refuses to give Wall Street sales and earnings guidance and has been fairly tight-lipped about its corporate strategy, has made some high-profile public relations gaffes this year that have raised the ire of many investors. The company missed fourth-quarter profit forecasts by a wide margin in January -- the company's first earnings disappointment since its August 2004 initial public offering -- due to a higher tax rate that caught analysts off guard. In addition, off-the-cuff comments from Google's chief financial officer George Reyes at a Merrill Lynch conference in February about how Google was starting to see slowing revenue growth in search spooked Wall Street. And in March, Google disclosed in a regulatory filing that it mistakenly put up slides detailing out-of-date financial targets during its analyst day Web cast. In addition, some investors are concerned about whether increased competition from the likes of Yahoo! (Research), Microsoft's (Research) MSN and IAC/InterActive's (Research) Ask.com will put a dent in Google's growth. Last week, Yahoo announced a broader alliance with online auction giant eBay (Research), a move that many interpreted as a way for both companies to more effectively fend off challenges from Google. Marianne Wolk, an analyst with Susquehanna Financial Group, said worries about competition are overblown, especially as Google continues to bulk up its local advertising business. "The market is reacting to fears that search is getting more competitive. But Google is clearly not standing still and I think they will solidify and extend their market lead," she said. Google searching for new growth

There are also some who think Google needs to do more to diversify beyond its search-based advertising roots in order to avoid being a one-trick pony. To that end, Google chief executive officer Eric Schmidt said during the call that Google was working on ways to expand into other areas of the advertising business, including helping companies buy targeted ads in print publications like magazines and newspapers as well as TV commercials. But Schmidt cautioned that Google would probably not be immediately successful in new ventures. "People forget, even inside our company, that the model that has been working so very well for us today took a couple of years to get right," he said. Jonathan Rosenberg, Google's senior vice president of product management, added during the call that Google is also still experimenting with ways to make money off its relatively new video search product. Online video has become a hot growth area with companies ranging from major media firms like Walt Disney and News Corp. to upstarts like YouTube and Grouper all seeking to capitalize on the growing demand for video. Rosenberg said that for now, Google's focus is on creating a great product first and figuring out the best way to create and sell video ads at a later date. Nonetheless, Steve Weinstein, an analyst with Pacific Crest Securities, said that it was interesting to hear Google talk about moving beyond search. "They are embracing new types of ads and are moving in the direction where they ultimately will offer more than one type of ad," he said. Google has also come under fire for aggressive capital spending plans. The company said during the call that it expected to spend more on real estate as it continues to hire more workers in Silicon Valley. Google is based in Mountain View, Calif. But Schmidt added that it was highly unlikely that Google would use any of its more than $10 billion in cash to make any major acquisitions in order to expand its market share. He said that instead of mergers, Google was more likely to continue partnering with other companies in order to try and boost its traffic. As such, Google has recently struck deals to have some of its software installed on personal computers made by Dell, handheld messaging devices from Nokia and phones from Japanese cell phone carrier KDDI. Google also announced last year that it was buying a 5 percent stake in AOL, the Web portal owned by Time Warner (Research), for $1 billion. Time Warner also owns CNNMoney.com. _____________________ For more about the Yahoo-eBay partnership, click here. Does Google make the grade in our search engine rankings? Click here. Analysts quoted in this story do not own shares of Google and their firms have no banking ties with the company.

The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

|