|

Static for Sirius and XM

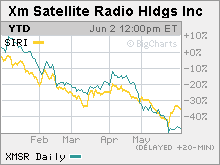

The two satellite radio stocks have taken a big tumble this year, but some on Wall Street think now is a good time to buy.

NEW YORK (CNNMoney.com) - Look up in the sky! It's a bird. It's a plane! Nope. It's the two satellite radio stocks plunging from orbit! Shares of XM Satellite Radio (Research) and its smaller rival Sirius Satellite Radio (Research) have both taken huge hits so far this year. Sirius' stock has fallen nearly 33 percent while XM has nose dived 46 percent. But some on Wall Street think that the sell-off is overdone, especially for Sirius, and that these two admittedly risky stocks might actually be close to bottoming out. "The stocks have pulled back for a number of different reasons. Do I think it's a good time to get in? Absolutely," said April Horace, an analyst with Hoefer & Arnett. XM and Sirius are both adding subscribers at a breakneck pace and, as a result, each company is expected to generate substantial increases in sales this year and next. Analysts are projecting that XM's revenues will soar 70 percent this year to $952 million and increase another 46 percent to $1.4 billion in 2007. Sirius, thanks to the arrival of shock jock Howard Stern on its airwaves this year, is growing even faster. Wall Street forecasts a 157 percent surge in sales this year, to $622 million, and a 73 percent increase in revenue to $1.1 billion next year. "The stocks have been behaving like the business model is broken and isn't going to work. But satellite radio is certainly here to stay. That has not changed at all," said David Bank, an analyst with RBC Capital Markets. XM problems taint Sirius

So why are the stocks taking a beating? Analysts say that it's mostly XM's fault. In April, the company reported a wider-than-expected loss for the first quarter and also said that the Federal Trade Commission is investigating its marketing practices. Last month, the Recording Industry Association of America, which represents all the major music labels, sued XM for infringement. The RIAA alleges that XM's new portable Inno device, which can store songs heard on XM, is more like a download service a la Apple's (Research) iTunes. But since XM listeners would not have to pay the music companies to keep individual songs on the Inno, this violates copyrights, the record labels claim. Finally, XM cut its 2006 subscriber forecast last week. The company said it now expects to have 8.5 million subscribers by the end of the year, down from its earlier forecast of more than 9 million. With all that in mind, it's understandable why both stocks have lost some fans on Wall Street. After all, there are only two satellite radio firms, so bad news for one is typically seen as a negative for the other. But Sirius may be getting unfairly tarred by XM's woes since Sirius actually reaffirmed its year-end forecast of more than 6.2 million subscribers last week. "These stocks tend to trade in tandem and what hits one will often hit the other, and that's frustrating for both companies at different times," said Bank. "In all fairness, Sirius hasn't stumbled." Horace agrees, adding that Sirius should probably continue to post higher growth rates than XM during the next year or two thanks largely to Stern. But she is also bullish on XM's prospects as well. Horace said that another reason XM may be getting punished by investors is because of its association with struggling automaker General Motors (Research). GM currently offers factory-installed XM radios in more than 50 models of cars, trucks and SUVs. GM reported Thursday that its monthly sales plunged 16 percent in May. But Horace said that even though GM's problems may be one reason behind XM's subscriber growth cut, she thinks the company will bounce back in 2007 as several Asian car manufacturers such as Toyota (Research), Nissan and Hyundai begin to offer XM radios in more of their vehicles. Good long-term buys but don't expect a comeback soon

That said, investors have to realize that both XM and Sirius are not likely to recover overnight. Matt Kelmon, manager of the Kelmoore Strategy Eagle fund, which owns both stocks, said investors should only buy them if they have at least a two or three year time frame in mind. Kelmon cautions that they will remain very volatile over the next few years and that as long as the overall market remains jittery, both stocks will remain under pressure. "These stocks will get slammed in sell-offs but in up markets they should do well," he said, adding that he has bought more of each stock during the first quarter. Still, RBC's Bank thinks that XM is a better value than Sirius right now. Part of the reason is that it has taken a bigger tumble than Sirius. But Bank also likes XM more than Sirius since XM is likely to report positive earnings before interest, taxes, depreciation and amortization, or EBITDA, before Sirius. Analysts currently expect XM to report EBITDA, a commonly used metric to value media companies, of $172.5 million in 2008 while Sirius is not expected to post a profit on this basis until 2009. Bank adds that despite all the concerns about XM, there is a disconnect in how Wall Street is valuing the two companies. He points out that even though XM is expected to have approximately 40 percent more subscribers than Sirius by the end of the year, Sirius' enterprise value divided by subscribers is actually about 60 percent higher than XM's. Of course, investors have a good reason to worry about how profitable either company may ultimately be as long as they continue to aggressively battle each other for subscribers. But Kelmon doesn't think this will be a long-term problem. He said he would not be surprised if Sirius and XM ultimately merged so they could focus on growth instead of fighting each other for subscribers. "It's way down the line and still soon to predict, but eventually I believe they will wind up being one company," he said. _____________________ For a look at why CBS, Stern's former employer, is a good buy, click here. Is the worst over for the radio business? Click here.

Analysts quoted in this story do not own shares of XM or Sirius and their firms have no investment banking ties with the companies. |

|