|

Growth guru: Avoid Google

Former star mutual fund manager Fred Kobrick says Google is a great search engine but not a good stock. Here's why.

NEW YORK (CNNMoney.com) - One of the most successful growth fund managers of the past few decades has a tip for investors about search engine giant Google: Don't buy it. "Google is kind of a metaphor for investing today. People want a short-term fix and they want something that has momentum," said Fred Kobrick, who has more than thirty-five years of investment experience with Wellington Management, State Street Research & Management and then his own firm.

While at State Street in the mid-1990s, MONEY Magazine named his State Street Research Capital Appreciation fund one of the six best funds of the past decade. After he left State Street, Kobrick started his own firm, and his Kobrick Capital Fund was named an "All-Star Fund of the Year" by USA Today in 1998 and 1999. Kobrick now advises institutions on how to invest, and is also the author of the recently published book "The Big Money: Seven Steps to Picking Great Stocks and Finding Financial Security." Kobrick said that he's often asked about Google (Charts) when giving lectures at universities or speaking at investment conferences. He said that what strikes him is that many people he talks to who own Google say that they own it simply because it has become synonymous with search in the way that Xerox (Charts) and Kleenex have for photocopiers and tissues. "People with a lot of money in Google aren't sure, other than that it's a household word, why they own it," he said. But that's not a good reason to own a stock, he says. After all, many other tech leaders who were thought to have an insurmountable market lead eventually fell by the wayside. Game not over in search

Kobrick said many Wall Street analysts and investors fall victim to what he calls the "game over syndrome," declaring a victor in a market too prematurely. He cites companies like workstation manufacturer Apollo Computer, word processor maker Wang and spreadsheet software firm Lotus as examples of tech firms that investors erroneously thought would be immune to competition. "Winners often come from behind and original leaders wind up running into problems," he said. Kobrick said that Google clearly has a great product, but that alone isn't enough to make it a good stock. He worries that the company is still experimenting with how else to make money beyond search advertising. The company has launched many new products over the past few months, and while each product release tends to generate breathless hype, there is little indication yet if any of them will be big profit generators for Google. "Google's throwing a lot of mud against the wall to see what sticks. That's pretty scary," Kobrick said. He thinks that over the next few years, search will become more of a commodity, especially since Yahoo! will be unveiling new search tools later this year. Microsoft will also be upgrading its MSN search features in anticipation of the launch of its next operating system Vista. "Google, to me, is one of those companies that look sexy, but I don't know if they can meet the competition from Yahoo and Microsoft," Kobrick said. He personally owns shares of Yahoo (Charts) but not Microsoft (Charts). 21st Century Xerox?

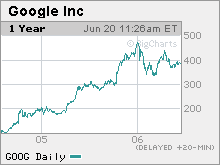

To be sure, the many Google bulls on Wall Street point to the fact that Google has already fended off challenges from Yahoo and Microsoft over the past few years, and continues to gain market share in search. Many Google fans also think that the company will eventually be able to extend its dominance in targeted search advertising to other areas of the media world, such as radio, television and print. But investors have grown wary of Google following last year's 115 percent surge in its shares. The stock has fallen more than 6 percent so far in 2006 and is nearly 20 percent off the all-time high it hit in January, partly due to concerns about looming competition and Google's lack of diversification. Kobrick thinks that management realizes it must branch out in order to stay on top. He said Google's main weakness is that it has yet to prove that it can find other ways to make money from its user base. And if Google doesn't succeed in broadening out its strategy, he thinks the company could eventually fall victim to the same fate that other former market leaders have. "Google has no ability to lock in users the way Microsoft and Yahoo have," he said. "Google has had a lot of success but they look a lot like the old Xerox to me." _____________________ Related: Internet stocks may avoid a summer swoon Related: Google defends growth plans

Related: The Internet wars report card |

|