|

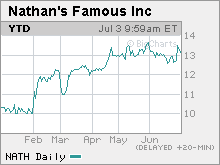

A stock with lots of mustard Shares of Nathan's Famous, the sponsor of the annual July 4th hot dog eating contest, have been on a roll this year. NEW YORK (CNNMoney.com) -- Ask people to name something they identify with the 4th of July and they're likely to say the flag, fireworks and barbecues. But there's another tradition associated with America's celebration of independence: people unabashedly stuffing their faces with Nathan's hot dogs on Coney Island.

Nathan's Famous, the franchise fast food chain company that also runs restaurants under the Miami Subs, Kenny Rogers Roasters and Arthur Treacher's brand names, is the sponsor of an annual hot dog eating contest. Most people probably know the Nathan's name because of this annual frankfurter gorgefest. So investors might be surprised to learn that Nathan's (Charts) is actually a publicly traded company. And get this. The stock's on a roll. (Ha!) Shares are up 28.6 percent this year. Why have investors relished (ha ha!) the opportunity to buy Nathan's? The company has been doing quite well lately. Nathan's reported late last month that earnings for its latest fiscal year (which ended in March) rose 38 percent from a year ago, excluding profits realized from a sale of real estate. And sales were up more than 20 percent from last year. In fact, the company's latest annual results were the its best since Nathan's went public in 1993. Still, investors probably need to be wary. No Wall Street analysts cover the company so there are no earnings or revenue estimates investors can use to gauge how the company is expected to do going forward. Nathan's is also an extremely tiny company, with a market value of just $76.2 million. Stocks with such a small market capitalization tend to be volatile. In addition, there aren't many shares outstanding, which could make the stock vulnerable to big moves. Trading volume on the stock is as thin as Takeru Kobayashi, the 144-pound Japanese wiener wunderkind who has won the hot dog contest for the past five years and is favored to repeat this year. Only about 10,000 shares a day have traded hands, on average, for the past three months. But for what it's worth, shares of Nathan's don't appear to be trading at too much of a high-end gourmet price. The stock is valued at 15 times earnings for the past 12 months, which seems reasonable considering last years's level of profit growth. This valuation also compares favorably with other larger fast food chains. McDonald's (Charts) and YUM! Brands (Charts) trade at 17 and 19 times earnings for the past 12 months while Wendy's (Charts) is valued at 30 times trailing earnings. And newly public Burger King (Charts) has a whopper of a P/E: 46 times earnings for the past year. So if you're a sultan of sauerkraut with a healthy appetite for risk, shares Nathan's might be a tasty treat. _____________________ Related: Get paid to eat Related: Overeaters: We've got meals for you |

|