|

GM to hold talks with Nissan, Renault Board to hold 'exploratory discussions' about possible alliance with French and Japanese auto partners after a push from Kerkorian. NEW YORK (CNNMoney.com) -- General Motors said Friday it would hold "exploratory discussions" with Renault and Nissan regarding a potential historic combination of three of the world's largest automakers. The statement from GM said the decision to start talks was a "recommendation by the company's senior management." But it is clear that the push came from Kirk Kerkorian, the company's largest shareholder, who a week ago wrote to GM to say that Nissan and Renault, which already have joint ownership positions in each other, was interested in buying "a significant minority interest" in GM.

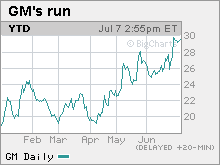

GM Chairman and CEO Rick Wagoner will lead the company's talks with Carlos Ghosn, the much-sought auto executive who leads both Nissan (Charts) and Renault. Some outside observers have suggested that Ghosn could be a threat to Wagoner's position if there is an alliance. "We will enter into discussions with the managements of Renault and Nissan with an open mind - eager to hear their ideas of how an alliance between our companies might work to our mutual benefit," said a statement from Wagoner. "Given the complexity of any potential relationship, it has to be carefully considered on its merits before coming to any conclusion. We are committed to an objective and thorough review of that potential." Kerkorian's concerns Kerkorian's investment firm, Tracinda, issued a statement saying it was pleased by the board's decision to hold talks, but also raised concerns about how committed GM management is to the talks. "We believe that the upcoming meeting between Mr. Wagoner and Mr. Ghosn is a good first step, but a full and objective evaluation of this unique opportunity will require establishment of a board committee that receives independent financial and legal advice." Nissan and Renault issued a brief joint statement that said, "We look forward to starting the discussion process soon." Shares of GM (up $0.31 to $29.51, Charts), already the best performing stock in the Dow this year even before Kerkorian's proposal about Nissan and Renault on June 30, rose almost 2 percent in midday trading Friday following the announcement. GM's statement acknowledged that the talks were spurred by a letter it received from Kerkorian's investment firm, which owns 9.9 percent of GM's outstanding shares, as well as public statements from Nissan and Renault expressing interest. "We periodically receive interesting proposals and we owe it to the company and its shareholders to explore how they might work, and to objectively weigh the potential benefits and issues that each might present," Wagoner said in the statement. "That is exactly what we recommended to the GM board in this specific case, and exactly what it has agreed we should do." The seven-year old alliance between Renault and Nissan is seen as having helped both companies cut both purchasing and development costs as well as improve sales. And Ghosn is widely credited with being one of the world's most successful and innovative auto executives, one who is credited with turning around Nissan, the No. 2 Japanese automaker measured by vehicles sold. But GM's track record with some combinations has been mixed at best. It was forced take about $1 billion in charges in 2004 to exit its partnership with Fiat and it has had mixed results with some other alliances, such as those with Suzuki and Fuji Heavy Industries. Eyes off the prize? GM is also in the middle of its own turnaround effort as it moves ahead with plans to cut more about one in four hourly workers in North America and close a dozen plans an facilities in an effort to stem losses. "There's an awful lot on Rick Wagoner's plate," said Michael Robinet, vice president of Global Vehicle Forecasts CSM Worldwide, auto consulting firm. "In fact the plate is overflowing, and adding Nissan-Renault to that plate has got to make something else fall on the floor." Robinet said that any cost savings from a combination won't be seen by GM until after 2010, and it won't be as important as issues such a new labor contract with the United Auto Workers to replace the contract that expires in September 2007. GM, wrestling with stiff foreign competition and high gasoline prices, is also introducing new vehicles in a bid to halt a sharp decline in sales and market share in the United States. "You couldn't have picked a worst time to bring this to the market," said Robinet, referring to the talks. But in its statement, Wagoner said the Nissan-Renault talks would not distract it from its turnaround plans. Still, some analysts expect GM stock to keep rising, at least in the short-term, on the prospect of an alliance. Ron Tadross, auto analyst with Banc of America Securities, upgraded the stock to a "hold" this week from "sell." Tadross, one of GM's harshest critics among analysts, wrote that some combination between GM and Nissan-Renault "would equate to a positive management infusion that could yield short-to-medium term benefits. "We think it is fair to reiterate our view that GM management has not done a good job and GM and its shareholders would probably be well served by this proposed management infusion," he added. But he also said that the long-term benefits were harder to quantify and that cost savings for GM from any combination would be years down the road. "We do not think a Renault-Nissan- GM combination has fundamental long-term merit, but this does not mean it will not happen," he wrote. Premila Peters, director of research for KDP Investment Advisors, an independent research firm specializing in junk bonds, including GM's debt, said news of the potential combination is a positive for the company, although it does present risks as well. "The fact that there is an interest from Nissan and Renault in buying a minority interest, we see it as a vote of confidence in the company's prospects," she said. "But one wonders how is this going to work. This cultural issue is a huge concern. The question is will you achieve more from a combination than you lose from the distraction it would cause for GM management." Related: GM's rally running out of gas? |

|