|

Wall St. connects with telcos and cable Investors are betting that Verizon and Comcast will win the 'Net neutrality' battle against the likes of Google and Yahoo. NEW YORK (CNNMoney.com) -- There is a big debate in Congress about "Net neutrality" - whether or not broadband network operators such as Verizon and Comcast should be able to charge big Internet companies such as Google and eBay in order to have their Web sites delivered in a smooth, timely fashion. The online giants are essentially arguing for maintaining the status quo - that phone companies and cable firms should not be allowed to set up tiered pricing plans that could make it difficult for both large and small Net companies to compete with the services offered by phone and cable companies. And that could lead to an environment in which there are fewer choices on the Web for consumers.

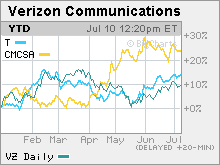

The telcos and cable firms counter that since they've spent billions on building their high-speed Internet infrastructure, they should be permitted to try and recoup some of their investment by charging online companies access fees. But on Wall Street, it seems like many investors have already chosen who will be the victor in the Net neutrality battle. "Gravy" for cable and telecoms.... Shares of Verizon (Charts) are up 13 percent this year while shares of fellow Baby Bell AT&T (Charts) have shot up 18 percent. And the stock of Comcast (Charts), the nation's largest cable firm, is up 24 percent so far in 2006. Meanwhile, shares of many leading Internet companies such as Yahoo! (Charts), eBay (Charts) and Amazon.com (Charts) are down sharply this year. Of course, telecom and cable stocks have been solid performers this year for other reasons. Investors appear to be recognizing that the wireless units of traditional phone companies are doing well. And many cable firms have been reporting healthy gains in subscribers for their Internet phone and digital cable offerings. But investors have good reason to expect that the telcos and cable firms may emerge victorious and that could be driving stock prices as well. Although proponents and opponents of Net neutrality have both aggressively lobbied Congress to plead their case, the telecoms and cable firms do have the upper hand. An attempt to add a Net neutrality amendment to a new telecom bill was shot down in the House in early June. Later that month, a Senate subcommittee failed to approve an addition of a Net neutrality amendment to a bill that would overhaul 1996's Telecommunications Act. "At present, we don't think the demand for strong Net neutrality language in the telecom bills are going to pass," said Thomas Eagan, an analyst with Oppenheimer & Co. who covers cable stocks. "If aggressive Net neutrality were part of the bills, it would be seen as a minor negative for cable and telecoms. But I think the unlikelihood of this is currently in the stocks right now," Eagan added. At stake is the potential for telcos and cable companies to be able to forge so-called "quality of service" arrangements, which could lead to a new stream of fees from Internet site operators. And investors may not be fully pricing in this possibility just yet. "I don't think the Street is factoring in increased revenue from Google (Charts) or Yahoo for telecoms and cable. It's going to be gravy on the top and it should be profitable. This could be a huge change in the revenue model for network operators," said Greg Gorbatenko, a telecom and cable analyst with Jackson Securities. ...but the Bells may be the biggest winners But the end of Net neutrality may not be as good for cable companies as some investors think. Instead, companies such as Comcast, Time Warner and Cablevision could actually be hurt by the end of Net neutrality. (Time Warner, which owns the second largest cable firm in the U.S., is also the parent company of CNNMoney.com.) Arnie Berman, chief technology strategist with Cowen & Co., wrote in a report last month that even though a cable company "would benefit from a greater ability to price traffic delivery over its network as it sees fit," the fact that the phone companies will also have more incentive to spend on building out their broadband capabilities could be a blow to cable firms. "The passage of telecom legislation on terms favorable to the telcos is more of a negative than a positive for the cable companies because such legislation is likely to embolden the telcos to make greater investments in infrastructure that competes with cable," Berman wrote. Patrick Comack, an analyst with Zachary Investment Research, an independent research firm, also thinks that the telephone companies stand to gain the most from any legislation that does not enforce Net neutrality. "Google wants it written up so that Net neutrality stays where it is but it doesn't look like they are going to get that," he said. "I think you will see quality of service deals struck and that would be a major positive for the Bells. It could actually be huge." - Oppenheimer's Eagan owns shares of Comcast and Time Warner but his firm has no investment banking relationships with the companies. Other analysts quoted do not own shares of the companies cited in this piece and their firm has not done banking for them. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. _____________________ Related: Net neutrailty debates rage at Fortune's Brainstorm Related: Google goes to Washington Related: The Broadband War of 2006 |

|