|

Google: The anti-Yahoo World's top search engine reports 2nd quarter results that top expectations; stock is edging up after hours. NEW YORK (CNNMoney.com) -- Google, unlike its top rival Yahoo, reported better than expected results for the second quarter Thursday thanks to strong demand for online search advertising. But will that be enough to impress fickle investors? Sales for the Mountain View, Calif.-based Google came in at $2.46 billion, an increase of 77 percent from a year ago.

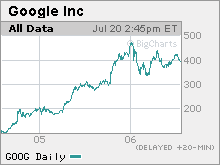

After deducting traffic acquisition costs (or TAC) that the company shares with advertising partners, Google reported revenue of $1.68 billion, better than Wall Street's consensus estimate of $1.65 billion in sales, excluding TAC. The company posted net income of $721 million, or $2.33 a share, up 110 percent from the same period last year. Excluding the cost of stock-based compensation and some other charges, earnings came in at $2.49 a share. That was well ahead of the $2.22 per share that analysts had forecast for the company on that basis. "We are very happy to have such a strong quarter in what is a seasonally weak quarter for us," said Eric Schmidt, Google's chief executive officer during a conference call with analysts. Shares of Google (Charts) initially dipped about 2 percent in after-hours trading on the news, but rallied a bit and were recently up about 1 percent after the close. The stock fell 3 percent in regular trading on the Nasdaq Thursday. The stock, which surged 115 percent in 2005, its first full year as a public company, has been a volatile performer this year. Shares are down about 6 percent on concerns about Google's valuation, its lack of diversification and the increased competition in search. Great expectations Google also may be a victim of unreasonably lofty expectations, said Sasa Zorovic, an analyst with Oppenheimer & Co. Google's earnings were about 12 percent higher than consenus forecasts. In the first quarter, Google beat estimates by 16 percent. "My sense is that they didn't beat by enough. It's a very strong quarter but people are still hoping that Google can blow away numbers," said Zorovic. Nonetheless, Google's results are a stark contrast to those reported by Yahoo (Charts)! on Tuesday. Yahoo reported earnings that merely met estimates, and revenue that missed forecasts slightly. Yahoo also warned that third-quarter sales would be lower than what Wall Street was expecting, and announced that it was delaying the launch of new search tools from the end of the summer to sometime during the fourth quarter. Yahoo's stock plunged nearly 22 percent on Wednesday as a result. Analysts said the delay should further benefit Google, which already enjoys a wide market-share lead in search over Yahoo. To that end, Zorovic said Google's results were strong enough to probably force most analysts to raise their 2006 sales and earnings targets for the company. Analysts currently expect Google to report revenue, excluding TAC, of $6.98 billion and pro forma earnings of $9.51 a share in 2006. Concerns about spending? Google is also doing much better than Microsoft's MSN unit, which owns the third largest search engine. Microsoft (Charts), which reported fiscal fourth-quarter results Thursday, posted a loss of $190 million from MSN during the quarter. Sales at MSN, which also include an Internet access business, fell 3 percent. However, some investors may be worried about Google's capital spending plans. The company has launched many new products this year, including Google Checkout, a payment service that some think will compete with eBay's (Charts) PayPal. Google also is aggressively hiring new workers both domestically and abroad. Google reported that it spent nearly $700 million on capital expenditures during the quarter, including $312 million for real estate purchases in its home base of Mountain View. "I did think it was noteworthy how much they talked about capital expenditures," said Scott Kessler, an equity analyst with Standard & Poor's. "But if Google continues to generate growth, people will accept that level of spending." During the conference call, Google chief financial officer George Reyes reiterated that the company's capital spending in 2006 will probably increase at a faster rate than its sales. He stressed, however, that investments will pay off and that Google is not recklessly spending. "Decisions about capital expenditures are carefully thought out and prudently debated," he said. Reyes also pointed out that Google is just starting to tap many international markets. Although Google generated 42 percent of its sales outside of the U.S., mostly from Europe, Reyes said that Google's presence in Asia and Latin America is still small. -------------------------------------------------------------- Related: Analysts quoted in this story do not own shares of the companies mentioned and their firms have no investment banking relationships with the companies. |

|