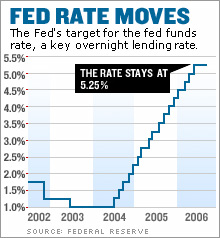

Jobs: Worried about weakness, for a change Sluggish job growth used to cheer investors nervous about the Fed. But if payrolls disappoint again, that could ring alarm bells. NEW YORK (CNNMoney.com) -- For much of the past two years, many on Wall Street have had a sort of topsy-turvy view of the government's monthly job report. Good news, in other words, strong job growth, was bad news since it suggested more Federal Reserve rate hikes ahead.

Meanwhile, bad news, or weak growth, often helped lift stocks since it raised hopes among investors that the Fed would stop raising interest rates sooner rather than later. But with the Fed finally pausing early this month after two years of rate hikes, the reaction to this jobs report could be much different, according to economists. Weak job growth could scare investors and hurt stocks because of rising concerns about an economic slowdown, the analysts said. And strong growth, as long as it's not accompanied by too big a rise in average hourly wages, could lessen those economic worries. Economists surveyed by Briefing.com are forecasting that employers added about 125,000 new workers to payrolls in August. That would be up from the 113,000 in July, a number that meant job growth missed forecasts for four straight months. The unemployment rate is expected to slip to 4.7 percent from 4.8 percent. And average hourly wages are forecast up 0.3 percent, after a 0.4 percent rise in July. John Silvia, chief economist with Wachovia, said that if job growth misses forecasts for August after falling short each of the previous four months, it would set off alarms for both investors and economists. "Everyone is comfortable with the moderate employment growth being forecast," said Silvia. "But given where the consensus is on jobs, anything weak would suggest the economy is weaker, and investors will be nervous about corporate earnings ahead." The Fed, the nation's central bank, raises rates when it wants to slow the economy and cuts them to spur growth. Investors dislike rising rates since this also tends to slow corporate profit growth. Silvia said that even an upside surprise on the payroll number probably won't spook investors worried that the Fed might raise rates again at its Sept. 20 meeting. "As long as the wage number doesn't show the pace of pay increases picking up, I think investors would be able to look past a strong payroll number and say, 'OK, we'll be alright with this,'" said Silvia. One thing that could be a worry is wages. If average hourly wages rise only the 0.3 percent forecast from the prior month, that could mean wages are up 4.0 percent year over year, up from a 3.8 percent rise in the July report. A 0.4 percent month-to-month rise would definitely fuel talk of a Fed hike in September, along with a sell-off in stocks, according to Silvia and Jeoff Hall, chief U.S. economist for Thomson Financial. "Four percent growth of average hourly earnings - that's inflationary," said Hall. "That will be taken as an inflationary trend." But he noted that a much weaker than expected wage gain could also spook investors. While flat or negative earnings would reduce inflationary pressure, they could also raise concerns about consumer spending, which accounts for more than two-thirds of the nation's economy. "The sweet spot is wage growth no lower than 0.2 percent, and no higher than 0.3 percent," Hall remarked. And he said that while a gain of 125,000 jobs might have been considered weak at one time, more recent research suggests that's closer to trend growth with current demographics and dynamics of the labor market: not too hot and not too cold. Still, economists and investors will want to see where the gains are coming from, and what sectors are losing jobs. "The composition of the gains is different from what we're accustomed to," said Hall. "Retail has been losing jobs. Construction, which has become a major sector, is down." |

| |||||||||||