|

Sony: The feel-good hit of the summer Problems with laptop batteries and PS3 delays are overshadowing the fact that Sony is having a killer year at the box office. NEW YORK (CNNMoney.com) -- Sony has been in the headlines a lot lately...but not for good reasons. Computer makers Dell (Charts) and Apple (Charts) both announced recalls of laptop batteries made by Sony late last month due to fears that the batteries may overheat and catch fire.

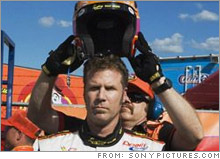

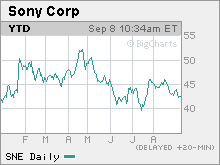

And earlier this week, Sony (Charts) said it needed to delay the launch of its new game console, the PlayStation 3, in Europe and that not as many PlayStation 3's would be available in the U.S. in time for the holiday shopping season as originally thought. This recent round of bad news has helped push shares of Sony's American Depositary Receipts (ADR) down 8 percent in the past three weeks. But investors may be ignoring Sony's strength in its media business. Da Vinci and comedies rule the box office So far this year, only Walt Disney's (Charts) Buena Vista studio has been more successful at multiplexes in the U.S. Disney, thanks to the top two hits of the summer, "Pirates of the Caribbean: Dead Man's Chest" and "Cars," has a 17.8 percent share of the total U.S. box office, according to figures from movie industry research firm, Box Office Mojo. But Sony is nipping at Disney's heels, with a 17.5 percent share. The company has released three of the top ten biggest hits at the box office this year: the film version of the blockbuster novel "The Da Vinci Code," and comedies "Talladega Nights: The Ballad of Ricky Bobby" and "Click." What's more, Sony has a strong presence abroad. "Da Vinci," for example, has grossed $217.5 million in the U.S. and has brought in $536 million in overseas box office sales. And the studio should keep doing well in the coming months. Sony will be releasing the sequel to its hit horror film "The Grudge" in October and the studio has also arguably the most eagerly anticipated new movie of the fall as well, the new bond flick "Casino Royale." Next year looks promising as well, with "Spider-Man 3" on tap. The first two "Spider-Man" movies grossed more than $775 million in the U.S. To be sure, Sony's entertainment unit is a relatively small part of the company, accounting for just 11 percent of total sales. It also reported an operating loss in Sony's fiscal first quarter, which ended in June. But the Sony Pictures division was the most rapidly growing unit for Sony in the first quarter, with sales increasing by 41.8 percent from the same period last year. And one analyst thinks the unit should wind up generating a profit this year. "Clearly, the film division is going to be an area of improvement driven largely by 'The Da Vinci Code' so we are expecting positive operating income there," said Daniel Ernst, an analyst with Hudson Square Research - Soleil, an independent research firm. And in a reflection of how well the studio is doing, Sony announced this week that it was promoting Amy Pascal, the chairman of Sony's Motion Picture Group, to co-chairman of Sony Pictures Entertainment, which oversees the production of television shows as well as the firm's online video strategy in addition to movies. In an e-mail response to questions from CNNMoney.com, Standard & Poor's equity analyst John Yang, who follows Sony from Tokyo, said Pascal's promotion is a good sign since she has a solid track record at the studio. However, he hopes that she will be able to get the studio to deliver more consistent results over the next few years. "Pascal's number 1 task is to stabilize the movie business' earnings. The segment appears to struggle in eking out profits when there is no Spider-Man - perhaps this reflects how significant the Spider-Man franchise has become to Sony Pictures," Yang said in the e-mail. "She has to make sure there are strong titles year in/year out so that the movie business can break away from the Spider-Man cycle." Grouper: Sony's YouTube? Analysts say it will also be interesting to see how Sony integrates its new online video acquisition with its studio business. Last month, Sony bought Grouper, a privately held online video firm, for $65 million. Grouper, which competes with the popular YouTube and other video sharing sites, could help Sony get a leg up on other media firms in the growing world of online video. With more and more people going online to watch short user-generated videos, the hope is that advertising dollars will follow. And increasingly, the Internet is being viewed as a way for media companies to sell movie downloads. To that end, Amazon.com (Charts) launched a video download service on Thursday and Apple is rumored to be doing the same next week. "User generated video sites are generating so much traffic so this makes a lot of sense," said Ben Bajarin, consumer technology analyst with Creative Strategies, a tech research firm. "Also, Sony could use Grouper to sell and distribute TV shows and films that can be then moved to computers or its PlayStation Portable." The challenge for Sony, though, will be boosting Grouper's profile so it can become a venue for Sony to sell downloads of its own movies. Although the site is fairly well-known among hardcore tech and media followers, Grouper is not a mainstream phenomenon ala YouTube or News Corp (Charts)-owned MySpace. According to data from Nielsen//NetRatings, Grouper had only 630,000 unique users in July. By way of comparison, YouTube had 30.5 million and MySpace's video sites had 18.2 million. Josh Felser, the co-president of Grouper, said he hopes that Grouper's exposure will be increased since it will be promoting the release of Sony films and TV shows. "The traffic that surrounds event videos, whether it's 'Spider-Man 3' or the release of 'Seinfeld' DVDs, that is a big deal for us," he said, adding that he hopes that Grouper will be able to have specific pages tied to all Sony movie and TV releases that could feature trailers, outtakes and other content, such as user-generated mash-ups. One mutual fund manager who owns shares of Sony said he's confident that the company will continue bulking up its presence in all forms of media. James McGlynn, manager of the Summit Everest fund, said that he expects Sony to become even more aggressive since Sony's CEO Howard Stringer, is a media veteran, having previously worked at CBS for 30 years. "If Sony didn't have the media component, we wouldn't own it," McGlynn said. "It's interesting to see how Stringer will whittle Sony down to become more media oriented. He is a media guy running the company." To that end, McGlynn said he doesn't rule out the possibility that Sony could eventually spin off its media and entertainment division since the media assets may be able to get a higher valuation than the much-larger consumer electronics division, which is a business that often is plagued by intense price competition. -------------------------------------------------------------------------------- Analysts quoted in this story do not own shares of Sony and their firms have no investment banking relationships with the company. |

|