|

'Old' media: We're not dead! Executives from Comcast, CBS, Time Warner and News Corp. stress that they are alive and kickin' in the age of new media. NEW YORK (CNNMoney.com) -- Most media stocks have bounced back sharply this year after a brutal 2005 as investors began to realize that entertainment firms are positioning themselves for growth in the new world of digital media. And executives from several big media companies expressed even more optimism about the business and how they were adapting at an industry presentation Tuesday.

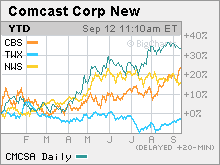

News Corp. said that it was in talks with Apple to sell movies from Fox's studio over iTunes. Comcast and Time Warner boasted about how many subscribers they are gaining for new services. And CBS said it expects to make money from its TV shows regardless of how, and when, people choose to watch them. Speaking at Merrill Lynch's Media and Entertainment Conference in Pasadena, Calif., John Alchin, the co-chief financial officer of cable giant Comcast, said the company expects to see strong revenue growth in the latter half of the year as Comcast continues to sign up customers for the so-called "triple play" of cable, phone and Internet access products. "Not only are we providing the best products and best value proposition to customers but in the course of doing this, it is driving financial results," Alchin said. Along those lines, Wall Street currently expects Comcast to report an 11 percent increase in third-quarter sales from a year ago and 12 percent jump in the fourth quarter. Alchin said that Comcast would invest more in new technology, including its joint venture with wireless firm Sprint Nextel, as the company hopes to fend off competition for subscribers from phone companies AT&T and Verizon, which are both rolling out video offerings for their customers. He added that Comcast would probably not make any major acquisitions though. Comcast (Charts) has been one of the better performing media stocks this year. Its shares have soared nearly 35 percent in 2006 as the company has racked up strong subscriber gains for newer products such as digital phone and high-speed Internet services. Other cable companies, such as Cablevision and Meidacom, have also benefited from these trends but Wall Street has not rewarded them as much. The stock price of Time Warner (Charts), which owns the nation's second largest cable firm behind Comcast, is down 2 percent this year. Although cable has been one of the better performing units for the media giant, which also owns CNNMoney.com, weakness at the company's AOL Internet unit and magazine publishing division have weighed on the stock. Time Warner is expected to sell a portion of Time Warner Cable to the public later this year in order to capitalize on investor interest in the sector. Landel Hobbs, the chief operating officer of Time Warner Cable, who also spoke at Tuesday's Merrill conference, said that the company has been successful in getting its customers to subscribe to all three components of its "triple play" services. So far, 10.5 percent of Time Warner's customers subscribe to cable, phone and Internet services and that in markets such as Kansas City, San Antonio and Albany, the figure is closer to 20 percent, Hobbs said. Comcast and Time Warner recently completed a joint acquisition of bankrupt cable provider Adelphia, with Time Warner mainly buying Adelphia cable clusters in New York, southern California, Ohio and Maine. Hobbs said that the integration of Adelphia has gone well so far but that the company now needs to focus on marketing and upgrading Adelphia's systems. Booming broadcasters The cable companies shared the spotlight with the leaders of two top broadcasting firms as well Tuesday. CBS' chief executive officer Leslie Moonves said it was encouraging to see the ratings increases at its CBS Evening News telecast since Katie Couric took over last week and that he expected more healthy results from its primetime lineup this season as well as from its thriving outdoor advertising business. "No one can accuse us of being off the radar," said Moonves. "We are alive and well and thriving on every front." Shares of CBS (Charts), which split from former parent Viacom (Charts) in January, are up 17 percent this year thanks to strong ratings at the CBS TV network. Wall Street has also applauded the company's decision to sell some underperforming radio stations and its theme park business. Despite this, Moonves said at the conference that he felt CBS's stock was still undervalued. In addition, he stressed that CBS would be a big player in "new media" going forward and that the company should be able to generate strong sales and profits from ads tied to its online and mobile shows as well as from video-on-demand fees. "No mater where the programs go, the programs are ours and we're going to get paid for them," he said. Peter Chernin, the president and COO of media conglomerate News Corp. (Charts), also spoke at the Merrill conference. News Corp.'s stock has gained more than 20 percent this year due to healthy results for its Fox TV, cable and movie units as well as excitement about the potential for its new media businesses. Last year, News Corp. bought social networking site MySpace, which now ranks as one of the most popular sites on the Web and recently signed an online-ad sharing deal with search kingpin Google (Charts). Chernin said News Corp. generated about $250 million in revenue from its Fox Interactive Media unit, which includes MySpace, in its most recent fiscal year and added that revenue should "easily double" this fiscal year, which ends in June 2007. He said that e-commerce could be another big generator of revenue for MySpace in the future. The company will soon start selling music downloads on MySpace and Chernin said that online auctions on the site are a possibility. Chernin also said that the company plans to invest more in its new video service in an effort to overtake YouTube, the web site that is the industry leader in user-generated video content. He added that News Corp. is also working with other companies to sell videos from Fox's TV and movie studios online. To that end, Chernin said News Corp. has been in talks with Apple to sell downloads of movies from Fox but that no deal has been struck yet. Apple announced Tuesday that it would begin to sell movies from Walt Disney-owned studios over iTunes. News Corp. is expected to remain active in mobile entertainment as well. Also on Tuesday, News Corp. announced it was buying a 51 percent stake in Jamba, a company that sells ring tones and games for cell phones. -------------------------------------------------------------------------------

The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

|