Why Comcast should buy Viacom Remember Comcast's failed bid for Disney? Viacom could be the next best thing if Comcast wants to bulk up on content. NEW YORK (CNNMoney.com) -- Hey, Comcast Chairman and CEO Brian Roberts: If you're reading this, I've got some friendly advice for you. Why don't you make a run at buying Viacom, the media giant that's in such disarray? Viacom didn't even give its former CEO Tom Freston nine months on the job.

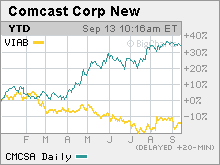

With the stock taking a bigger hit than Tom Cruise's movie career this year, he got the boot as well, and now some people, like yours truly, think that Viacom could be in play. Seriously, Brian, Viacom (Charts) Chairman Sumner Redstone might be willing to sell out if the price is right. After all, even if he gave up control of one of his babies, he's still chairman of CBS. And everybody loves Les Moonves and CBS (Charts) right now. It's Viacom that's making Sumner poorer on paper. And Redstone's recent rant about Cruise in The Wall Street Journal may be a sign that he's tired of the movie business and would rather concentrate on CBS. After Viacom unceremoniously dumped Freston last week, Soleil-Media Metrics analyst Laura Martin told me that she thought this was clearly a sign that a "self-made billionaire may throw up his hands and give up" and that Viacom could be a good fit for Comcast (Charts). Now I realize that your company may not want to do any more big deals after chipping in with my corporate parent (Time Warner (Charts)) to buy Adelphia. Thomas Eagan, an analyst with Oppenheimer, said Comcast is probably better off focusing on Adelphia and creating new cable channels instead of buying them. In fact, your co-chief financial officer, John Alchin, said as much on Tuesday at the Merrill Lynch Media and Entertainment Conference. "In terms of potential acquisitions, there is nothing in the pipeline, nothing contemplated. Expect more of what you've seen over the past couple of years," he said. Well, here's the thing. Some might interpret that statement as meaning that you wouldn't want to buy Viacom or anything else big for that matter. But I'm reading between the lines. "Expect more of what you've seen over the past couple of years." Not ESPN, but MTV and Nick will do OK. In early 2004, your company made a bold play to buy Disney. So if we should expect more of what we've seen the past couple of years, then why not expect Comcast to make another big play for a media firm and go after Viacom? Remember the cliché: Content is king! You were willing to spend $54 billion plus take on $12 billion in debt to buy Walt Disney (Charts) 2-1/2 years ago. Granted, the key to that deal was gaining control of ESPN, arguably the crown jewel network of cable TV. Still, Viacom is no slouch. It's cable networks include MTV, Nickelodeon, Comedy Central, BET and Spike - all of which could clearly be beneficial for Comcast. In the second quarter, Viacom's cable networks reported revenue of $1.8 billion, up 8 percent from last year, and operating profit of $710 million, up 12 percent from a year ago. Sure, that's not as sexy as the 12 percent jump in sales and 15 percent gain in operating profit that Disney's cable networks posted in its fiscal third quarter. But it's not as if ad revenue and profits at Viacom are withering away. So some of the doom and gloom about how badly Viacom is doing does seem a bit overdone. And Viacom comes at a much cheaper price. Its market value is $25.2 billion. So even with a premium and factoring in Viacom's $7.7 billion in debt, you're still looking at a total purchase price of probably $36 billion tops, $30 billion less than what it would have cost to buy the House of Mouse. And Disney's obviously not weak enough to be considering a merger anymore. Plus, your stock price is slightly higher now and your company has seen healthy gains in subscribers for digital cable, phone and Internet services. So you're working from a position of strength. Comcast is valued at about 9 times 2007 projected earnings before interest, taxes, depreciation and amortization (EBITDA) and 31 times estimated earnings per share. Viacom trades at only a slight premium of 9.6 times EBITDA estimates for 2007 and just 16 times projected EPS for next year. So a deal would not necessarily have to be a huge damper on Comcast's earnings. Paramount library = Video $$$ Excuse me if I now sound like a commercial you might see on E! Entertainment Television, one of the cable channels you own, at 4 a.m. but wait....there's more! Viacom wouldn't be attractive to you simply because of its cable networks. Viacom also owns the Paramount movie studio. Yeah, the movie business is not an easy one. But you already put your pinky toe in the water when you teamed up with Sony (Charts) and some private equity firms to buy MGM. And we all know that for Comcast, the key to movies is not how they do at the box office but how they do once they are available on cable via video-on-demand services. Your company is aggressively touting video-on-demand and you've already done a decent job of putting old titles from the MGM library, such as the James Bond franchise, on VOD channels. During your last earnings report in July, your chief operating officer, Steve Burke, said that in June alone, customers watched 150 million VOD sessions, a 33 percent increase from a year ago. Burke added that "a digital customer that uses VOD, is a much more loyal, much happier" subscriber. So it's clearly in your best interest to bulk up your offerings. And buying Viacom would give you Paramount titles that include "The Godfather" trilogy (well, let's just forget that the third one existed), all the "Star Trek" films and the "Indiana Jones" trilogy. Sure, buying Viacom would be a lot to handle since you also have Adelphia on your plate. But it would be a lot easier to manage than Disney. Oppenheimer's Eagan said one reason he didn't like your bid for Disney was because that company also owned a broadcast network, ABC, and theme park business - divisions where results are more tied to swings in the economy. Well, what do you know? Viacom doesn't have that problem anymore since CBS is no longer part of the company. So come on Brian. Give Sumner a call. -------------------------------------------------------------------------------- Oppenheimer's Eagan owns shares of Comcast and Time Warner but his firm has no banking ties with the company. Soleil's Martin does not own shares of the companies mentioned and her firm does not have a banking relationship with any of them. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

| ||||||||||||||||