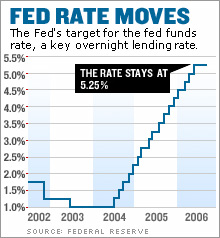

After the pause: The Fed's kindest cut? The Fed probably won't raise interest rates. But Bernanke & Co. may soon start thinking about lowering rates in 2007. NEW YORK (CNNMoney.com) -- The Federal Reserve is widely expected to keep short-term rates steady when its policy committee meets Wednesday. But now market observers are starting to wonder when the central bank might want to consider lowering rates as the economy starts to show signs of softness. The Fed did not raise the federal funds rate, a key short-term interest rate, at its last meeting in August. That came after 17 consecutive quarter-point hikes, dating back to June 2004. During that time, the federal funds rate has gone from 1 percent to 5.25 percent.

The fed funds rate is important because it helps determine overnight bank lending rates and therefore affects how much interest consumers and businesses have to pay when borrowing money for certain types of loans. According to federal funds futures contracts listed on the Chicago Board of Trade, investors are pricing in a 90 percent chance that the Fed will hold pat on Wednesday and just a 10 percent chance that the central bank will boost rates by a quarter of a percentage point. The central bank's policymakers were meeting in Washington Wednesday. An announcement is expected about 2:15 p.m. ET. No more hikes in '06 and cuts in '07? The central bank raised rates as many times as it did during the past two years to keep inflation in check. But some economists think inflation is no longer the biggest risk facing the economy. On Tuesday, the Census Bureau reported that housing starts sank to a three-year low, raising concerns about overall economic weakness. And reports in the past few weeks for both consumer and producer prices show tame inflation. The Fed alluded to the housing slowdown several times in the minutes from its previous meeting. In addition, Fed chairman Ben Bernanke told Congress in July that inflation was under control. With that in mind, some think that short-term rates will go no higher than where they are currently. "I think the Fed will hold rates unchanged at [this week's] meeting and likely through the end of the year," said Mark Zandi, chief economist at Moody's Economy.com. After Wednesday's meeting, the Fed's policy committee is scheduled to meet two more times this year, in October and December. Oscar Gonzalez, economist with John Hancock Financial Services, also thinks that the Fed will take a wait-and-see attitude towards the economy and hold rates steady Wednesday...and perhaps beyond that. He said that what happens to housing is the biggest economic wild card right now. "The Fed will stay put. It's time to evaluate information from the housing market and consumer spending trends," Gonzalez said. And if the housing market continues to deteriorate, Zandi said the Fed may need to start lowering interest rates in order to make sure the economy doesn't slow down too drastically. He argued that short-term rates of 5.25 percent, while not high by historical standards, are still high enough to put a crimp in borrowing and consumer spending. "Rate cuts next year are a possibility as the economy continues to grow below its potential and inflation continues to moderate," Zandi said. "Rates are at a slightly restrictive level and that is weighing on growth. That's why the argument for rate cuts early next year is sound." Eric Dube, an economist with National Bank Financial in Montreal, said that the housing slowdown could be so severe that it may force the Fed to lower interest rates several times next year. Dube said he thinks that by the end of 2007, the fed funds rate could be at 3.25 percent. Inflation hasn't gone away But one market expert pointed out that inflation is not exactly dead...so that should remain the Fed's priority. Earlier this month, data from the government's second-quarter productivity report showed that unit labor costs rose at a much higher rate than expected over the past year. That could be a worrisome sign since wage increases are generally viewed as one of the strongest indications of overall inflation. "Unit labor costs were elevated and that's got to make people on the Fed uneasy," said Nasri Toutoungi, a managing director of fixed income with Hartford Investment Management. Toutoungi said that he still expects the Fed to keep rates unchanged despite the boost to labor costs. But he said it would not surprise him if Fed governor Jeffrey Lacker, who voted for a rate hike in August, once again dissents and votes for a rate increase. As such, Toutoungi said that it may be premature to expect that the Fed will start lowering rates in 2007. Stocks have recently moved to four-month highs on the hopes that the Fed is done raising rates and could begin cutting them next year. And the Dow Jones Industrial Average is within 150 points of surpassing its all-time peak from January 2000. "The market is a little ahead of itself. In order for the Fed to cut rates, you have to see evidence that the economy is weakening. Yes, it's softer but it's not weak," he said. Dube concedes that inflation is still something the Fed needs to keep an eye on but that it shouldn't be the central bank's biggest worry. "It's a tug of war between inflation pressures and the slowdown but in our view, the slowdown is the winner," he said. -------------------------------------------------------------------------------- |

| ||||||||||||||