|

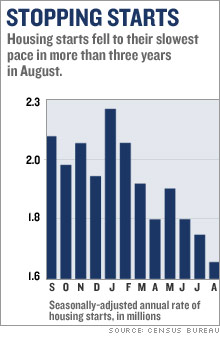

Housing starts tumble Builders pull back on new projects, permits as latest reading shows real estate market even weaker than forecast. NEW YORK (CNNMoney.com) -- Home builders slammed on the brakes in August as starts on new homes sank to their lowest level in more than three years, and a drop in permits signaled more weakness ahead for the real estate market. Housing starts sank to an annual rate of 1.67 million last month from July's 1.77 million pace, the Census Bureau reported Tuesday. That marked a 6 percent decline from July and a nearly 20 percent drop from a year earlier.

Starts are at the lowest level since April 2003. It also marked the sixth time in the last seven months that starts have fallen from the previous month's level. Economists surveyed by Briefing.com had forecast starts would drop to a 1.74 million rate. Building permits, which are seen as a reading of builders' confidence in the market, fell to a 1.72 million annual rate in August from a downwardly revised 1.76 million in July. Economists had forecast permits would slow to a 1.75 million pace in August. Many of the nation's largest home builders, including KB Home (Charts), Lennar (Charts), Toll Brothers (Charts) and Hovnanian (Charts), have been lowering guidance on home sales in recent weeks, reporting lower prices and excess supply of homes on the markets. Economists said that as weak as housing starts and permits were in August, it's likely they will both continue to fall in future months. "Until we see a recovery in housing permits, it is unlikely that we have seen the bottom," said Phillip Neuhart, an economist with Wachovia. Monday the National Association of Home Builders' survey of members showed the eighth straight month of falling confidence among builders, as the group's index dropped to a more than 15-year low. The one piece of good news for the housing market from Tuesday's report is it suggests that the supply of new homes on the market could start to narrow, since builders are pulling back so sharply. The inventory of completed new homes on the market for sale hit a record high in July, according to a separate government report, and that glut of homes on the market has put downward pressure on all home prices. "Thank goodness the builders are cutting back on their additions to supply; it's an absolutely essential adjustment at this point," said David Seiders, chief economist with the builders' trade group. Seiders said his estimates are that the "normal" level of housing starts given current factors such as population growth and job creation suggest there should be about just under 1.9 million housing starts a year. The building boom of 2004 and 2005, topped with last year's record 2.07 million starts, has left the market with an oversupply that could take years to work through, he said. "2004 and 2005 were clearly excessive, far beyond potential, and that's come home to roost," Seiders said. "We probably won't see a bottoming until the middle of next year, but we could well be running below potential into 2008." Home building has become an important segment of the economy, and the weakness in building could put a crimp in hiring and economic activity for years to come. ____________ |

|