|

Time is running out for Bill Miller Legg Mason Value Trust has beaten the market 15 years in a row but the streak may come to an end this year. NEW YORK (CNNMoney.com) -- A wise man once said that it ain't over till it's over. But with a little more than three months remaining in the year, the chances of legendary fund manager Bill Miller extending his streak of beating the market are not looking good. Miller's Legg Mason Value Trust has outperformed the S&P 500 for the past 15 years. However, the fund will need a huge fourth-quarter surge if Miller wants to have a Sweet 16 party.

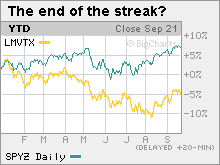

Through Sept. 21, the Legg Mason Value Trust was down 4.8 percent for the year while the S&P 500 had gained 7.1 percent, including dividends. He's been here before Miller has come from behind in the past. He lagged the S&P 500 at the end of the third quarter for the past two years and went on to beat the market thanks to fourth-quarter rallies in tech and other growth stocks. Despite the "Value" in the name of Miller's fund, he has big bets on pricey Internet companies like Google (Charts) and Yahoo! (Charts) Greg Carlson, a fund analyst with Morningstar, said you can't rule out Miller yet. "Judging from past history, it's possible to keep the streak alive. His stocks do tend to rally in the fourth quarter," he said. But in 2004, Miller's fund was only lagging by 4.1 percentage points. Last year, the deficit was even less. "It's a big gap at this point," Carlson said of this year's 12-point difference. In addition, several of Miller's top holdings continue to get hit by bad news. Wireless company Sprint Nextel (Charts), Miller's top holding, reported a steep drop in earnings during the second quarter as subscriber growth slowed. The stock has fallen nearly 20 percent this year. Shares of online retailer Amazon.com (Charts), Miller's fifth largest holding, have plunged 35 percent due to concerns about profits as the company spends heavily on new technology as well as its free shipping program for frequent customers. What's more, the introduction of Amazon's new movie download business was met with a collective yawn. And Miller increased his exposure to computer maker Dell (Charts) in the second quarter. Since then, Dell announced that it's the subject of an SEC probe, issued a big sales and earnings warning as increased competition from Hewlett-Packard (Charts) put pressure on the company, and recalled more than 4 million laptop batteries due to fears they may catch fire. Dell's stock has tumbled 13 percent in the third quarter and nearly 30 percent this year. To be sure, Miller's had his share of winners this year. Utility company AES, Miller's third largest holding, has gained nearly 30 percent, while telecom Qwest, the fourth largest holding in the fund, has surged almost 60 percent. Big bets on JP Morgan Chase and Sears Holdings Corp. have also performed well. Miller would not comment for this story. But based on comments that he made in his letter to shareholders in July, it does not appear that he is all that interested in making short-term changes to the portfolio just to keep the streak alive. "We are long term investors and not traders. Our contrarian approach often puts us at odds with the prevailing views in the market. When our approach leads to underperformance, such as in the current market, there is increasing pressure to change or do something different. It is our willingness to own securities which other people regard as wrong which historically has been part of the long term success of the fund," he wrote. Still shying away from energy To that end, Miller has acknowledged that his performance was hurt by avoiding the energy sector, which even with a recent pullback in oil prices remains one of the best performing sectors this year. But Miller clearly hasn't drunk the energy Kool-Aid. He jokingly added that he probably would not buy energy stocks now since they've already enjoyed such a big run-up. "The call is much harder from here, with only scattered Stone Age tribes in the Amazon, the comatose, or newly arrived aliens from Alpha Centauri, unaware that energy stocks are a one way ticket to outperformance due to demand from China and India, the location of reserves in unstable areas, the lack of investment in new refining capacity, the rate of depletion, the dwindling ability to locate giant new fields, and so on," he wrote. So if Miller falters and does not outperform the S&P 500, who will inherit the title as the fund manager with the longest streak of beating the market? The Quaker Strategic Growth fund with eight years of outperformance has the second-longest streak behind Miller's fund. But the mostly large-cap fund, run by Manu Daftary, is also in danger of seeing its streak end. Through Thursday, the fund was flat for the year. And if neither Miller nor Daftary extend their run, it's likely that no one fund will inherit the title as the one with the longest streak of outperforming the market. Several funds currently riding seven-year winning streaks are on track to beat the S&P 500 this year, including Goldman Sachs Growth Strategy, Davis Opportunity, Ivy Global Natural Resources and Cohen and Steers Realty Focus. ---------------------------------------------------- |

|