Selling out: Media's 'private' affairExpect more big media companies to sell out to investment firms in the coming months. Who's most likely to get taken over?NEW YORK (CNNMoney.com) -- Media companies are notorious for their copycat ways. Any time a studio, record label or publisher comes out with an unexpected hit, you know it won't be long before rivals start churning out TV shows, movies, albums and books that are suspiciously similar to the original success story.

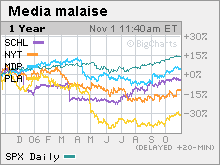

And now it's starting to look like the next big thing in media may be going private. Spanish-language TV and radio firm Univision is in the process of being taken over by a group of private equity firms. Cablevision wants to do so, too. Newspaper publisher Tribune (Charts) is exploring the possibility. And most recently, radio station owner Clear Channel Communications (Charts) said it would consider a sale of the company. Everybody's doing it. And it's not going to end any time soon, especially since companies like Blackstone, Texas Pacific and Kohlberg Kravis Roberts are still sitting on a ton of cash. "There absolutely will be more private equity buyouts in media since firms are attracted to the strong cash flow and sustainability of media brands," said Tolman Geffs, a managing director with Jordan Edmiston Group, a New York-based boutique firm specializing in media deals. Shares of Univision, Cablevision, Tribune and Clear Channel have already gained an average of 15 percent this year. So it might be too late to cash in on their desire to leave Wall Street and those pesky analysts and shareholders behind. But after talking to some experts in the mergers and acquisitions business, I came up with my own list a list of potential takeover candidates. I ran a stock screen to look for media companies with relatively low debt-to-capital ratios, strong cash flow and moderate levels of expected earnings growth over the next few years. Geffs said that low debt levels and strong cash flow are critical. That's because private equity firms often use debt to finance their purchases. But it's just as important to find companies that don't have the level of earnings growth to keep Wall Street excited anymore. These are companies that may have management teams that are fed up with the grind of constantly needing to beat estimates. "As a public company there is a lot of pressure quarter to quarter to deliver earnings growth. Some of these media companies have experienced difficulty with that recently," said Morton Pierce, head of the mergers and acquisitions group with Dewey Ballantine, a New York-based law firm. So who did I find? Interestingly enough, Clear Channel and Tribune both made the cut. Several other relatively well-known media names popped up as well. From the struggling world of newspapers and magazines, The New York Times Co., Meredith, which publishes magazines such as Better Homes and Gardens and Family Circle, and Playboy all made the list. All three stocks have had a rough go this year. Shares of Meredith (Charts) have barely moved, while shares of the New York Times (Charts) and Playboy (Charts) have fallen 9 percent and 14 percent respectively. A spokesman for Meredith said the company does not comment on market speculation. A spokeswoman for Playboy also issued no comment. A spokesperson for the New York Times was not immediately available to discuss the possibility of the company selling out to a private equity firm. I've actually already written about why it might make sense for the New York Times to sell out, as earnings are expected to increase at just a 7 percent clip a year for the next few years. The newspaper business is not getting any easier as the Internet continues to steal away readers and advertisers. To be sure, the New York Times, like other publishers, is making an attempt to become more of a digital company. But Glover Lawrence, co-founder of McNamee Lawrence & Co, an investment bank based in Boston, said it might be easier for a company like the Times to take even more drastic action if it did not have to deal with shareholders and quarterly earnings. "Many media companies are in need of fundamental restructuring and you can't do that in the public light," he said. "Newspapers are going through fundamental shifts. The rules are changing." The magazine business is going through tough times for similar reasons. Playboy, in fact, has already been the subject of takeover speculation after a June article in Barron's suggested that the company could be a good fit for a private equity firm. And both Meredith and Playboy could be attractive because they own well-known publications. Jordan Edmiston's Geffs said that one of the key things that private equity firms are looking for are strong brand names. With that in mind, another well-known company that came up on my list that also has a strong brand name is Scholastic (Charts), the book publisher known for children's books such as the "Harry Potter" series of novels, which it publishes in the United States. A spokesperson for Scholastic was not immediately available for comment. There has been speculation on Wall Street in recent months that large media firms may want to get rid of their slow-growth book divisions. News Corp. owns Harper Collins, and CBS owns Simon & Schuster. In fact, my parent company, Time Warner, sold its book unit earlier this year to French media firm Lagardere. But rather than look to buy a small division of a company, M&A experts say that private equity firms are increasingly interested in gobbling up corporations as a whole. So that could make Scholastic more appealing. "The old strategy of private equity buyers was 'Let's pick up a non-performing asset.' Now the strategy is to go for the entire company. The view is that if they can fix a division, they can fix the whole company," said Reed Phillips, managing partner with DeSilva & Phillips, a media investment bank in New York. In addition, publishing companies might make more sense as targets of investment firms rather than other media conglomerates because Wall Street is increasingly focused on how traditional media can expand online. So, for example, one newspaper company buying another newspaper publisher might not get a warm reception from investors. "There is a view in the media business that because of the Internet and the focus on digital, people don't want to buy more assets like those they already own," Phillips said. And since many of the big-name private equity shops have plenty of money to spend, just about any media firm could be a target. "I don't think any media company is out of the question," said Glover. "There is lots of money chasing lots of opportunities so I don't think anything is off the table."

The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

| |||||||||||||||