TV political ad spending hits recordWith a few days left before Election Day, politicians are on track to spend $2 billion. That's good news for TV station owners.NEW YORK (CNNMoney.com) -- It's been business as usual when it comes to political advertising this year: the nastier the better. And in the midst of this year's highly contentious mid-term election campaign, politicians have already broken the record for TV advertising spending.

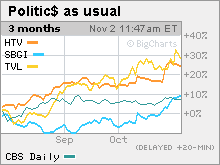

According to research firm Campaign Media Analysis Group, a subsidiary of TNS Media Intelligence, which tracks ad spending, more than $1.8 billion has already been spent on political ads this year. That breaks the record of $1.7 billion in advertising expenditures from 2004. These figures include spending on local and national network TV and national cable, but not local cable. And with a few days left before Election Day, Evan Tracey, the chief operating officer of TNS Media Intelligence-CMAG, said that political spending is on track to reach $2 billion this year. Tracey said the record spending has been driven in part by the fact that there are few races where the outcome seems to be certain. He points to Senator Joseph Lieberman's defeat in the Connecticut Democratic primary in August as a wake-up call to many politicians. "Not many candidates feel safe right now. There is a national anti-incumbency movement. Once Lieberman lost in Connecticut it sent a shock throughout the political community and we started to see a lot more ad spending from what were thought to be relatively safe incumbents," Tracey said. He added that several states have controversial ballot initiatives, on such topics as gay marriage, stem-cell research funding and tobacco taxes, which are also fueling the record amounts of political spending. That's been good news for both large media companies and smaller owners of television stations. Tracey said that he's been hearing that ad rates are soaring ahead of the election, as candidates start to get more anxious and stations realize they can command higher rates. He said one client told him that a commercial spot in California that cost $125,000 on Tuesday wound up being sold for $250,000 on Wednesday. As such, shares of local TV station operators Sinclair Broadcasting (Charts), Lin TV (Charts) and Hearst-Argyle TV (Charts) have each surged during the past three months, partly in anticipation of strong third-quarter and fourth-quarter ad sales. "The fact that the control of the House and Senate is at stake in this election, the amount of advertising is above what investors might have expected and this will heat up even more in the final few days before the election," said James Goss, a media analyst with Barrington Research. To that end, Sinclair reported on Wednesday that political ad sales for the fourth quarter were about $8 million ahead of what the company had originally budgeted and that overall political ad sales were now on track to increase 18 percent over the last mid-term election cycle in 2002. And last week, Hearst-Argyle TV told Wall Street that it expected full-year 2006 sales to be at the high end of the company's forecast thanks to better-than-expected political ad revenue. The increase in ad spending has also been a boost for larger media conglomerates. CBS (Charts), which owns a network of local stations, said Thursday when it reported its third-quarter earnings that "strong political advertising sales" helped to partially offset weakness in other areas. Edward Atorino, an analyst with The Benchmark Company, an independent research firm that focuses on media stocks, said that several newspaper and magazine publishers which also own TV stations could also benefit from the record level of ad spending. He cited Tribune (Charts), Gannett (Charts), Meredith and Belo as some examples. However, the increase in TV ad spending may not be enough to overcome the fact that circulation continues to decline and newspaper ad revenue growth is also sluggish. "It's a glass half-full/half-empty issue. The broadcast business may do better but the newspaper business still struggling. The good news may not be sufficient to offset bad news," he said. In addition, this year's strong increase in political ads could provide an only temporary lift to TV station owners. The overall ad market continues to be relatively weak due largely to the struggling auto sector. Companies like GM and Ford are big TV advertisers. Indeed, CBS said Thursday that overall TV ad sales in the third quarter were down three percent from a year ago. Sinclair said that its local ad revenue, excluding political ads, fell two percent in the third quarter. And TV ad sales at Hearst-Argyle dipped nearly 5 percent, excluding political ad revenue. For this reason, Goss said that the increased political ad spending is "gravy" and investors can't count on it after this year. Atorino agrees. After all, there won't be too many hotly contested political races in 2007. "This is good news in the short-term. It will help fourth-quarter earnings quite a bit," he said. "But the trouble is that political spending goes away next year so comparisons to the second half of this year will be tough." Benchmark's Atorino owns shares of Meredith. Barrington's Goss owns shares of CBS and Tribune. Their firms do not have investment banking relationships with the companies. |

|