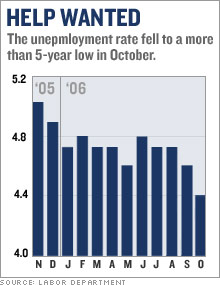

Unemployment sinks to 5-year lowRate posts unexpected drop to lowest since May 2001; job growth revised higher.NEW YORK (CNNMoney.com) -- The unemployment rate fell to the lowest level in more than five years in October, the government reported Friday, a sign of unexpected strength in the job market. The jobless rate sank to 4.4 percent from 4.6 percent in September, the Labor Department said. It was the lowest since May 2001. Economists had forecast the rate would hold steady.

The department also said that employers added 92,000 jobs in October, down from a revised 148,000 in September, and short of Wall Street forecasts for a gain of 125,000. But the September reading was revised up from the originally reported 51,000, and the increase, together with a revision to the August reading as well, had employment up 139,000 above earlier estimates heading into October. Those revisions and the modest October gain mean that 1.5 million jobs have been added so far this year, which is above forecast by most private economists, and blunts the effect of the modest October gain. The Bush administration hailed the report, but one political analyst said it wasn't likely to help Republicans facing tough elections battles on Tuesday. Polls indicate the economy isn't the top issue in the midterm elections. The tighter job market is apparently helping to lift wages, according to the Labor Department report, which showed that average wages rose 6 cents to $16.91 an hour last month, a shade above what economists had forecast. Average wages are now up 3.9 percent over the last 12 months while the Consumer Price Index, the government's main inflation gauge, is up 2.1 percent for the 12 months ending in September, partly due to the recent sharp decline in oil prices. The spike in gas prices in September 2005, in the wake of Hurricane Katrina, also blunted the year-over-year gain in the price measure. Economists generally agreed that the report showed a strong labor market, and not the weakening economy portrayed in some other recent economic readings, such as the third quarter gross domestic product report a week ago that showed the weakest economic growth in more than three years. "All this points to a very robust labor market," said Steven Wieting, senior economist at Citigroup. "Almost all the data this week have been weak. It's possible that the cuts in production will clear the deck and set us up for strong growth in 2007." Rich Yamarone, director of economic research at Argus Research, said he thinks the return to strong growth could come as soon as the fourth quarter. "Never bet against a fully-employed American work force," he said. "With full employment and wages on the rise, you can forget any talk of recession." The unemployment rate is based on a survey of households, rather than the survey of employers used to calculate the payroll number. The household survey showed a 437,000 gain in jobs, and a 238,000 decline in the number of people who are unemployed. Most economists consider the department's household survey as less reliable than the employer survey. But Yamarone believes the household survey is more accurately capturing the increase in the number of people who are self-employed or working as independent contractors and therefore not showing up on the survey of traditional employers. Yamarone also believes the Federal Reserve will have to abandon any thought of rate cuts to spur economic activity and may soon have to start raising rates again. But Wieting thinks rate cuts are still the most likely move for the central bank when it decides to end the pause in rate changes seen at the last three meetings. The jobs report is always closely watched by investors, but it has taken on particular importance this month after a series of weaker-than-forecast economic reports sparked the first five-day losing streak for the Dow Jones industrial average since June of 2005. On Wall Street, stocks opened higher on the report, but Treasury bond prices tumbled as investors in the inflation-sensitive bond worried about a strong job market leading to wage inflation. Another group cheering the report was members of the Bush administration, which is facing a tough outlook in midterm elections set for Tuesday. The White House put out a release heralding the drop in unemployment and the increase in wages. It credited the administration tax cut policy for the labor market strength. "To keep our economy growing, the President and Republicans in Congress want to make these tax cuts permanent, leaving more money in the hands of American workers, families, and businesses," said the White House statement. But Greg Valliere, a chief political strategist for Stanford Group, a Washington research firm, said he doubted the job report would translate into votes for Republicans next Tuesday. "It's hard to see how it's going to be a big plus," he said. "I think it's too late to change many votes. The economy is a big story when it's bad. When it's good, people focus on other things, and they're focusing on Iraq. If it was a bad number it might hurt them a little more. The fact that it's a good number doesn't help very much." The latest CNN polls showed that 62 percent of those surveyed saying the economy is very good or somewhat good even before this report. But a poll two weeks earlier in mid-October found only 40 percent approved of President Bush's handling of the economy, compared to 58 percent who disapproved, even in the face of lower energy prices and record highs for the closely watched Dow Jones industrial average. The more recent CNN poll also showed only 33 percent rated the economy as "extremely important," putting it tied for fifth with the war in Afghanistan, behind the war in Iraq, terrorism, ethics in government and the situation with North Korea. State unemployment: See where your state ranks |

| |||||||||||