2007: Bigger is betterT. Rowe Price fund managers like large-cap growth stocks in the U.S. and abroad. Here's why.NEW YORK (CNNMoney.com) -- Economic growth is likely to slow but not stall in 2007 and that could benefit investors in large U.S. companies as well as those who buy international stocks and bonds. That was the take of several fund managers from T. Rowe Price, one of the world's largest money management firms, at the company's 2007 briefing for reporters in New York Wednesday.

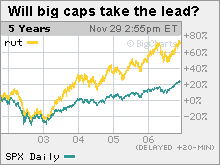

Alan Levenson, T. Rowe Price's chief economist, said the U.S. economy is slowing but does not appear to be at risk of teetering into a recession - the so-called soft landing. With that in mind, Levenson said he highly doubts the Federal Reserve will cut interest rates next year, as many on Wall Street have been hoping. If anything, he said the Fed might need to raise rates in order to combat inflation. Fed Chairman Ben Bernanke, in a speech in New York Tuesday, indicated that the central bank is still concerned about inflation, calling it the "predominant" risk to the economy, language that suggests the Fed isn't planning to cut rates anytime soon. Levenson noted that the job market is improving, and if that continues into next year, he said, that could keep the Fed on inflation watch throughout 2007. The good news though is that a stronger employment picture also means that U.S. consumers are likely to be able to keep spending, despite some concerns about a slowdown in the housing market. "If you have a modicum of job growth and continued wage growth, then the consumer will be okay and not run away," he said. "But rising unit labor costs is public enemy number one for Ben Bernanke." This isn't such a welcome development for corporate America though. Unless companies can pass higher labor costs on to consumers, many businesses are likely to see profit margins decline, Levenson said. So what does that mean for stocks? Larry Puglia, manager of the T. Rowe Price Blue Chip Growth fund, pointed out that the valuations for the largest 100 stocks are at their lowest levels since 1983 when compared to other large-cap stocks. And since big caps tend to outperform smaller companies when economic and earnings growth slows, now could be a good time to buy some of the most well-known large cap growth companies. Two that he likes are General Electric (Charts) and Procter & Gamble (Charts). "Growth has been out of favor for a long time so now could be a buying opportunity," he said. "Large-cap growth could be one of the better performing areas of the market for the next few years." Puglia added that investors should probably put more money into big-cap stocks, particularly those in growth areas like tech, financial services and biotech. Examples of stocks Puglia owns in his fund that fit these criteria include Apple (Charts), Google (Charts), State Street (Charts) and Genentech (Charts). Biotech is also a favorite area for Kris Jenner, manager of the T. Rowe Price Health Sciences fund. He said that an aging population makes companies developing new treatments for diseases attractive. Jenner listed Gilead Sciences and Vertex Pharmaceuticals as two top picks. Another T. Rowe Price fund manager said that investors should not limit themselves to domestic stocks. Raymond Mills, manager of the T. Rowe Price International Growth and Income fund, suggested that investors look to European stocks since many of them will benefit from increased merger and stock buyback activity as well as cheaper valuations than their U.S. counterparts. And Mills, like Puglia, said that growth stocks are starting to look more attractive than value stocks. The firm's bond expert, Mary Miller, also stressed an international approach. She said that many foreign bonds looked more attractive than U.S. Treasury bonds, since they're tied to stronger currencies than the U.S. dollar and have higher yields. Miller, who runs the T. Rowe Price Tax-Free Income fund, said investors looking for domestic bonds to buy should focus more on high-quality bonds such as mortgage and other asset-backed securities, municipal bonds and investment-grade corporate debt. The outlook from T. Rowe Price managers was similar to the one provided by the top economist and chief U.S. equity strategist of Citigroup Monday. Citigroup's economist also said the U.S. consumer will probably not get hurt too badly by the housing downturn while the firm's strategist also indicated that large caps, especially those in growth sectors like media, technology and retail, should outperform the market. |

|