Drilling for oil riches in AfricaGlobal competition for oil contracts is fierce in the resource-rich continent. Here's how U.S. firm Hyperdynamics learned to thrive in a cutthroat world.NEW YORK (CNNMoney.com) -- Shady backroom deals. Gifts of expensive jewelry. Suitcases full of cash. Okay, so maybe securing an oil contract in Africa isn't quite like a James Bond movie. But that's not to say the system isn't without its share of savvy hires, diplomatic jockeying and good ol' fashioned glad-handing.

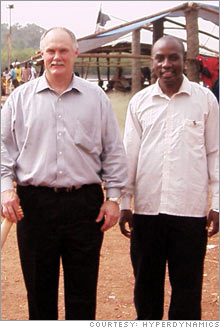

Just ask Kent Watts, founder of Texas-based oil exploration firm Hyperdynamics. Hyperdynamics, which specializes in seismic mapping, had been busy hunting for oil and natural gas off the coast of Guinea since the early 2000s. Then last year, already $20 million into the project and poised to start drilling wells at $20 million a pop, a letter arrived for Watts: The rights under their current contract were canceled, per order of the Guinean government. Watts was blindsided. "They breached every deal in the contract," said Watts. "We realized we needed to step up our relations with the government." And to save the company. Watts headed straight to the airport and boarded a plane to Africa. No quick fix Upon arriving in Guinea, he was met by a bodyguard and Famourou Kourouma, who is Hyperdynamics's chief in-country officer. Watts met Kourouma, the son of a former Guinean ambassador to the U.S., in 2003 when Kourouma was in Houston doing cancer research. Kourouma had been following Hyperdynamics's venture in Africa through the local press, and eventually contacted Watts about a job. "In the dictionary, when you see [the word] key man, he's the picture," said Watts. Together Kourouma and Watts set out to salvage Hyperdynamics's work in Guinea. Watts said they soon discovered that the notice terminating their old contract didn't come from the president's office but another official who didn't have the authority to send it. Even so, the Guinean government wanted to broker a new deal. "I thought we'd come in, get a new contract signed, and go," said Watts. "But it was a process." Selling the company A year-long campaign ensued. Kourouma set up an extensive list of meetings with government officials, former ambassadors and even spiritual leaders. "They are like one big family in Guinea," Watts said. Watts told officials that Hyperdynamics was the best firm to drill Guinea's oil supply because they had been doing exploratory work in the country the longest of any foreign oil company, they completed projects, and they conducted business in a transparent manner. Eventually Watts and his team met with the country's president, Lansana Conte. "I expected there to be a big building with soldiers around and stuff," said Watts. "But there he was, sitting under a tree." Watts also convinced the U.S. ambassador to support Hyperdynamics's bid, which signaled that the company was on good terms with the U.S. government. He set out to win the hearts of the Guinean public too. He advertised Hyperdynamics on television, opened up a charity, and handed out soccer balls to kids. He's even considered sponsoring a soccer team. Watts, who traveled to Guinea three times within the year, won a new contract in September. A geopolitical win Guinea is not the easiest place to do honest business. The country is ranked by international business leaders as the fourth most corrupt on a list of 163 nations, according to the watchdog group Transparency International. Calls to the United Nations in New York, which in turn contacted its representative in West Africa and the U.S. embassy in Guinea, did not turn up any allegations of wrongdoing on the part of Hyperdynamics. The new contract gives Hyperdynamics exclusive rights to 33,000 square miles of territory off the country's coast. If oil or, more likely, natural gas is found, Hyperdynamics has a royalty agreement that gives the government anywhere from 10 to 60 percent of the proceeds, depending on the age of the well. The variance, which is standard in oil royalty contracts, allows the company to keep more money at first while it recovers the cost of exploration and drilling, then transfers more money to the government after the well is paid off. Next up: striking oil. If Hyperdynamics finds oil or gas, Guinea's economy and the United States stand to gain, noted Watts. Given Africa's vast resources and the tight energy market, the competition among international and state-run oil companies for exploration rights is fierce. "[The contract] didn't go to China, it didn't go to Russia," he said. _______________ |

|