Let's all go to the movies - and marketsMultiplex owner Marquee Holdings has filed to go public, and so has in-theater advertising firm National CineMedia. Should investors buy a ticket to these stocks?NEW YORK (CNNMoney.com) -- 2006 was a nice comeback year for Hollywood. According to figures from movie tracking firm Box Office Mojo, films grossed $9.2 billion in the U.S. last year, up 4 percent from a year earlier. That's a healthy shot in the arm for an industry that was reeling, pardon the pun, in 2005. Ticket sales fell 6 percent that year.

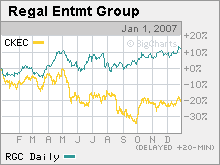

And 2007 has the potential to be even bigger than last year. With the third movie in the "Spider-Man," "Shrek" and "Pirates of the Caribbean" franchises due out, in addition to the fifth "Harry Potter" film, a fourth "Die Hard" movie and another new cartoon from Walt Disney (Charts)-owned computer animated powerhouse Pixar, some movie experts are even predicting that this year could break 2004's box office record of $9.4 billion in ticket sales. So with that in mind, it shouldn't come as a huge surprise that private companies with ties to the movie business are hoping to attract the interest of investors. Marquee Holdings, which owns more than 400 theaters worldwide (mostly in the United States and Canada) operating under the AMC and Loews Entertainment brand names, filed to go public in December. And National CineMedia, a company that runs digital networks that connects theaters and also sells advertising rights in movie theaters, filed for an initial public offering in October. Both companies are backed by some savvy investors who may be sensing that now is the right time to cash in. Marquee's investors include private equity firms Apollo Capital Management, Bain Capital and The Carlyle Group, while one of National CineMedia's top owners is Philip Anschutz, the billionaire mogul best-known for founding telecom Qwest (Charts). And considering that the well-regarded private equity firm Madison Dearborn Partners has a controlling interest in the other major movie theater chain, Cinemark, it probably would not be a huge shock to see Cinemark file for an IPO sometime soon as well. But should average investors scoop up these stocks once the companies go public? It's worth noting that the movie theater business is, at best, a slow-growth one. To that end, analysts expect sales for the two theater chains that are already publicly traded, Regal Entertainment (Charts) and Carmike Cinemas (Charts), to increase just 3.6 percent and 4.5 percent respectively this year. Dennis McAlpine, an independent entertainment analyst, points out that the major source of growth for movie theater operators isn't really increased demand (attendance was only up slightly in 2006) but higher movie ticket prices. "Even though box office sales were up marginally in 2006, they were not up from 2004 level. And the only growth in most cases has been due to the increase in ticket prices. That's not encouraging," he said. It's also worth noting that, even though last year was a great year at the box office for Hollywood, the two publicly traded theater chains had a mixed year. Shares of industry leader Regal gained more than 20 percent in 2006, but shares of smaller rival Carmike Cinemas fell 16 percent. Still, there could be value in movie theater firms. Matthew Harrigan, an analyst with Janco Partners who follows Regal, points out that Regal pays a fat dividend that yields 5.6 percent. To put that in perspective, that's nearly a percentage point higher than the yield on a 10-year U.S. Treasury note. It remains to be seen, though, whether Marquee or National CineMedia will pay a dividend. Harrigan adds that even though the movie business is not necessarily in a growth phase, the good news is that the big theater chain operators have done much of the hard work, closing down unprofitable, older theaters, refurbishing existing ones and building new ones with more fancy features like digital sound and stadium seating. So as long as the big operators don't succumb to the urge to build more new theaters, companies like Regal, Marquee and Cinemark should be solid performers. "Most of the industry is in fairly healthy shape and the exhibitors have credible real estate portfolios," Harrigan said. However, Marquee has continued to rack up losses, while Regal has been profitable. According to Marquee's latest filing with the Securities and Exchange Commission, the company reported a net loss of $53.4 million in the 26 weeks that ended last September. So Regal, with its big dividend and history of profitability, appears to be a safer bet. David Menlow, president of IPOfinancial.com, an independent research firm, adds that one question mark for Marquee is the fact that the company did not name any underwriters in its offering. He said investors should wait and see which investment banks are taking Marquee public before making a decision on whether to buy the stock. The fact that Credit Suisse, one of the top IPO underwriters of 2006, is the lead underwriter for National CineMedia, he added, is a positive sign. JP Morgan, Lehman Brothers and Morgan Stanley are also involved in the deal. And both Harrigan and McAlpine said that National CineMedia, which also includes Regal, Marquee's AMC and Cinemark as investors, has some strong growth potential. More and more companies are advertising in spots that air before movies, much to the consternation of many film fans. (If I see that "Don'cha wanna. Wanna Fanta?" commercial one more time I'm going to lose it.) But the trend has led to healthy revenue growth for National CineMedia. According to the company's most recent filings with the SEC, sales doubled in the third quarter as ad rates increased and the company added more movie screens to its network. National CineMedia said it also generated more revenue from meetings that took place in theaters in its network. The company did report a net loss of $600,000 in the quarter, but this loss was lower than a year ago. McAlpine added that there is a lot of potential for National CineMedia, as well as the theater chains themselves, due to the increased use of movie theaters for events beyond just showing films. To that end, the New York City Metropolitan Opera broadcast a live performance of Mozart's "The Magic Flute" in theaters on December 30. "With a lot of theaters getting interconnected, that may expand the use of these facilities. Instead of being just a movie theater, you could air concerts or conventions or group meetings," he said. And at the end of the day, McAlpine said that as long as Hollywood keeps churning out movies that people want to see, theater operators should continue to benefit from better box office trends since he thinks movies are still a relatively affordable form of entertainment. "The major thing the theater business offers consumers is a cheap way to get out of the house. It may not be as cheap as it used to be but it's still a pretty inexpensive evening out," McAlpine said. In other words, the death of the movie theater business is greatly exaggerated, even in an era where more consumers use DVD rental services like Netflix (Charts) and have fancy in-home digital TV and stereo systems. "This is an almost 100-year old business that's durable. You'll see movie theaters 50 years from now. I don't think you can say the same for Blockbuster stores," Harrigan said. |

| |||||||