Showtime for Time Warner CableWith the Adelphia bankruptcy plan approved, analysts say Time Warner Cable stock should soon hit the market. But what should TWC be worth?NEW YORK (CNNMoney.com) -- Shares of Time Warner Cable, the second largest cable company in the U.S., could hit the market within the next few weeks, analysts said. Time Warner Cable, which like CNNMoney.com is owned by media conglomerate Time Warner (Charts), filed for an initial public offering in October. The shares that will publicly trade are ones currently owned by bondholders of bankrupt cable firm Adelphia.

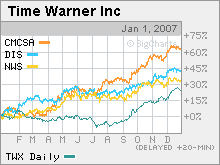

Time Warner and cable rival Comcast (Charts) teamed up last year to buy the assets of Adelphia. And earlier this week, a judge presiding over the Adelphia bankruptcy case said he would confirm the company's Chapter 11 reorganization plan. Based on the IPO filing from October, Adelphia shareholders will receive a 16 percent stake in Time Warner Cable, which would be worth $5.5 billion. The remaining 84 percent will be held by Time Warner. Analysts say the approval of the bankruptcy plan paves the way for Time Warner to bring its cable unit public without having to go through the traditional IPO process, which could be costly and time consuming. A spokesman for Time Warner Cable would not comment on whether the company was still planning a traditional IPO but he did say that Time Warner Cable expected to have its own securities trading on the market in mid-January. If Time Warner chose to sell shares in its cable unit through an IPO, the company would need to hire investment banks to underwrite the stock and management would have to go on what is known as a road show, meeting with prospective investors to discuss the company's financials. By doing that, an IPO of Time Warner Cable probably wouldn't take place until April at the earliest. With the bankruptcy plan officially approved, Time Warner is free to file with the Securities and Exchange Commission to report that Time Warner Cable shares have been distributed to Adelphia bondholders. Time Warner Cable would then need to file with the New York Stock Exchange to have the shares listed there; the shares are set to trade under the symbol TWC. Shares could begin trading in a matter of weeks. "I think we'll see Time Warner Cable trading by the third or fourth week of January," said Thomas Eagan, an analyst with Oppenheimer & Co. Now that a publicly traded Time Warner Cable appears to be imminent, what could the company be worth? Based on the company's IPO filing, Time Warner Cable will have 976.9 million shares outstanding. So if Adelphia shareholders will receive a 16 percent stake worth $5.5 billion, Time Warner Cable overall would be worth $34 billion, or about $34.80 a share. That appears to make sense since Time Warner's total market value is $89.5 billion and Time Warner Cable accounts for 29 percent of the company's sales and 39 percent of its adjusted operating income before depreciation and amortization. That would seem to imply that Time Warner Cable's market value should fall somewhere between $26 billion and $35 billion. But the stock could fetch at a higher price. In fact, shares of Time Warner Cable began trading Friday on a so-called "when issued" basis, priced at $41 a share on Friday afternoon. "When issued" shares track the trading of a stock that has yet to begin official trading and help to determine the eventual opening price. If Time Warner Cable had a market value of about $34 billion, it would be trading at a discount to Comcast on several levels. Eagan points out that Comcast trades at about 10.2 times 2006 cash flow estimates while Time Warner Cable, with a $34 billion market capitalization, would be trading closer to 9.5 times cash flow estimates for 2006. In addition, investors are valuing Time Warner Cable, which has approximately 13.5 million subscribers, at about $2,500 a subscriber. Comcast, which has a market value of about $89 billion and 21.4 million subscribers, is valued at about $4,200 a subscriber. Using that valuation for Time Warner Cable, the second largest cable firm with approximately 13.5 million subscribers, you come up with a market value of $56.5 billion for Time Warner Cable, or about $58 a share. Eagan argues that Time Warner Cable should trade at a valuation that's closer to Comcast. "It's likely that the market will give Time Warner Cable a haircut compared to Comcast but it shouldn't be a significant one. Time Warner Cable's growth rates are relatively similar to Comcast's," he said. But not all analysts think Time Warner Cable deserves to trade at a level that's on par with Comcast. Greg Gorbatenko, an analyst with Jackson Securities, argues that Comcast deserves to trade at a premium to Time Warner Cable since it's had a longer track record of success in cable and is doing a better job of adding new subscribers for services such as high-speed Internet, digital cable and Internet phone services. "Comcast right now is having their day in the sun and is at the top of the game. Time Warner Cable should start with a valuation south of a Comcast," he said. Richard Greenfield, an analyst with Pali Research, wrote in a report Friday that there are several other reasons why investors should be wary of Time Warner Cable stock. Greenfield pointed out that some Adelphia bondholders may look to quickly sell their Time Warner Cable shares in order to cash in on their investment. That could put "significant near-term selling pressure" on the stock, he wrote. In addition, Greenfield wrote that Time Warner Cable may look to make acquisitions, possibly of systems owned by Cablevision (Charts) or Charter Communications (Charts), since the company will have separately traded stock to use to make deals. Finally, he noted that Time Warner Cable will need to increase its capital expenditures in order to upgrade or roll out new services for the customers acquired from Adelphia. "Time Warner Cable should trade at a modest discount to Comcast," Greenfield wrote. But for Time Warner, a separately traded cable stock could also help to boost the value of the overall company, Eagan said. Although Time Warner's stock had a strong 2006, gaining 26 percent, it still underperformed shares of media rivals Walt Disney (Charts) and News Corp (Charts). But it was far from the worst performer in the sector: Viacom shares were flat last year. Time Warner also lagged Comcast, which surged 63 percent. Eagan added that if you look at Time Warner's other businesses, such as the AOL Internet unit, its movie studio and cable networks, and exclude cable, Time Warner trades at about 10 times 2006 cash flow estimates. Walt Disney, News Corp. and Viacom (Charts), meanwhile, trade at about 11 to 13 times cash flow projections for the year that just ended, he said. "Separating Time Warner Cable should help the market see how inexpensive the balance of Time Warner is," he said. Oppenheimer's Eagan owns shares of Time Warner and Comcast but his firm has no investment banking ties to the companies. The other analysts quoted in this piece do not own shares of companies mentioned and their firms do not have banking relationships with them. The reporter of this piece owns shares of Time Warner through his company's 401(k) plan. |

|