The wonderful world of Disney earningsMedia giant says net more than doubles on solid DVD sales, ESPN ratings; stock rallies after-hours.NEW YORK (CNNMoney.com) -- Walt Disney Co. Wednesday reported solid gains in sales and profits for the latest quarter, driven by healthy sales of "Pirates of the Caribbean" and "Cars" DVDs as well as strong results at its ESPN and ABC networks. The news sent the stock higher after hours.

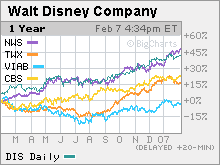

Disney (Charts) reported sales climbed 10 percent to $9.7 billion for its fiscal first quarter ended Dec. 30, ahead of the $9.5 billion that analysts were expecting, according to estimates from Thomson First Call. The Burbank, Calif.-based media giant, which also owns a theme park business, reported net profit more than doubled to $1.7 billion, or 79 cents a share. Excluding a one-time gain from the sale of assets, earnings came in at 50 cents a share, well ahead of consensus forecasts of 39 cents on Wall Street. "I am very pleased to report such strong quarterly earnings to kick off 2007," Disney CEO Bob Iger said in a statement. "These results are particularly gratifying given the great year we had in 2006 and are another clear sign our strategy is driving growth and creating shareholder value." Disney's studio entertainment division was the star performer in the quarter thanks to the strong DVD sales. Sales jumped 29 percent and operating profit soared 372 percent. "The earnings are great. It's hard to find any holes here. They had a great year in the studio business," said Joseph Bonner, an analyst with Argus Research. Sales in its broadcast business rose 6 percent and were up 12 percent at its cable networks. Operating profits in the broadcast division gained 24 percent. During a conference call with analysts, Disney chief financial officer Tom Staggs said that the cable networks were continuing to perform well during the second quarter, with ad sales at ESPN, for example, expected to grow in the mid-single digits on a percentage basis during the quarter. Staggs added that advertising sales in the so-called scatter market, which represents commercial time that is not sold when advertisers and networks negotiate ad rates before the fall TV season begins, were also strong for ABC, thanks to demand for ads during hit shows such as "Desperate Housewives," "Grey's Anatomy" and "Lost." Disney's theme park sales grew 4 percent and operating profits rose 8 percent. The one sore spot was Disney's consumer products division. Sales fell 6 percent in that segment and operating profits fell 13 percent due to lower revenues from Disney-branded video games. Disney is the latest media company to report upbeat quarterly results. Time Warner (Charts), the parent company of CNNMoney.com, reported fourth-quarter results last week that matched expectations and issued profit guidance for 2007 that was in line with Wall Street was expecting. And on Wednesday morning, News Corp (Charts)., the parent company of the Fox TV network and movie studio, reported fiscal second-quarter results that beat forecasts and reaffirmed its profit growth outlook for the current fiscal year. Although Disney no longer gives guidance, analysts are predicting another relatively year for the company. Analysts expect Disney to report revenue of $35.7 billion, up 4 percent from a year ago, and earnings per share of $1.73, an increase of 7 percent. Bonner said that even though Disney's movies did so well last year, the company is poised to have a solid 2007 at the box office as well. "Given the film slate this year, it's highly feasible that Disney can match last year's performance. There's another 'Pirates' movie coming out and another Pixar movie coming out," Bonner said, referring to the final movie in the "Pirates of the Caribbean" trilogy, which will be released in May, and "Ratatouille," which comes out in June. Disney, a Dow component, has been one of the best performing media stocks of the past year due to the box office success of many of its movies, strong ratings at ABC and ESPN and optimism about the company's new-media strategy. Disney was the first media company to partner with Apple (Charts) to sell TV shows and movies on Apple's iTunes store. During the call, Staggs said that Disney expected to generate about $25 million in revenues from downloads during the current fiscal year, which ends in September. Staggs added that the company should generate more than $700 million in revenue from all of its digital media businesses, excluding revenue from online booking for travel to Disney's theme parks, in this fiscal year. That's up from about $500 million in digital revenue during its last fiscal year. One analyst asked Staggs if the company's sales of movie downloads on iTunes was hurting Disney's relationships with high profile retailers such as Wal-Mat and Target, which are big sellers of DVDs. Staggs said selling downloads through Apple was not a problem and added that Disney movies would also be available on Wal-Mart's new movie download service, which the retailer unveiled on Tuesday. Shares of Disney have surged 41 percent in the past year, outperforming media rivals Viacom (Charts), CBS (Charts) and Time Warner and slightly lagging the performance of News Corp, which has gained 44 percent. Disney's stock gained 2 percent in after-hours trading following the earnings release. The stock rose nearly 1 percent in regular trading on the New York Stock Exchange Wednesday. |

Sponsors

|