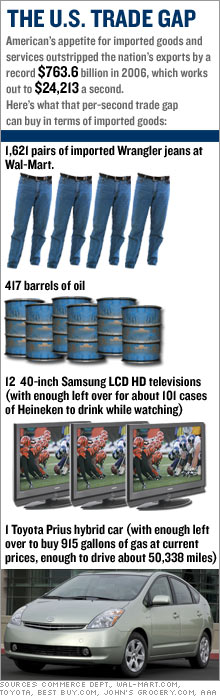

Made in U.S.A.: Record trade gapImports top exports by nearly $764 billion, fed by record oil prices, insatiable consumer appetite for imports.NEW YORK (CNNMoney.com) -- The U.S. trade deficit jumped 6.5 percent to a record $763.6 billion last year as high oil prices and Americans' appetite for foreign-made goods outpaced strong exports. The deficit came even as U.S. exports surged to a record $1.44 trillion last year, up 12.3 percent from 2005. But imports also jumped, up 10.5 percent to about $2.20 trillion for the year.  Even with exports growing, the deficit was a drag on the economy, as it meant that every man, woman and child spent an average of about $7,300 on imported goods and services during the year, turning to factories overseas rather than U.S. producers for the products they wanted. By many measures the deficit was stunning. It equaled roughly $24,000 a second, or enough to buy a Toyota Prius hybrid car and enough gas to drive it more than 50,000 miles. The gap is now so large that exports would have to grow more than 50 percent faster than imports for the trade gap simply to stay at last year's level. Still, some economists argue that the trade deficit isn't necessarily a bad thing. They say it helps keep inflation in check since overseas goods are often less costly than goods made at home, and helps the competitiveness of the U.S. businesses and economy. And the gap isn't much of a problem in the short term as long as our trading partners take the dollars they get from those sales and invest them here, as they have been doing. "We are buying imports cheaper than we'd be able to produce them here ourselves," said Jay Bryson, an international economist with Wachovia. But, he cautioned, the growth of the trade gap cannot continue indefinitely. "Eventually we'll have to start paying this borrowing off to the rest of the world," he said. "So in the future our standard of living could suffer." How quick the bill for the imports comes due will influence how much pain it might cause the U.S. economy. "The quickest way to bring about a big decline in the trade gap to have a recession," said Bryson. "I don't think anyone is advocating that." For December, the deficit hit $61.2 billion, up from $58.1 billion in November. That was more than the forecast of a December trade deficit of $59.5 billion. Record oil prices during the year were a major factor in the widening trade gap for the year, even though oil prices retreated in the fourth quarter. For the year, the average price of a barrel of imported oil came in at $58, up 24 percent from the 2005 average. But the trade gap also rose for non-petroleum goods as well. Among the factors was the loss of market share by U.S. automakers such as General Motors (Charts), Ford Motor (Charts) and the Chrysler Group unit of DaimlerChrysler (Charts) to Asian-based brands such as Toyota Motor (Charts) and Honda Motor (Charts). The imports of autos and auto parts rose by $17.1 billion during the year. In addition, the U.S. consumer eagerly grabbed up goods from low-priced clothing to expensive big-screen televisions made overseas. Consumer goods saw a $35.7 billion rise in imports last year, while the import of computers and other expensive capital equipment jumped $39.3 billion during the year. Aircraft maker Boeing (Charts), the nation's largest exporter, had a strong sales year and saw exports of civilian aircraft and parts rise $11.4 billion during the year. By country, the United States posted the biggest deficit with China, whose exports here outstripped its imports of U.S. goods by $232.5 billion, up 15.4 percent from 2005. The rising China-U.S. trade gap has sparked calls in Congress for tariffs on Chinese goods unless the Chinese currency, the yuan, is allowed to trade higher in open markets rather than being pegged to the dollar. Several members of Congress are prepared to unveil the latest legislative push along those lines Wednesday morning. The trade report also came the day after the Bush administration asked Congress to extend the president's so-called "fast-track" authority to negotiate trade agreements that Congress can't change, but rather are subject only to an up-or-down vote on Capitol Hill. The U.S. Business and Industry Council, a group of small and mid-size businesses critical of the Bush administration's trade record and supportive of a tougher stance on the Chinese yuan, said the trade report shows the administration should not be extended fast-track authority for another year. "If President Bush deserves blank-check trade negotiating authority from Congress with this record, then Paris Hilton deserves to be Girl Scout of the Year," said Alan Tonelson, a research fellow with the group. Imports about to overtake Big Three |

Sponsors

|