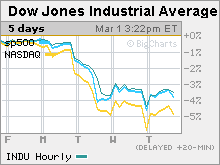

NEW YORK (CNNMoney.com) -- The stock market looked set to take another beating Thursday after Wednesday's brief respite from the previous day's global selloff.

Fortunately for investors, Thursday's selloff seemed to be shaping up to be less drastic than Tuesday's, when the Dow industrials tumbled 416 points, their worst one-day point drop since September 2001.

|

| It has been a volatile week for investors. |

Following another drop in Chinese markets overnight, the Dow sank about 200 points in early trading but rebounded after a report showed that the manufacturing sector may be recovering.

The Dow wound up finishing the day with only a 34 point, or 0.3 percent, loss and was briefly in positive territory. The broader S&P 500 Index and the tech-heavy Nasdaq composite also recovered from earlier losses and briefly traded higher Thursday afternoon. The S&P wound up closing 0.3 percent lower and the Nasdaq, which had plunged more than 2 percent shortly after the opening bell, finished with a 0.5 percent decline.

"Today is an interesting test. I'm encouraged by what the market has been able to do in light of the recent selling," said Tobias Levkovich, chief U.S. equity strategist with Citigroup.

Yet investors, once again, appear to be concerned about the slowing U.S. economy, the recent uptick in oil prices and worries about burgeoning problems in the subprime mortgage market, home loans made to people with poor credit histories.

Comments from former Federal Reserve chairman Alan Greenspan Monday about the possibility of a recession also have spooked investors. But current Fed chair Ben Bernanke assured investors during testimony at a Congressional budget hearing Wednesday that Tuesday's market carnage did not change the Fed's outlook on the economy.

"Bernanke made a valiant attempt to mollify any concerns caused by comments that his predecessor made," said John Lynch, chief market analyst with Evergreen Investments.

Still, one market strategist said investors should not ignore Greenspan's comments.

"Investors do need to be worried about a recession any time you are at the end of a lengthy expansion," said Liz Ann Sonders, chief investment strategist with Charles Schwab. "Economic soft landings are more elusive than recessions, so to write a recession off as being out of the realm of possibility is just burying your head in the sand."

Further confusing maters for investors, a government report released Thursday morning showed that an inflation gauge closely watched by the Federal Reserve ticked up in January. That could keep the Fed from lowering interest rates anytime soon, despite other evidence that is showing the economy cooling.

One market strategist said that investors appear to be coming to grips with the fact that even though economic growth and earnings growth may be moderating, the Fed may not cut rates anytime soon since it is still concerned about inflation.

"There was over-enthusiasm about the prospects for earnings and the economy. Towards the end of last year, people got mesmerized by this notion that growth would continue and the Fed would accommodate this," said Subodh Kumar, chief investment strategist with his own independent research advisory firm based in Toronto.

Kumar said he thinks the markets could head even lower before recovering, noting he thinks fair value for the Dow is 11,750, or about 500 points lower than its current level, while he said the S&P 500's fair value is 1,275, or 125 points below its current level.

Schwab's Sonders said that investors should be prepared for more volatility and that the worst thing they can do is to panic and drastically change their investment strategy. She says investors should hold on to stocks for the long haul and not try and profit from short-term market moves.

"The market is doing what it does best, which is slap people around every now and then and remind people that it is volatile," she said. "What I don't think investors should do is shorten their time horizons and try and trade around this. That's not investing. That's just gambling. You should take less of a trading approach and ride through this."

Another investment expert was hopeful that once the markets settle down, investors will realize that stocks are still, for the most part, attractively valued, and that earnings growth, while slowing, is still expected to be fairly solid.

"We strongly believe that cooler heads will prevail. We'd been expecting a pullback if for no other reason that you keep reading about how one is needed. But we're not expecting a major rout," said John Norris chief economist and senior fund manager with Morgan Asset Management in Birmingham, Ala.

Evergreen's Lynch agreed, pointing out that as long as interest rates remain low and profits keep growing, the stock market should bounce back. "Sustained periods of weakness in equities are typically accompanied by soaring interest rates and falling profits. That's not happening," he said.

Both Norris and Kumar added that concerns about rising delinquencies in the subprime loan market are overblown and shouldn't have a major impact on big banks and the market overall.

"Subprime makes up a relatively small percentage of loans outstanding. It's not a significant line of business for major commercial banks," said Norris.

Kumar agreed, saying that what's going on in the subprime loan market is not a crisis like the savings and loan meltdown from the early 1990s. He did say, though, that if problems in subprime persist, that could cause the overall housing market to slow even more and that could dampen consumer spending, which fuels about two-thirds of the economy.

And if that's the case, then the Fed might have a reason to cut rates, Kumar said. But it will take some time, he noted.

"The ramifications of subprime market cooling down are still working their way through the economy. When there's more evidence of this, that's when Fed will ease. But that's more of an early 2008 story," he said.

But Citigroup's Levkovich disputed the notion that further pain in the subprime market will hurt the consumer. He pointed out that some people have argued for the past three years that consumers would pull back on spending if the housing market slumped, but that this has yet to occur.

"The real issue is job growth. That is the most important dynamic of consumer spending. I don't see job growth falling off a cliff so I don't see consumer spending falling off a cliff," he said.

And investors will have a better sense about how strong the job market is when the government reports labor figures for February on March 9. According to a survey by Briefing.com, economists predict that 110,000 jobs were added to the nation's payrolls last month and that the unemployment rate will hold steady at 4.6 percent.