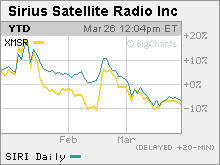

Bad reception for Sirius and XMShares of the two satellite radio firms have taken a hit since their merger plans were announced in February as Wall Street bets that a deal will not get approved.NEW YORK (CNNMoney.com) -- Consumers and investors currently can choose between two satellite radio companies. And although Sirius Satellite Radio and XM Satellite Radio are hoping to change that, Wall Street appears to be betting that their merger is not going to get approved. Shares of Sirius (Charts) and XM (Charts) are each trading lower than they were before the two companies announced last month that they intended to combine, forming one satellite radio giant with 14 million subscribers.

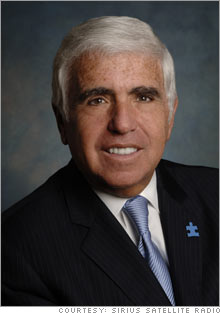

The deal would bring shock jocks Howard Stern and Opie and Anthony, as well as programs featuring Oprah Winfrey and Martha Stewart and satellite broadcasts of all major sporting events, under one corporate roof. When Sirius and XM unveiled their merger plans on President's Day, the terms of the deal valued XM's stock at $17.02 a share, a 22 percent premium from its price before the announcement. But based on their most recent closing prices, the deal now values XM at $15.41, just 10 percent above the Friday before President's Day level. "Skepticism regarding this deal has run rampant," said Frederick Moran, an analyst with Stanford Group. "Most Wall Streeters are heavily handicapping the likelihood of the deal coming to fruition at a less than a 30 percent chance." The biggest concern for investors is that the Federal Communications Commission has said its rules prohibit a merger between Sirius and XM since they are the only two companies that have been granted satellite radio licenses by the FCC. Sirius and XM have disputed this, however. Still, the FCC needs to approve the merger in order for it to go through. In addition, the Justice Department will also review the deal to see if a combination violates antitrust law. Several organizations, including the powerful National Association of Broadcasters, a trade group that represents traditional media firms, are lobbying to block the deal. Thomas Eagan, an analyst with Oppenheimer & Co., said he's not sure the FCC will approve the merger, especially since the agency has come under fire from the Democratic-controlled Congress for approving AT&T's (Charts) acquisition of rival telecom BellSouth with few conditions. "Our concern is that because of the criticism the FCC took from Congress, which was very critical of AT&T's purchase of BellSouth, it may take a much more aggressive stance towards this deal," Eagan said. "Our expectation of a deal happening has been reduced since the FCC will be a lot more aggressive in their analysis." Sirius chief executiver Mel Karmazin, who would be the CEO of the combined company, has been to Washington several times since the merger was announced to testify at Congressional hearings on behalf of Sirius and XM. He has stressed that a deal would be good for consumers since it would allow more choice. Karmazin has faced intense questioning from various members of Congress, who have wondered if a deal would lead to higher prices for consumers. Both companies charge subscribers $12.95 a month for their most basic package. However, Karmazin has said he would support price caps in order to get the deal approved. The two companies have also announced that a combined company plans to offer an "a la carte" offering that would feature fewer channels for less than $12.95 a month, in addition to a service for $12.95 a month as well as a more expensive plan featuring more channels. The companies said the priciest offering would cost "considerably less" than the $25.90 a month it currently costs to subscribe to both Sirius and XM separately. However, other analysts point out that no matter what Congress thinks of the merger, it's highly unlikely that lawmakers will step in and try and oppose the deal. So even though there has been a fair amount of public disapproval of the merger, it really only matters what regulators, not legislators, think. "Rationally, it makes sense to approve the deal since it is a different era. Satellite radio does compete against a wider array of audio outlets for consumers now than when the licenses were granted a decade ago. There should not be such a narrow definition of a marketplace," said David Joyce, an analyst with Miller Tabak & Co. In addition, some think the fact that neither company is profitable could bolster Sirius and XM's argument that a merger would be in the best interests of consumers, and not create a giant that would use its monopoly status in satellite radio to drastically raise prices. Rather, a merger might be necessary in order for the two satellite radio companies to remain economically viable. "There's no benefit for the government to not let the deal go through. These are two companies that are losing money and killing each other. That's not in the government's interest," said Richard Dorfman, a managing director with Richard Alan Inc., a financial advisory and investment company focusing on the media industry. "It's one thing when you take two well-performing companies already in a dominant position. These are struggling companies that some folks say will not survive without a merger." That said, analysts said investors probably shouldn't get their hopes up about a deal being approved. Joyce points out that FCC chairman Martin has tended to side more closely with the interests of traditional broadcaster and media companies in regulatory issues. Martin was a member, although not chairman, of the FCC when it voted to reject the planned merger between satellite TV firms DirecTV (Charts) and EchoStar Communications (Charts) in 2002. Analysts said they did not expect Sirius or XM to walk away from the merger. But if the deal does not get approved, they said that the stocks would likely take another hit. And even if a deal does pass government muster, it's probably going to take several months to get approved, which means that both stocks will likely be volatile performers for the foreseeable future . "Investors remain skeptical about the merger going through. Plus, the potential to know if it will get approved is too far away," said Stanford's Moran. "Investors should take a wait-and see approach toward these stocks at this point."

Richard Alan's Dorfman owns shares of Sirius but his firm has no business relationships with Sirius or XM. Other analysts quoted in this piece do not own either stock and their firms have not done investment banking for the companies. |

Sponsors

|