Game's on for big media firmsAnalysts think the next big growth opportunity for media conglomerates could be video games. And it might make more sense to buy instead of build.NEW YORK (CNNMoney.com) -- Take-Two Interactive Software, the troubled maker of the popular Grand Theft Auto series of video games, has said that it might consider a sale. And one of the companies that is said to be interested in Take-Two (Charts) is Rupert Murdoch's media giant News Corp (Charts). With that in mind, will News Corp. and other media companies actually look to make a bigger push into the booming world of games?

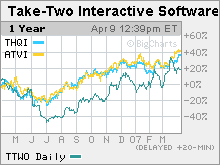

Several analysts said they believe companies like News Corp., Walt Disney (Charts) and Time Warner (Charts) will try to increase their presence in gaming, perhaps through acquisitions. As the traditional media giants continue to see growth in the movie and television business slow, games could present a key way to reach younger consumers. (Time Warner is the parent company of CNNMoney.com.) "Ten years ago, video games were a small part of the media pie but now more and more time is being spent in front of a TV connected to a game console instead of a TV while people are passively watching a TV show," said Daniel Ernst, an analyst with Soleil-Hudson Square Research, an independent research firm in New York. Ernst notes that, so far, few media companies have made a big effort to become substantial players in the gaming development market. Instead, media companies have tended to strike licensing deals with companies such as Electronic Arts (Charts), Activision (Charts) and THQ (Charts) to make games based on their characters. Disney is one exception, having built up its own Disney Interactive Studios unit that develops games based on some popular Disney movies for the big three consoles: Sony's PlayStation, Nintendo's Wii and Microsoft's Xbox. Disney also partners with THQ on games based on Pixar movies, though. French media company Vivendi also has its own gaming unit - it purchased Blizzard Entertainment, the developer of World of Warcraft, in 1998. And Sumner Redstone, chairman of media firms CBS and Viacom, has personally invested in game publisher Midway Games. But he has yet really to tie that investment to games based on content from CBS and Viacom. "There has been a little bit of toe-stepping by media companies in the water but more deals make sense," Ernst said. Media companies have also embraced the world of online gaming. News Corp. purchased gaming news and community site IGN in 2005, and Viacom bought Xfire last year. As advertising in online games becomes more prevalent, something that is likely now that Google has purchased in-game advertising company Adscape, analysts expect media companies to embrace further the online arena. But analysts said that it's also probably only a matter of time before media companies either seek to buy out game publishers or, like Disney, start their own in-house studios in order to capitalize on the popularity of console games that are based on mainstream movies and TV shows. "A lot of content that you see in gaming is coming from the large media companies. It simply is an economic equation over time. The fees and license payments the media companies get from publishers has been an effective way for them to participate but as the industry grows and the pie gets bigger they'll want to get a bigger piece of that," said Mark Argento, an analyst with Craig-Hallum Capital, a brokerage based in Minneapolis. Still, there are several obstacles that could prevent marriages between media companies and gaming developers. For one, even though Take-Two is probably the company most vulnerable to a takeover - shareholders ousted the company's CEO and other board members at the company's annual meeting last month - the company's controversial games and troubled finances may make it difficult to attract buyers. Take-Two disclosed last week that it was being probed by the Securities and Exchange Commission for options backdating practices. The company's acting management team is hosting a conference call with investors Tuesday afternoon to talk about developments at Take-Two. "It's interesting that Take-Two has been known to be in a distressed state but nobody has stepped in to buy them," Argento said. But Michael Pachter, an analyst with Wedbush Morgan Securities in Los Angeles, said he does think News Corp. is interested in entering the video game market in order to make Fox-branded sports games and could try and do so by buying Take-Two which has games based on Major League Baseball, the NHL and NBA. And if other media firms shy away from Take-Two, then that leaves the other major publicly traded companies, EA, THQ and Activision. Along those lines, Pachter said a Disney-EA merger actually makes the most strategic sense since Disney owns the sports cable powerhouse ESPN and EA is the leading maker of sports video games. But there's a problem. EA, with a market value of about $16 billion, is most likely too expensive a purchase for Disney, Pachter said. "The acquisition lust certainly exists for media companies but the question is will it make any business sense? The best match out there is Disney and Electronic Arts," Pachter said. "But do the math. If Disney does a deal with stock it's dilutive to earnings. A merger makes sense but it's probably not happening because Disney can't cost justify it." Pachter said it's possible that Disney could make a run for the cheaper THQ, which has a market value of $2.4 billion. That deal could make sense since THQ already is making the Pixar-licensed games. He added that Atari, which is also public and has a market value of just $52.5 million, could be an easily digested acquisition for a media firm that is looking to capitalize on the Atari brand name. Still, since shares of smaller game publishers have surged during the past year, analysts said that the more cost-effective way to get into the gaming market could be through purchases of smaller companies or by simply hiring away programmers from the established firms. To that end, Pachter said he wouldn't be surprised to see Time Warner eventually buy Codemasters, a privately held firm based in the U.K. Last year, Time Warner's Warner Bros. unit struck a deal to distribute Codemasters games in North America. And Argento points out that Disney has already lured away talent in order to build up its gaming division. Analysts quoted in this story do not own shares of the companies mentioned, and their firms have no investment banking ties with the companies. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

Sponsors

|