Lights, camera, earnings!Wall Street eagerly awaits results from Time Warner, CBS, Disney, News Corp. and Viacom. Here's what to expect.NEW YORK (CNNMoney.com) -- Media companies have been criticized by some on Wall Street and in Silicon Valley for being to slow to adapt to new competition, like the Internet. But most big media firms have actually been fairly aggressive in targeting the digital world in a bid to revitalize their growth prospects. And as News Corp.'s surprise bid for Dow Jones (Charts), the publisher of The Wall Street Journal, shows, many media firms are also looking to use acquisitions to broaden their scope.

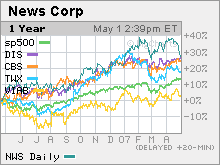

Investors have taken notice. Shares of News Corp (Charts, Fortune 500)., Walt Disney (Charts, Fortune 500), CBS (Charts, Fortune 500) and Time Warner have all outperformed the market the past twelve months. Viacom (Charts, Fortune 500) is the only laggard. And so far this year, Time Warner, the parent of CNNMoney.com, is the only major media stock that's not in positive territory. All five media giants are due to report results over the next two weeks. So here's a look at what Wall Street expects from the nation's biggest media companies. Time Warner: When Time Warner reports Tuesday, it will also release separate results for its newly public Time Warner Cable (Charts) division. Time Warner still owns a majority stake in Time Warner Cable, which was partly spun off in March after Time Warner and Comcast completed their acquisition of bankrupt cable provider Adelphia. Time Warner Cable accounted for 30 percent of sales at New York-based Time Warner in the fourth quarter and 43 percent of earnings before depreciation and amortization - a key measure of profitability for media firms. Investors will be interested to see if the cable division can keep reporting strong gains in subscribers for the so-called "triple play" digital cable, digital phone and high-speed Internet services. To that end, Comcast reported revenue growth of 32 percent in its first quarter, slightly topping analysts' expectations. For the first quarter, analysts are predicting Time Warner Cable will report sales of $3.94 billion and earnings of 24 cents a share, according to a survey by Thomson Financial. For all of Time Warner, analysts expect revenue of $11.2 billion, up 7 percent from a year ago, and a net profit of 20 cents a share, unchanged from last year. Joe Bonner, an analyst with Argus Research, said that beyond cable, Time Warner should also see strength in its movie business since the Warner Bros. film "300", released in early March, has grossed more than $200 million in the U.S. and $430 million worldwide. But he's uncertain how Time Warner's AOL Internet division, which is making a transition from a subscriber-based business model to one that depends on online advertising, will do in the quarter. In the fourth quarter, AOL, despite strong online ad sales growth, reported a decline in sales and adjusted earnings. "Time Warner should turn in a good quarter. If Comcast is any indication, cable should do well and the film side had a hit with '300,' which definitely performed above expectations," Bonner said. "But who knows about AOL? It's always a question mark." CBS: The Eye Network is expected to post decent results for its first quarter on May 2. Analysts expect revenues of $3.61 billion, just a hair higher than a year ago, and earnings of 33 cents, up 10 percent from last year. The company, which owns the CBS broadcast network as well as a sizable radio and outdoor advertising business, probably will benefit from strong ratings this year due to CBS' airing of the Super Bowl in February. James Goss, an analyst with Barrington Research, said sales in the so-called scatter market - ad spots sold during the TV season as opposed to the upfront period the prior spring - has been strong this spring. And since CBS currently ranks first in total viewers, according to Nielsen Media Research, and is in second place with 18-49 year-olds, that bodes well for ad sales next year too. "Scatter market strength puts CBS in firm footing heading into this year's upfront season," Goss said. Goss added that healthy growth reported by billboard owner Clear Channel Outdoor last week also bodes well for CBS. The outdoor advertising business of CBS accounts for about 15 percent of total sales and operating earnings. Walt Disney: It's hard to get overly excited about The House of Mouse's fiscal second quarter results, which Disney will release on May 8. Analysts expect sales and earnings to be relatively flat for the quarter. Ratings at Disney's ABC television network have cooled this spring after a hot start in the fall. In addition, the company faces a tough comparison to last year's fiscal second quarter since ABC televised the Super Bowl in February 2006. "I don't expect a bad quarter from Disney but it shouldn't be anything spectacular," said Argus' Bonner. But Bonner said the guidance from Disney will be key. Investors have high hopes for Disney's movie studio division this summer since the company will be releasing a third movie in the popular "Pirates of the Caribbean" franchise as well as "Ratatouille," the latest animated feature from Pixar, which is now a fully owned subsidiary of Disney. News Corp.: Many investors have been excited about the prospects for News Corp.'s growing online business, most notably its hot social networking site MySpace. But Rupert Murdoch's media empire threw Wall Street for a loop Tuesday when it announced a $5 billion takeover bid for Dow Jones, the publisher of the Wall Street Journal. Still, while Wall Street debates the merits of that deal, it's worth noting that newspapers only account for about 15 percent of News Corp.'s overall sales and operating profits. So despite the offer for Dow Jones, investors looking at News Corp.'s fiscal third-quarter results on May 9 are probably going to focus more on the strength of the company's broadcast and cable TV operations, movie studio and higher revenue from Fox Interactive Media, which includes MySpace. Investors expect News Corp. to report revenue of about $6.8 billion in the quarter, up 10 percent from last year, and earnings of 27 cents a share, up 23 percent. Assuming News Corp. hits these targets, that would make the company by far the best performing media company of the quarter. "It's fair to say that News Corp. should be the media star," said Bonner. "Cable rates are going up for its Fox News channel and there is optimism about MySpace. So I don't see any big problems." Viacom: Last year's media stock laggard has started to turn things around in 2007. While the company earlier this year set a $70 million charge to restructure its MTV cable networks unit - $50 million of that's expected to be recorded in the first-quarter - analysts are optimistic about a turnaround in the company's Paramount and DreamWorks movie studios. Viacom has had several hits this year, including comedies "Norbit" and "Blades of Glory," released in February and late March, and current box office champ "Disturbia," released in April. Although the box office from these films may have a greater impact on second-quarter results, Bonner said the recent strength in the movie business is encouraging. And Goss said Viacom is not getting enough credit for some of its digital initiatives. The company recently announced an online ad-sharing deal with Yahoo! and is planning to distribute video content on Joost, a hot private company started by the founders of Skype and Kazaa. Viacom is also suing Google and its online video unit YouTube for copyright infringement and is seeking $1 billion in damages. "What Viacom is trying to do is important because the company needs to take advantage of their own content and benefit from that online," Goss said. Nonetheless, Viacom is expected to report mixed results on May 10. Analysts expect sales rose 8 percent to $7.5 billion but that profits sank 26 percent to 32 cents a share. Barrington's Goss owns shares of CBS and Viacom but his firm has no banking ties to the companies. Argus' Bonner does not own shares of the companies mentioned and his firm has no banking ties to the companies. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

Sponsors

|