Playboy isn't sexy (at least not financially)The adult entertainment company has developed licensing deals and 'new' media businesses, but that's not enough to offset the slowdown in print and cable TV.NEW YORK (CNNMoney.com) -- Do Playboy Playmates get stock options? If so, you might see this in a centerfold sometime soon: "My biggest turn-offs are guys with no sense of humor, mean people and a stock that goes nowhere!"

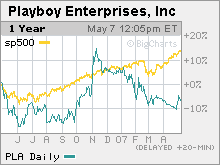

Shares of Playboy (Charts), which publishes the eponymous magazine and owns an "adult entertainment" cable channel, have fallen 10 percent so far this year and are trading only 15 percent above their 52-week low. The company will release its results for the first quarter on Tuesday, and analysts aren't exactly expecting a titillating report. According to consensus estimates from Thomson Financial, Wall Street analysts are forecasting a profit of 1 penny per share, down from 2 cents a share a year ago, and sales of $84 million, an increase of only 3 percent from the same period last year. What's plaguing Playboy? David Bank, an analyst with RBC Capital Markets, said that although the company is experiencing rapid growth in its licensing business, thanks mainly to a new Playboy club that opened in the Palms casino in Las Vegas last year, this isn't enough to compensate for the sluggish prospects for the company's traditional publishing and TV divisions. To that end, Playboy's licensing revenues grew 19 percent in 2006. But sales from this division accounted for just 10 percent of the company's total revenue. The company also has seen healthy increases in sales from "new" media, such as mobile and online services. Sales from e-commerce, online subscriptions and other entertainment operations, which include Internet advertising sales, rose 18 percent last year and accounted for nearly 20 percent of total sales. But revenue at Playboy's domestic TV unit fell 16 percent last year as the company is in the midst of a transition from a pay per view model for individual movies to a monthly, subscription-based video-on-demand service with cable operators. Meanwhile, publishing revenue tumbled 9 percent, and the unit posted an annual loss of $5.4 million. Subscription revenues for the magazine fell 8 percent last year, and ad sales declined by 13.6 percent. The publishing and domestic TV businesses accounted for more than half of Playboy's overall sales in 2006. "Investors are looking for stabilization in traditional media. People are convinced that licensing and digital are good businesses that can contribute high growth. But is it enough to offset weakness in the traditional business?" Bank asked. Michael Kelman, an analyst with Susquehanna Financial Group, said Playboy needs to cut more costs in its publishing and TV divisions in order to increase profitability. He expects that lower expenses will help boost earnings later this year. But he adds that investors also want to see higher revenue growth as well. "We should see improvement in earnings in the back end of the year, but at what level? They need to cut more costs in TV and print but a cost-driven story can only take you so far. For real long-term growth you need to have more visibility about where sales are going," Kelman said. Bank said that, barring the announcement of more cost cutting or more big licensing deals in its first quarter report, he expects Playboy's stock to do little after the results are announced. Plus, even though there has been a flurry of deals and takeover bids in the media world as of late, Playboy does not appear to be likely to take part in the industry's consolidation. Chief Executive Officer Christie Hefner said during the company's last earnings conference call in February that Playboy is not up for sale and that the Hefner family is also not considering taking the company private. So, with all that in mind, Playboy's stock may continue to be one of the least sexy in a suddenly hot sector. Analysts quoted in this story do not own shares of Playboy, and their firms have no investment banking ties to the companies. |

Sponsors

|