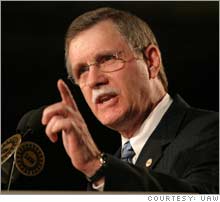

The UAW's wary dance with Chrysler's buyerChrysler's new owners' success turning around losses at the company depends on winning concessions from a union now giving the deal wary support.NEW YORK (CNNMoney.com) -- The most surprising part of the Chrysler sales announcement Monday was the vote of support for the sale of the automaker to Cerberus Capital Management voiced by by Ron Gettelfinger, the president of the United Auto Workers union. While a sale of Chrysler has appeared to be a foregone conclusion for months, union support of a deal seemed like a pipe dream, especially with recent warnings from Gettelfinger that private equity firms were looking to "increase their wealth by stripping and flipping" companies in the auto sector.

But many experts say it will be an even bigger surprise if the mutual support that the UAW and Cerberus voiced for each other Monday can continue in the tumultuous months ahead. They point out that Cerberus has seen its proposed multibillion-dollar investment in bankrupt auto parts maker Delphi stalled as negotiations between Delphi and the UAW have dragged on past one self-imposed deadline after another. And some experts say the $7.4 billion that Cerberus is putting into the deal, basically to capitalize Chrysler going forward, only makes sense if Chrysler wins deep cost cuts from the union in upcoming negotiations. "I've got to feel that Cerberus is counting on getting advantageous contracts terms," said Tulane University Finance Professor Peter Ricchiuti. "Otherwise the deal doesn't make sense." Indeed, if Chrysler as well as General Motors (Charts, Fortune 500) and Ford Motor (Charts, Fortune 500) can win some significant concessions from the union when their current labor deals with the UAW expire in September, they will be in a much better competitive position versus their nonunion rivals such as Toyota Motor (Charts) and Honda Motor (Charts). Then Cerberus's bargain-basement purchase of Chrysler will look like a steal. But winning those concessions will be difficult and could be expensive. The union has thus far refused to give Chrysler the cost savings on retiree health care that it has granted to GM and Ford, leaving Chrysler at an estimated $600-a-vehicle cost disadvantage compared to its U.S. rivals and an bigger gap compared to Japanese automakers. And the UAW is already facing plant closings and the evaporation of 9,000 of its members' jobs as Chrysler moves ahead with plans to stem losses. David Cole, the chairman of the Center for Automotive Research, said he's been told by a couple of different sources that Cerberus and the UAW officials met over the weekend, ahead of the announcement from DaimlerChrysler (Charts) early Monday that it would sell the money-losing unit to Cerberus. Cole said the expression of support for the deal by Gettelfinger might be read by some as a signal that Cerberus and the union might have some rough framework of a labor deal in the works already. But he said it's far too soon to predict clear sailing ahead in the upcoming make-or-break auto talks. "They have to have talked at great depth about what they're going to do," said Cole. "We really don't know exactly how it's going to unfold, but it's going to unfold probably pretty soon." Cole and other experts said that the UAW, despite the words of support for the deal Monday, can't be happy about the choices that await its leadership and its members heading into these talks. "There's really no good answer from union perspective," said Cole. "Gettelfinger is in a real box. It's an extremely difficult time to deal with these negotiations." UAW spokesman Roger Kerson said while Gettelfinger and other union officials met with Daimler and Chrysler executives this weekend, he was not aware of meetings with Cerberus. But he confirmed that they are set to talk with Cerberus officials on Tuesday. As to the impact on the upcoming negotiations, Gettelfinger told a press conference Monday he didn't expect it to change because the Chrysler management team will stay in place. But Cerberus is likely to be the one giving marching orders to the management negotiators rather than Daimler. And they'll probably be demanding significant changes in the company's health care obligations to its retirees, as well as other labor cost savings in terms of pay and work rule flexibility to make Chrysler competitive once again with nonunion automakers. "Cerberus will play things differently from the way that the automakers and UAW negotiations have played out in the past," predicted Erich Merkle, director of forecasting at IRN Inc., an auto industry consultant serving primarily the auto parts industry. "They have to get what they need to be remain viable. Otherwise, it's not a matter of if they go out of business, it's a matter of when. Those health care costs will kill them." Chrysler's promises to its retirees and their families to provide health care will cost the company an estimated $18 billion, according to its most recent annual report. And the fact that Cerberus is now on the hook for that obligation is the reason Daimler was basically willing to pay to have someone take Chrysler off its hands, only nine years after paying $37 billion for it. The price tag of retiree health care at GM and Ford is even higher, perhaps $60 billion for GM and $35 billion at Ford. One way that all three might be able to get out from under the cost is to follow a model established by Goodyear Tire & Rubber Co (Charts, Fortune 500). in its 2006 contract with the United Steelworkers union, in which the company gave the union a lump sum to have the union assume those costs into the future. Merkle said that Cerberus could be in better shape to come up with an estimated $10 billion down payment needed to buy out the obligations to Chrysler retirees than cash-strapped GM or Ford might be in attempting to come up with the bigger sum needed at those companies. The announcement of a deal had many union members worried Monday, even with Gettelfinger's newfound assurances. Michele Mauder, the president of a group of assembly line workers in Toledo that had been hoping to make a employee-led bid for Chrysler, said that Gettelfinger was right to be concerned earlier about a purchase by a private equity firm and wrong not to get behind the employee-led buyout efforts, which she claimed could have raised even more money than Cerberus to complete a deal. "Our whole package was a much better package than theirs, but we weren't given the opportunity to present it to the union or DaimlerChrysler," she complained. Mauder said that rank-and-file support for an employee buyout grew in Toledo after one high-ranking union official, whom she would not identify, had told a union meeting there that Cerberus planned to cut another 30,000 jobs at Chrysler, close five plants and sell the Jeep brand if it were successful in buying the company. Kerson said he was not aware of those plans, and a spokeswoman for Cerberus could not comment on plans beyond the public statements |

Sponsors

|