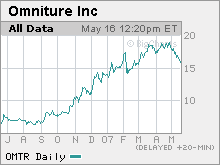

The other online ad boomSure, Google and Yahoo are doing extremely well. But companies that measure Internet traffic are also forging ahead in the new dot-com renaissance.NEW YORK (CNNMoney.com) -- Much has been made about how the explosion in demand for online advertising has lifted the fortunes of companies like Google, Yahoo! and Barry Diller's IAC as well as perceived takeover targets like interactive ad agencies aQuantive and 24/7 Real Media. But there's another part of the online advertising market that isn't followed as closely. Companies that measure how much traffic popular Web sites get may be less exciting than Google (Charts, Fortune 500) but their business is also booming. As such, Wall Street, private equity investors and larger data providers are starting to take notice. "Look at the overall value chain in online advertising, the metrics providers. It's not just about Microsoft versus Google versus Yahoo," said Russ Mann, chief executive officer of SEMDirector, a provider of search marketing analytics software to large companies. To that end, software company Omniture (Charts), whose SiteCatalyst product lets companies track traffic to their Web sites in real time, has been one of the best performing initial public offerings of the past year. Shares of Omniture, which went public last June at a price of $6.50 a share, have surged more than 155 percent since their IPO. And other measurement companies may also soon test the public waters. comScore, which is one of the two main Internet traffic measuring firms, filed for an initial public offering last month. With big private equity and venture capital firms backing fellow measurement companies like Coremetrics and WebTrends, it would not be a huge surprise if more IPOs are far behind, especially if comScore performs as well in its debut as Omniture has. Plus, there also has been a substantial amount of merger interest in this area. Media information giant Nielsen announced in February it was buying the 40 percent in publicly traded NetRatings (Charts) that it didn't already own for a 16% premium. Experian, the information company most well known for being a provider of credit scores for consumers. announced last month it was buying privately held Hitwise, another Web analytics firm for $240 million. And analytics company WebSideStory recently purchased privately held Visual Sciences, a top Omniture competitor. The publicly traded Web Side Story renamed itself Visual Sciences (Charts) upon completion of the deal. Mann says he believes more consolidation is likely in the future as more and more large advertisers shift ad budgets from traditional media like TV, radio and print to the Web, which is far more easy to measure. "Fortune 500 companies are just scratching the surface in search, and chief marketing officers will demand more accountability," he said. "The future of advertising will be more metric-driven and less creative-driven." Wall Street analysts are predicting fairly robust results for the two main public companies in this business, Omniture and Visual Sciences, over the next few years. Omniture is expected to report a profit of 8 cents a share this year, compared to a loss of 8 cents in 2006, and a profit of 30 cents a share in 2008. For the next few years, analysts are forecasting annual earnings growth, on average of 37 percent. For Visual Sciences, Wall Street analysts predict earnings growth of 31 percent in 2007, 27 percent in 2008 and 35 percent a year, on average, for the next few years. But Omniture is a much more expensive stock, trading at 53 times 2008 earnings estimates, compared to a P/E of only 15 times next year's profit forecasts for Visual Sciences. In recent research notes, Friedman Billings Ramsey analyst David Hilal, who follows both companies, wrote that despite "promising growth prospects in the near-term" for Omniture, he recommends that investors stay on the sidelines for now since the company has "a more-than-fair valuation." Hilal argues that Visual Sciences is a much better buy, partly due to concerns about patent litigation between the company and rival NetRatings. However, Hilal thinks this is already baked into the stock price and that the case won't actually go to trial. "Unfortunately the legal overhang associated with the NetRating lawsuit remains. However, we believe this could be settled over the coming months, and this could act as a positive catalyst as it would remove the overhang and push EPS higher without the associated legal costs," Hilal wrote. In addition, Michael Kern, an analyst with Canaccord Adams, wrote in recent research reports that although he likes both stocks, he warned that increased competition in Web analytics, possibly even from Google, is a risk for the companies. As for Web measurement companies that aren't yet public, since comScore is the only one that has filed for an offering, it is the only private company that has detailed financial information available. But for what it's worth, the stock could be another hot IPO. According to the company's prospectus, comScore reported total sales of $66.3 million in 2006, making the company a bit smaller than Omniture, which reported revenue of $79.7 million but slightly larger than Visual Sciences, which posted sales of $64.5 million last year. comScore's sales increased 32 percent from 2005 and the company also posted a net profit of $5.7 million, compared to a loss of $4.4 million in 2005. So while many investors continue to bet on which Internet company is going to be the next takeover target for Google,Yahoo (Charts, Fortune 500) or Microsoft (Charts, Fortune 500), it might be wise to start paying attention to the less glamorous, but equally lucrative, companies in Web measurement. Analysts quoted in this story do not own shares of the companies mentioned and their firms have no investment banking relationships with them. |

Sponsors

|