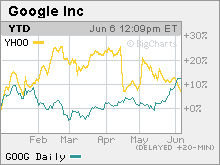

Online ad spending surgesInternet display ad spending jumped 17% in the first quarter while total ad spending fell. No wonder Google stock's at a record high.NEW YORK (CNNMoney.com) -- Online advertising is once again the brightest spot in an otherwise moribund advertising market, according to first-quarter figures reported by two prominent media research firms. TNS Media Intelligence said Tuesday that spending on online display advertising - which does not include search - jumped 16.7 percent in the first quarter from a year ago to $2.7 billion. By way of comparison, overall ad spending fell 0.7 percent. Traditional media categories took it on the chin. Ad spending on television and radio dipped more than 2 percent while newspaper ad spending dropped nearly 5 percent, TNS said. And on Wednesday, the Interactive Advertising Bureau in conjunction with PricewaterhouseCoopers reported that overall Internet ad spending soared 26 percent in the first quarter to a record $4.9 billion. Not surprisingly then, the surge in Internet ad spending has boosted the fortunes of the leading pure play online media firms. Shares of Google (Charts, Fortune 500), the world's top search engine, have gained nearly 13 percent this year. What's more, Google's stock hit a new all-time high on Tuesday. Google has benefited more from the explosion in keyword search advertising but is also seeking to bulk up in so-called display and rich media advertising, which includes banners and other graphical ads as well as video. Along those lines, Google acquired online video leader YouTube last year and announced in April that it's buying DoubleClick, an online ad placement company that specializes in display advertising. Google rival Yahoo!, (Charts, Fortune 500) widely acknowledged as the leader in display advertising, has seen its stock rise in tandem with the growth in online ad spending. Shares of Yahoo have gained 11 percent this year. Clayton Moran, an analyst with Stanford Group, said he expects overall online ad spending to increase 25 percent this year. This should bode well for Google and Yahoo, he said, as well as two smaller publicly traded online advertising firms, ValueClick and Marchex. ValueClick's stock has surged more than 35 percent this year, partly due to hopes that it will be the next online ad network company to be taken over. Shares of Marchex, which is focusing on local advertising and has scooped up many Web domain names, have gained 13 percent this year. Marianne Wolk, an analyst with Susquehanna Financial Group, said search advertising should continue to grow at robust pace and that the healthy gains in display advertising signal a new wave of growth in that segment. "Display should do better than it has been and the big reason is that we are seeing the advent of video ads online. This could be a very big market," Wolk said, adding that she expects Google to generate about $300 million in sales from video advertising in 2008. She thinks overall online video ad revenue could hit $1 billion next year. As more and more viewers, listeners and readers migrate online, advertisers are following suit. As such, traditional media firms News Corp (Charts, Fortune 500)., Walt Disney (Charts, Fortune 500), CBS (Charts, Fortune 500), Viacom (Charts, Fortune 500) and Time Warner (Charts, Fortune 500), which is the parent company of CNNMoney.com, are also all bulking up their presence on the Internet. In addition, companies ranging from online marketing firms like aQuantive and 24/7 Real Media to Internet content companies Last.fm, Feedburner and Photobucket have all been scooped up by large publicly traded firms in what has become a dot.com merger feeding frenzy in the past month. Stanford Group's Moran said he expects more deals ahead since it will probably be easier for the "old" media firms to acquire, rather than build, a bigger foothold on the Web. "The traditional media companies are definitely behind Google right now and I don't think they will be able to grow at the same rate as Google. So they will look to buy their way into digital media more and more in the future," Moran said. Analysts quoted in this story do not own shares of the companies mentioned in this story and their firms have not performed investment banking with the companies. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

Sponsors

|