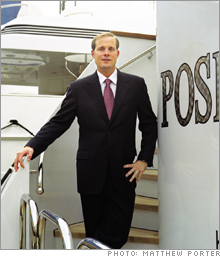

Fund manager's fun sailing awayHedge fund manager John Devaney looking to sell 142-foot yacht for $23.5 million after bad bet on subprime mortgage assets.NEW YORK (CNNMoney.com) -- A hedge fund manager whose fund ran into trouble from the sell-off in securities backed by subprime mortgages is having to put his huge yacht up for sale, seeking $23.5 million. John Devaney, the CEO of United Capital Markets, a fund that specializes in buying and selling bonds that are backed by the mortgage payments, particularly adjustable rate subprime mortgages, has put his 142-foot yacht "Positive Carry" up for sale, according to a yacht broker's Web site.

Devaney's fund has run into trouble lately. A spokesman for the firm told Reuters on July 3 that it had stopped honoring request from some of its investors for redemptions, or withdrawal, of investments. The market for assets backed by subprime mortgages has taken a huge hit over the last two months, causing large losses by some top Wall Street firms, including Bear Stearns (Charts, Fortune 500). Devaney told Money magazine this spring that despite problems that the loans cause for borrowers, the assets backed by them provided a good return for his fund. "The consumer has to be an idiot to take on those loans," he said. "But it has been one of our best-performing investments." But with rising delinquency and default rates in the sector, investors have been scared away from the assets lately, hitting those like Devaney who made a big bet on the investment. According to the yacht broker's listing, the yacht has accommodations for 10 passengers in its five staterooms, along with space for a crew of seven. Its amenities include his and her baths in the master suite, and four guest bathrooms with Jacuzzi tubs and showers and cherry wood interior throughout. It has two 2,250-horsepower engines and a range of 3,500 nautical miles. The New York Post reported Monday that Devaney is also seeking to sell a home in Aspen for $16.5 million. The Aspen Times reported in November that he bought that house, for $16.25 million, and that property includes a 16,000-square-foot main house and carriage house which include 16 bedrooms, 18 full bathrooms, two fireplaces, three kitchens and two caretaker bedrooms with bathrooms. But the sale of the yacht and the Aspen vacation home won't leave Devaney without any high-priced holdings. Money reported in May that he also owned a Rolls-Royce, a Gulfstream Jet, a 12,000-square-foot mansion in Key Biscayne, Fla., as well as a few Renoirs and a valuable 1823 reproduction of the Declaration of Independence. |

Sponsors

|