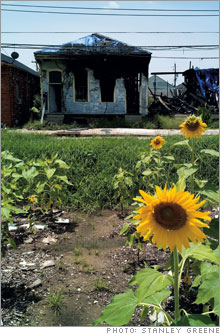

New Orleans: Where's the money?Billions have been spent to rebuild the city, but not enough is reaching the local economy. Residents wonder where the funds are being spent.Fortune Magazine -- Ask New Orleanians how their city is faring these days, and their responses follow an eerily consistent arc. They begin with gratitude that you bothered asking and then move on to recitations of all the good that's going on. Hurricane Katrina, and the flood that followed, struck two years ago this month, and since then the tourists have returned, basic services are operating, and the city has crafted a comprehensive recovery plan.   Linger a bit on the subject, however, and optimism quickly turns to exasperation. Lack of government leadership, the glacial pace of rebuilding, and outright rage at absent neighbors who've yet to demolish blighted homes top the list of gripes. New Orleanians talk darkly of emotional stresses on residents and hidden health risks, like the recent revelation that the city hasn't been fluoridating its tap water since the storm. "Those of us who have chosen to stay are very optimistic that we can make this work," says Bill Freiberg, New Orleans branch manager for regional brokerage Morgan Keegan and a sixth-generation native. "But after two years the frustrations become depressing." The frustrations are many, and all too often they boil down to money. By some measures, New Orleans is flush with cash. About $25 billion of Katrina-related private insurance claims have been paid out in Louisiana, some of which went to rebuilding damaged homes. What's more, the federal government has allocated nearly $27 billion for housing, rebuilding the levees, and what's known as hazard mitigation, the messy job of removing debris and repairing critical infrastructure, like broken sewer lines and potholed roads. Too few of those dollars, however, have found their way into the local economy. Bank deposits have skyrocketed, indicating that the insured haven't decided whether to reinvest in their community. Just 22 percent of the funds Washington has set aside for rebuilding Louisiana have been spent. For example, the program that compensates uninsured homeowners for their losses took more than a year to establish and only recently has begun distributing checks in significant quantities. The population of Greater New Orleans is roughly 200,000 below its pre-Katrina level, which has triggered a labor shortage. Private-sector investors, in turn, have scaled back or postponed development plans, furthering a vicious circle of inaction. "We're in a terrible catch-22," says Scott Howard, a local banker with Regions Bank. "We can't build because we don't have enough people. We don't have enough people because there's nowhere to live." Unsticking the gridlock is no simple task. It's as complex as getting local and federal bureaucrats to work better with one another - and with Louisiana politics that's extra tough - and as prosaic as finding enough plumbers to build new homes. Uneven development There's no one-size-fits-all way to describe the state of New Orleans today. During a citywide tour on a rainy July day, ritzy Uptown neighborhoods and the famous French Quarter look the way they did before Aug. 29, 2005, while the shattered Lower Ninth Ward, etched on the nation's guilty conscience in the days after the storm, still looks as if a powerful bomb had struck. Residential neighborhoods like Lakeview and Gentilly display what locals call the "jack-o'-lantern" effect: spots of light surrounded by darkness. In those sections of town, it's common to see a tastefully landscaped and recently refurbished home next to a badly damaged house with a white trailer in the driveway supplied by, yes, the Federal Emergency Management Agency. The lot across the street may well be barren but for a lonely concrete slab. In many parts of New Orleans, abandoned homes still sport the large "X" that National Guardsmen painted and annotated to signify, among other things, that the structure held a dead body. Plenty of people wanted to help New Orleans. KB Home (Charts, Fortune 500) CEO Bruce Karatz thought his company, the big homebuilder, could pitch in not merely by giving money to charity but by doing what it does best, building homes. In December 2005 he appeared with New Orleans Mayor Ray Nagin and Jim Bernhard, CEO of Louisiana-based Shaw Group, an engineering firm, to announce that KB would open a regional office in New Orleans and that the two companies would build houses there. By May, KB was in contract on three land deals - including a 3,000- acre parcel in nearby Jefferson Parish, where it planned to construct 8,000 to 12,000 homes - and said it was negotiating for 40 more sites. "Nobody knows what demand will be," Karatz told FORTUNE last year, which featured KB's efforts. "I just know we're doing the right thing." It turns out that supply and demand were problematic. KB scaled back its plans in Jefferson Parish, then backed out altogether when the owner of the land wasn't interested in selling a smaller parcel. KB has begun building in the region, but primarily in Baton Rouge, as well as on the north shore of Lake Pontchartrain. The company is developing 73 Greek Revival homes in a transitional neighborhood near downtown New Orleans called River Garden. So far it has sold eight homes there. Karatz retired from KB in late 2006 amid questions over the timing of options grants. His successor, Jeff Mezger, inherited the commitment. "It's taking longer for the city to rebound than we expected," he says. One unusual problem: a severe shortage of plumbers. KB learned after it arrived that state law requires plumbers to complete more than four years of training before obtaining a license, and that Louisiana follows different plumbing codes than most other states. That means KB effectively can't bring plumbers from Houston, where it has an extensive contractor network. The company promoted a bill in the Louisiana legislature to loosen the requirements. The state's Plumbing-Heating-Cooling Contractors Association saw that the bill was killed. A handful of hardy national players have jumped back into New Orleans. Starbucks (Charts, Fortune 500) opened a new store in the recovering Lakeview neighborhood on the spot where an independent coffee shop didn't return. Lowe's is constructing a giant store in East New Orleans. Even Donald Trump still plans to move ahead on a 69-story condo and hotel tower he announced days before the storm. But more investors are as frustrated as KB. Strategic Hotels & Resorts (Charts), the Chicago owner of the badly damaged Hyatt Regency downtown hotel, unveiled a plan this spring to develop a 20-acre site that would include a new hotel, a new city hall, and a jazz museum. That plan is dormant. Even companies that made significant investments in New Orleans have fled. Smith & Wollensky (Charts) ran a restaurant on a prime downtown spot for seven years but decided not to reopen after the storm. "It wasn't viable to run an $80-per-person restaurant in the area," says Alan Stillman, the company's CEO. "We owned the best location, the best corner, in the best quarter of town. But the dynamics have changed." Although the Port of New Orleans is operating at pre-storm cargo levels, several longtime tenants who were wiped out have relocated permanently to Mobile, Ala., or Houston. "Every day we feel the impact of Katrina," says Patrick Gallwey, chief operating officer of the port, an entity administered by the state. Every city covets national chains and major businesses, but their absence is acute in New Orleans, never much of a headquarters town. Of the 23 publicly traded companies that were based in the city before the storm, only half remain. (Ruth's Chris Steak House (Charts), for instance, moved to Florida.) Domestic Marshall Plan Nobody expected the private sector to rebuild New Orleans by itself. It was assumed the federal government would step up, especially given that the worst of the damage was caused not by the hurricane but by flooding attributed to shoddy levee construction and maintenance by the U.S. Army Corps of Engineers. What seemed to make the most sense was a kind of domestic Marshall Plan, or at least the appointment of a politician with disaster experience who would be as empowered as Commerce Secretary Herbert Hoover was when river flooding destroyed Greenville, Miss., in 1927. What New Orleans got instead is Donald Powell, the former chairman of the Federal Deposit Insurance Corp. Powell's title is federal coordinator of Gulf Coast rebuilding. His role is to be President Bush's ambassador to the disaster-stricken region, meaning his job is to deflect the considerable flak local residents send the feds' way. Unlike Hoover in the 1920s, Powell has no real power, only a bully pulpit and an ability to play referee when local governments have a beef. "The President was very clear that this should not be an exercise in centralized planning and that the locals need to control their destiny," Powell says over endless rounds of Diet Cokes at the sleek InterContinental Hotel, where he stays when he's in town. He lives in Washington, D.C., but hails from Amarillo, Texas, where he was a banker for decades. A lanky and courtly type, the white-haired Powell is determined that Washington not shoulder all the blame for the slowness in rebuilding. "At the end of the day, the federal government's role in assisting the good people of the Gulf Coast will be satisfactory," he says. "Could it have been more efficient? Sure. But we're limited by laws. We give them the money, and say, 'Here's the deal.' " It wasn't until last summer, however, that Louisiana worked out the deal of how to reimburse uninsured homeowners. Congress appropriated more than $6 billion through the Department of Housing and Urban Development, to be paid to the state. Concerned that the state's endemic corruption would pervert the process, the Louisiana Recovery Authority hired a private contractor, ICF International of Alexandria, Va., to run its Road Home homeowners' assistance program. Adding yet another bureaucracy slowed down the process further, as did the state's decision to include homeowners whose only damage was from wind to those eligible for Road Home checks. (Flood insurance wasn't required in areas supposedly protected by the levees.) Road Home got off to a slow start, and a year later - years after the storm - has distributed just 37,000 checks, or $2.8 biIlion, out of 162,000 applications. Because the state changed who could be covered after Congress appropriated the money, the program currently is estimated to be underfunded by more than $4 billion, much of which it hopes to get from Congress. If Congress doesn't act, Road Home will run dry by the end of the year. The absence of Road Home payments speaks directly to the halting nature of the city's recovery. Residents who can't afford to repair their homes won't move back from wherever they've resettled. The longer the checks take to arrive, the longer they'll stay away, and the less likely they are to return. "We've been frustrated since day one," Powell says of the Road Home program. "But that's a contractual relationship between the state and the contractor." Some $6 billion in FEMA disaster money is held up because of federal rules for distributing it. According to those rules, recipients of federal disaster aid need to apply for grants through their state, which in turn is required to make a 10 percent deposit for the grant. It's Washington's way of making sure states will watch over its money. Congress, working with the President, can waive the 10 percent requirement, as they did for New York City shortly after 9/11. After nearly two years of fighting over the 10% waiver, Congress finally granted it to Louisiana in June, freeing up $750 million in additional funding. At the end of my conversation with Powell, I ask him what advice he plans to give to his successor in the next administration. He said he's working on a list of suggestions, because "there is no handbook" for disasters like this, a comment I hear repeatedly in New Orleans. I remind him that Hoover did provide a successful model 80 years ago - it involved near dictatorial powers - and ask if there isn't any possibility of creating a similar recovery czar for New Orleans. Having already explained to me more than once the President's position on the matter, Powell simply shakes his head in a silent "No." The man behind the rebuilding effort On the eighth floor of the rundown, 1950s-era New Orleans City Hall, at the end of a long corridor, is an office with no number. Beside the doorpost, taped over whatever sign was there before, is a single sheet of 8½-by-11-inch photocopy paper that reads, "Office of Recovery Management." This is the redoubt of Edward J. Blakely, Mayor Nagin's point man for rebuilding New Orleans. Blakely, 69, is a longtime professor of urban planning and an expert on disaster recovery. He coordinated the relief efforts in Oakland after the 1989 earthquake, and Nagin hired him to craft and implement one plan that would decide where the city would and wouldn't rebuild. Blakely inherited more than 50 plans that had been drafted by numerous consultants and community groups, and in March he presented his blueprint for spending $1.1 billion over five years on 17 "targeted areas." He promised fast results, predicting "cranes in the sky by September." Blakely fancies himself a man of action. He leads reporters on Saturday-morning bike rides through blighted and recovering neighborhoods, both to show citizens that the mayor's office is paying attention to their plight and to familiarize himself better with New Orleans. He arrived Jan. 8 of this year, "the day of the Battle of New Orleans, a providential omen," he tells me. In his spare time he is developing a residential real estate project near Riverside, Calif. On his desk sits a plaque that reads, footprints in history aren't made sitting down. For all his biking and planning, however, Blakely has yet to spend any money. For one thing, he's not certain he'll be able to find the billion dollars. He intends to get about a quarter of the money from a municipal general obligation bond passed before the storm, though it isn't legally clear whether that money can be spent on hurricane recovery. He intends to use $117 million of federal housing money from the state, and he also hopes to float a so-called "blight bond," using condemned properties as collateral for borrowing an additional $300 million. The state may be able to supply the balance. Blakely lately has begun to acknowledge that there'll be no cranes in the sky by September. (Locals cluck that only a newcomer would have promised construction projects during the heart of hurricane season.) The delay and the uncertainty over funding highlight an unfortunate fact: Blakely, too, has only so much power. He explains that some traffic lights in the eastern section of town are administered by the city and others by the state. The board that runs the sewage and water system is a separate entity over which he has little control. So despite the existence of a workable plan that generally is supported by residents, Blakely is in a holding pattern. "It takes time to build things," he says. "They don't appear overnight. It also takes a certain process to put things in order." New Orleanians I talk to admire Blakely's intellect and his ability to look at the situation dispassionately. It's impossible, however, to overlook the contradiction between his professed love of action and his calm, measured approach to what in many areas remains a crisis situation. A positive note By New Orlean standards, it's a mild summer evening on the leafy campus of Tulane University. The twilight sun dances off the stately homes along St. Charles Avenue, the toniest address in the city's Uptown neighborhood, as students jog along the dormant tracks of an electric streetcar line. This part of town is the antidote to the destruction that weighs so heavily on the soul elsewhere, an oasis of Southern charm in a blemished city. I've come to Tulane to meet its president, Scott Cowen, a professor of management and a big bear of a man whose decade in New Orleans has done nothing to soften the honk of his native New Jersey accent. As leader of the city's most prestigious university, and its largest employer, Cowen has been active with numerous recovery groups, including the New Orleans Redevelopment Authority, which is helping Ed Blakely implement the city's plan. He displays the zeal of a convert, more unabashedly boosterish of his adopted hometown than many old-school New Orleanians. Cowen launches into the positives. The port is doing well, he notes. Tourism and higher education are coming back. Of course there are problems. The Road Home assistance program "didn't work for a long time." The federal government "grossly underestimated what it was going to take to get us on solid footing." Tulane alone suffered $600 million in damage and has borrowed some $200 million for daily operations. (It is using insurance claims and FEMA grants to pay down the debt.) "The fact that the money is flowing bodes well," Cowen says. "A lot of surveys have been done, and 80 percent of the former residents of New Orleans would love to return." Counseling patience, Cowen has become a proponent of the Rule of Ten, a disaster-recovery timeline tool postulated a generation ago by a Brown University geographer named Robert Kates. It posits that the amount of time it takes for a place merely to function again is 10 times the period it was uninhabitable, which was eight weeks in the case of New Orleans. (This past March marked the 80-week point.) The time needed to completely rebuild is another factor of ten, or, for New Orleans, a total of 15 years. "I've got to believe this is one of the great development stories in America," he says, "especially as people more clearly can see the progress we're making. Developers in particular have been taking a wait-and-see attitude. But I think private money will come down in droves." With that, I thank Cowen for his time and head out into the pleasantly muggy New Orleans midsummer's night feeling ever so slightly upbeat. Finally, a conversation that began hopefully - and ended that way too. The next energy crisis: More than a quarter of America's oil flows through southern Louisiana. Too bad the land is slowly sinking into the Sea. An immigrant community thrives: This 20,000-strong Vietnamese enclave is ferociously self-sufficient. Video: Photojournalist Stanley Greene and Fortune senior writer Adam Lashinsky document the progress in New Orleans. Time returns to New Orleans: How years of misguided policies and bureaucratic bungling left New Orleans defenseless against Katrina - and we are making the same mistakes again. Sports Illustrated: A teen without much of a home even before the killer storm struck New Orleans, Joe McKnight escaped the devastation to find a second family, greater high school glory and renewed hope of playing college football. Essence: In 2005, ESSENCE met three New Orleans families whose lives changed dramatically the day the levees broke. Jeannine Amber follows up with them. |

Sponsors

|