Midwest floods may send gas up 15%

Soaring corn prices could increase the price of ethanol, driving up demand for oil and sending gas prices even higher. Some think it's time for Congress to act.

NEW YORK (CNNMoney.com) -- Continued flooding in Iowa and Illinois - the nation's top two corn-growing states - is inciting fears that the cost of the high-priced crop could soar even further, driving up ethanol and gas prices, too.

Days of heavy rain across the Midwest Corn Belt region have wreaked havoc on the crop, sending front-month prices to $7.08 a bushel on the Chicago Board of Trade Friday. Corn futures have risen for seven straight trading sessions.

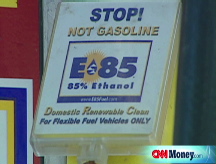

Since ethanol - a mandated ingredient in U.S. gasoline - is produced domestically with corn, rising crop prices could send already-record gasoline prices even higher.

"The floods in the Midwest will have a major impact on ethanol," said Phil Flynn, senior market analyst at Alaron Trading in Chicago.

Gasoline in the United States is comprised of only about 6% to 10% ethanol, as mandated by federal and state governments. But Flynn believes gas prices could jump 10% or 15% if corn were to hit $10 a bushel and crude oil maintains its current high level.

With the national average of gasoline at a record $4.07 a gallon, according to AAA, a 15% increase would translate into an additional 61 cents.

"Crude oil is still the predominant factor why gas prices are high, but don't think that 6% to 10% isn't going to matter," Flynn said.

But others disagree, saying ethanol has not historically kept pace with corn prices.

"Ethanol has historically been more closely tied to the price of gasoline than corn," said Geoff Cooper, director of research at ethanol trade group Renewable Fuels Association. "The value of the product is its ability to displace gasoline, not on the cost of its input."

But as Congress continues to search for a way to relieve Americans' pain at the pump, members may look to change their ethanol policies if gas prices spike another 50 or 60 cents.

"Congress is going to have a hard time justifying mandating the use of ethanol in gasoline if we lose one-third of the corn crop," Flynn said.

But simply relaxing ethanol mandates may not be enough. According to the latest short-term energy report released by the U.S. Energy Information Administration, use of ethanol has reduced U.S. oil demand by 440,000 barrels a day.

If the nation consumes less ethanol, crude oil usage - and prices - could rise as well.

"For every drop of ethanol that we're not using, we'll be using (more oil-based) gasoline," noted Flynn.

Flynn argued that the market should determine ethanol's price, saying the root of the problem was Congress' rushing the use of ethanol in the first place.

"The problem with ethanol is that it was driven by the government and not by market forces," Flynn said. "Ethanol would have come on naturally had the government not acted."

Another potential solution that is gathering support in Congress is reducing or eliminating the foreign ethanol tariff. The import tariff of 54 cents a gallon on ethanol keeps the price of imported ethanol high in an effort to support domestic farmers.

Much of imported ethanol is made from sugar cane, which is cheaper to produce than domestic corn-based ethanol.

Energy industry experts say lifting the tariff entirely will likely lower gas prices by 10 cents a gallon, but legislation that proposed canceling the tax found little support in Congress. As a result, Sens. Dianne Feinstein, D-Calif., and Judd Gregg, R-N.H., recently introduced a compromise bill to reduce the tariff to 45 cents.

"The need for inexpensive and cleaner-burning fuels continues to grow, and yet U.S. refiners are forced to pay a 54-cent tariff on ethanol imported from Brazil and other foreign sources," Feinstein said on the Senate floor last week. "This makes no sense, given the record oil prices and the limited supplies of domestic ethanol."

Gregg noted that ethanol cannot be transported through pipelines, which makes the domestic product hard to come by in some states. As a result, many non-midwestern states are forced to use foreign ethanol and pay the tariff at the pump.

"States outside the Midwest, especially ... coastal states, are at a huge disadvantage when it comes to accessing domestically produced ethanol due to shipping challenges," said Gregg on the floor. "Imported ethanol from Brazil and other friendly nations can be provided to these coastal states more easily and at a lower cost." ![]()