Friday flameout on Wall Street

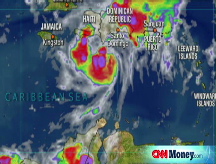

Stocks slumped at the end of a positive month and ahead of a long holiday weekend. Dell earnings, a plunge in personal income and Hurricane Gustav jitters were in focus.

NEW YORK (CNNMoney.com) -- Stocks slumped Friday at the end of an upbeat August as Dell's earnings miss, a big drop in personal income and worries about the threat of Hurricane Gustav rattled investors ahead of a long weekend.

The Dow Jones industrial average (INDU) fell 1.5%. The broader Standard & Poor's 500 (SPX) index lost 1.4%. The Nasdaq composite (COMP) slid 1.8%.

U.S. oil for October delivery hit $118.76 per barrel on the New York Mercantile Exchange, before retreating to close at $115.49, a decline of 10 cents. Nonetheless, concerns remain about the risk of higher commodity prices in an already tough economic environment. Prices have been rising of late after tumbling more than 20% off record highs of over $147 a barrel hit in mid-July.

These worries have been amplified lately by the steady advance of Hurricane Gustav, which is expected to make landfall in the Gulf of Mexico Tuesday. Facilities in the area are responsible for roughly 25% of U.S. oil production and a disruption would drive up already high fuel costs.

"Everybody understands that there's a tight oil market," said Kim Caughey, senior equity analyst at Fort Pitt Capital Group. "The question is what happens if we have another bubble that goes up to $150 a barrel when the consumer is already strapped."

The drop follows a Thursday rally, when the Dow and S&P 500 rose for their third straight session on lower oil prices and a surprisingly strong reading on second-quarter economic growth.

Friday also brought encouraging readings on the economy, including a spike in a key regional manufacturing index, the Chicago PMI. But the report was overshadowed by the other concerns.

Trading volume was light with many market pros checking out early ahead of the three-day holiday weekend. All financial markets are closed Monday for Labor Day.

All three major gauges managed gains in August. The Dow gained 1.5%, the S&P 500 gained 1.2% and the Nasdaq gained 1.8%.

Bond insurer MBIA was the biggest S&P 500 gainer in the month, rising nearly 173%, while Fannie Mae and Freddie Mac were the two biggest losers, falling 40.5% and 45% respectively.

Advanced Micro Devices was the second biggest gainer, rising 49%, while a variety of retailers were in the top 20, bouncing back thanks in part to the impact of government stimulus checks. J.C. Penney, Limited Brands, Dillard's and the Gap all gained 20% in the month of August.

August is only the third up month for the S&P 500 since October of last year, when it hit an all-time high of 1565.15.

Dell and the tech sector: Dell (DELL, Fortune 500) reported earnings after the close Thursday that fell from a year ago and missed forecasts. The PC-maker also reported sales that rose from a year ago and topped predictions. Analysts said the company cut prices too aggressively in an attempt to grab market share, hurting results. (Full story).

Dell shares slumped 13.80% Friday in active Nasdaq trade, leading a tech sector selloff.

Other big tech losers included Intel (INTC, Fortune 500), Cisco Systems (CSCO, Fortune 500), Research in Motion (RIMM) and IBM (IBM, Fortune 500).

Novell (NOVL) managed gains after the business software maker reported earnings that topped forecasts, thanks to a rise in sales of the Linux operating system. The company also said 2008 earnings would top forecasts.

Microsoft (MSFT, Fortune 500) said it is buying a European Web-comparison shopping site and its parent company for $486 million in cash. Shares slid along with the rest of the tech sector.

Financials: After rising for six straight sessions, government-backed lenders Fannie Mae (FNM, Fortune 500) and Freddie Mac (FRE, Fortune 500) both tumbled around 14%.

The financial sector as a whole rose for three sessions in a row, before backing off Friday. Dow finance components American Express (AXP, Fortune 500) and JP Morgan Chase (JPM, Fortune 500) were among the big decliners.

All 30 Dow components slid, including General Motors (GM, Fortune 500), which said it is recalling 944,000 vehicles due to a fire hazard.

Market breadth was negative while volume was light. On the New York Stock Exchange, losers beat winners three to two on volume of 960 million shares. On the Nasdaq, decliners topped advancers by nine to five on volume of 1.61 billion shares.

Personal income and spending: Income plunged in July as the impact of the $90 billion economic stimulus plan wore out. The drop was the biggest monthly decline in nearly 3 years. But spending rose in line with expectations, due to higher prices.

Personal income fell 0.7% in July after rising 0.1% in June. Economists thought it would fall by 0.2%. Personal spending increased by 0.2%, which was in line with forecasts. Spending rose 0.6% in June thanks in part to higher prices. (Full story)

Economy: Other morning reports showed improvements in manufacturing and in consumer sentiment.

The Chicago PMI, a regional read on manufacturing, rose to 57.9 from 50.8 in the previous month. Economists thought it would dip to 50.0.

The University of Michigan's consumer sentiment index was revised higher than expected in August.

Other markets: Retail gas prices rose overnight for the first time in more than a month, according to a survey of gas station credit-card activity. Gas prices are down nearly 11% from all-time highs hit in mid-July, but remain 33% above last summer's levels. (Full story.)

In the bond market, Treasury prices fell, raising the yield on the benchmark 10-year note to 3.82% from 3.78% late Thursday. Prices and yields move in opposite directions.

The dollar rose versus the euro and fell against the yen.

COMEX gold for November delivery fell $2 to settle at $833.20 an ounce.

In global trading, Asian and European markets ended higher. ![]()