Oil plunges to near 5-month low

After Gustav hit with less force than feared, crude markets - driven by a stronger dollar - sell off, even before final damage assessment is done.

NEW YORK (CNNMoney.com) -- Oil futures on Tuesday tumbled to levels not seen since early April on a strengthening dollar and concerns that an economic slowdown has crippled demand for energy.

U.S. crude futures for October delivery dropped $5.75 a barrel to settle $109.71. It was the lowest oil has settled since April 8, according to the U.S. Energy Information Administration.

Oil prices hit their lows for the day early Tuesday. Prices tumbled nearly $10 from Friday's settlement of $115.46 a barrel, according to NYMEX, as traders bet that damage to Gulf oil infrastructure from Hurricane Gustav was less than had been anticipated.

However, damage reports from the government and companies operating in the Gulf have not been released. "We're still in assessment mode, but so far, things are looking good," said Cathy Landry, a spokeswoman for the American Petroleum Institute.

Adding further pressure was the U.S. dollar, which climbed against most major currencies early Tuesday. Because crude is traded in dollars around the world, a stronger greenback puts downward pressure on oil prices. When the dollar gains, it costs foreign investors more to purchase the same amount of energy, explained Neal Dingmann, senior energy analyst at Dahlman Rose & Co.

Oil prices have plummeted nearly $38 from a record high of $147.27 a barrel, set on July 11, as demand for pricey energy slackened in a struggling economy. Now that Gustav has passed, "at least for the next 3 or 4 days, the health of the economy has come to the forefront," said Dingmann.

Another analyst also said now that the market perceives that the storm passed without great disruption, it has very quickly returned its focus on slumping global demand. "You look at the overall fundamentals," of the oil market, "and they are bearish really," said Andrew Lebow, an energy analyst at MF Global. "Gustav was just a stopping point - a brake for the time being," until prices continue their long slide.

Assess damage: While it appears that Gustav did not do major damage to the energy infrastructure in the Gulf - home to 26% of U.S. oil production and 56% of imports - the complete story of the aftermath is not yet known.

Oil prices have come off sharply on reports that Gustav was not as bad as expected because "people were sort of bracing for the worst," said Dingmann. "Early assessment that I have heard this morning is that some [production equipment] could be back on line as early as this evening."

Other analysts were more skeptical. "Though I sure hope that the production region dodged a bullet - as many market players have been saying - I think this mindset may be a bit premature," said Jim Rouiller, senior energy meteorologist at Planalytics, a firm that predicts how weather will impact businesses.

"It will take some time for all the oil and gas companies to send people out for damage assessment," said Rouiller. "Many times before, this was the initial mindset only to be followed by bad news, discovery of damage."

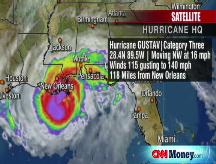

Gustav was a Category 2 hurricane when it touched land on Monday and has since been downgraded to tropical depression status. Its heavy rain and strong winds threatened oil refineries, according to Rouiller.

"What was really key was that we had a major portion of US refinery capacity shuttered," said Lebow, because the it can take a long time for refineries to restart. "Gas stocks are already on the low side so if we lose some refinery capacity for any length of time, that would be problematic."

Production suspended: Oil production, natural gas production and refineries were suspended as Gustav approached the Gulf Region. According to a U.S. Department of Energy report issued Tuesday, 100% of crude oil production was shut down in the Gulf of Mexico.

In addition, 23 refineries in the Gulf region had been shut down or were operating at reduced capacity by Tuesday, according to the report. In advance of Gustav's movement into the Gulf Coast region, 95.4% of natural gas facilities had been shut down.

Even as fears of Gustav settled, Tropical Storm Hanna was brewing, moving over the Turks and Caicos Islands. The National Hurricane Center predicts Hanna could make landfall as a major hurricane somewhere on the southeastern U.S. coast by Friday evening.

"The US remains under a heightened threat from storm impacts unlike the past few years - it is a whole different ball game this year," said Rouiller. "Gustav and Fay were just a beginning." ![]()