Danger: Bumpy retirement ahead

For decades you worked hard, earned a competitive salary, lived within your means and faithfully socked money away in your 401(k). Yet here you are in your fifties or sixties, and suddenly your retirement dream has turned into a nightmare.

|

| You may think you're on track for a swell retirement. But between then and now lies the...Dangerous Passage |

|

| You thought you could trust stock market returns to carry you. Now you're not sure what to trust. |

|

| A few fairly simple tactics can buy you peace of mind and assurance that your money won't run out. |

|

| The 10 years before retirement and five years after make up the riskiest period of your financial life. |

(Money Magazine) -- The decade before you quit the work force, along with the five years immediately after, is the most sensitive period in an entire lifetime of retirement planning. The saving, investment and career decisions you make during this time will dictate in a major way whether you'll spend the next 30 to 40 years enjoying the life you've always looked forward to or eating the early-bird special at Denny's.

Even if you do everything right, perils outside of your control lurk at every turn: A parent or adult child suddenly needs your financial help, so you can't save as much as you'd planned. You develop a health problem and are forced to stop working sooner than you expected. An employer pushes you into early retirement. Or the financial markets suddenly and sharply turn against you. Sound familiar?

Welcome to the Dangerous Passage, starring...you.

"It's natural to have a queasy feeling at this time in your life, wondering if your retirement will happen as planned," says Joseph Chadwick of the Longevity Alliance, a financial services firm that specializes in retirement products. "But there's no need to panic."

Dim the lights to view the plot twists you may encounter and the strategies you need to follow to keep your story moving in the right direction. Understand that whatever dangers you face, you still have time. You just need to do what Hollywood does when the script isn't building to the desired ending: rewrite.

OPENING SCENE: Retirement is closing in like G-men on the heels of Bonnie and Clyde. But you don't have the dough you need.

Sure, you've been steadily contributing to your 401(k) and IRA for years now. But it's still awfully hard to amass as much as the experts say you'll need. The numbers are ridiculously daunting: If you're currently in your fifties, your retirement portfolio at this point should be worth six to eight times your salary. By 60 you should have saved about 11 times your income, and by 65 the equivalent of 15 times your earnings.

And the markets aren't exactly helping matters lately. The housing slump has thwarted dreams of cashing in and retiring on the house, while lackluster stock market returns haven't provided the gains you were banking on. "For much of the past 25 years the markets did most of the work for you, but you can't expect them to carry you in the future," warns Bill Bengen, a financial adviser in El Cajon, Calif. He adds, "The only way you'll reach your retirement goal is to commit to having more money pulled out of your paycheck."

You probably have plenty of opportunity to save more in taxadvantaged plans. In a recent survey of nearly a million 401(k) accounts, retirement research firm Financial Engines found that a quarter of 401(k) investors 50 or older don't even contribute enough to qualify for the maximum employer match (typically 50% of the amount you put in, up to 6% of your salary).

And only 6% of eligible participants take full advantage of catch-up provisions that allow those 50 or older to save an extra $5,000 a year in a 401(k), for a total of $20,500 this year (you can put an additional $1,000 in an IRA, or up to $6,000 in 2008).

The time to start pumping up those contributions is now, right now, even if you plan to stay in the work force another 10 years or more. Because you never know when something could happen to change your plans. More than a fifth of the retirees in a Sun Life survey reported that they had been forced into retirement, eight years earlier than expected on average, typically because of downsizing or ill health.

And if you do keep working, the sooner you get with the savings program, the greater the benefit. A couple who manage to save an extra $10,000 a year for 10 years - that is, who both max out their catch-up contributions - could retire with an extra $152,000, assuming they earn an average of 8% a year.

Before you convince yourself that kicking in $416 more a month (which is what $5,000 a year amounts to) will put you in a financial bind, go ahead and try it. Automating contributions is often all that it takes to get on - and stay on - a more rigorous savings plan. Then put some elbow grease into wringing any excess out of your spending so you don't feel a financial pinch. "

From making your home more energy-efficient to limiting your shopping to mostly sale items, it's amazing how a lot of small savings can help over time," says financial adviser Lou Stanasolovich, founder of Legend Financial Advisors in Pittsburgh. Rethinking your bigger-ticket expenditures will, of course, help matters too. "I am always amazed when people tell me they just spent $10,000 on a big family vacation but then complain about how they can't afford to contribute more money to their 401(k)," says Stanasolovich.

PLOT TWIST: Okay, okay, you're all set to start saving more - a lot more. Then your kid shows up with an acceptance letter to NYU.

In theory, saving more should be easier now than at any other time in your life. After all, you're in your peak earning years and are mostly done with establishing a comfortable home and raising a family and paying the hefty bills that go with that.

If only. You may be past orthodontics and summer camp - and that's a big maybe given the older age at which many boomers started families - but you're likely still spending serious money on your kids. Nearly 60% of boomers and almost 40% of those 60 and older with children over 18 say they're still supporting them to some degree, from paying for college to lending a hand with rent, a car or other expenses, the Pew Research Center reports. Nearly 30% of boomers are also supporting an aging parent, sometimes at the same time as they're helping their kids.

So if family responsibilities prevent you from saving as much as you should, where will the extra money you need for retirement come from? "Working longer is the best possible safety valve to ensure you will have enough retirement income," says Olivia Mitchell, head of the Boettner Center for Pensions and Retirement Security at the University of Pennsylvania. "Every year you delay retirement is a year you can save more and a year you don't draw down your savings."

Adds Alicia Munnell, director of Boston College's Center for Retirement Research: "No one is suggesting you have to keep working until you are 90. Just two or three more years will help tremendously."

The math is compelling. According to an analysis by T. Rowe Price, every year you postpone retirement adds about 7% to the retirement income you can eventually expect to earn from your investments. A 62-year-old who delays his exit from the work force until age 65 will see the income generated from his retirement account rise 22% (based on a salary of $100,000, a well-diversified portfolio worth $500,000 and 15% annual salary contributions); if he waits until 67, he'll get 39% more.

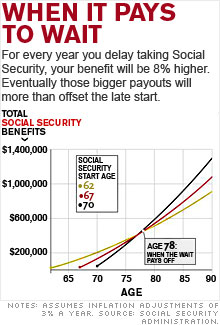

Staying on the payroll longer likely also means you'll be able to postpone drawing Social Security benefits. While you can collect starting as early as age 62, your benefits will be permanently reduced if you do; every year you delay between ages 62 and 70 adds 8% to your eventual payout. For example, someone who retires this year and qualifies for the maximum early benefit can collect $20,244. Put off drawing the benefit until age 70 and the annual payout will be $35,629 (in today's dollars).

Working longer is the wonder cure for a multitude of ailments that can imperil your retirement plan. It buys time for your portfolio to recover from the market's recent nosedive. And it helps keep health-care costs in check until you qualify for Medicare at age 65.

That's why Julius Roy is still behind the counter as a pharmacist in Slidell, La. at 60 and why he intends to stay there a few more years. Although Julius and his wife Diane, 64, also a pharmacist, have more than $1.6 million in their investment accounts, he doesn't want to give up his employer-provided health insurance. Having undergone double bypass surgery when he was 40, he figures he'd have a tough time qualifying for a private policy and might still face big expenses if he was hit by a major illness. "Staying at work a few more years to stay insured could make all the difference to my financial security in the long run," Julius says.