What MySpace Music means for Amazon

The online retailer needs to steal music customers from Apple. MySpace can help.

|

| MySpace Music will give Jeff Bezos access to the social networking site's 120 million members. |

(Fortune) -- Jeff Bezos has done it again. The Amazon (AMZN, Fortune 500) CEO has created an MP3-download store that has quickly become the second largest digital music outlet after Apple' (AAPL, Fortune 500)s iTunes. Now he's struck an exclusive deal to build a similar store for the soon-to-launch MySpace Music.

What does the MySpace (NWS, Fortune 500) deal mean for Amazon? It could mean a lot. The Amazon store is second place only a year after its launch. But it still trails Apple by a huge margin. Gene Munster, senior research analyst at Piper Jaffrey, estimates that Apple will sell 2.4 billion songs this year, giving it an 85% market share. By contrast, he says, Amazon will sell 130 million downloads - 5% of the market.

Munster says Amazon's sales should climb by 60% next year to 208 million songs. That should be enough to keep the Seattle-based online retailer ahead of other digital music stores run by companies like Napster and Wal-Mart (WMT, Fortune 500). But it's a long way from Apple's billions.

Amazon needs to start stealing customers from iTunes if it wants to level the playing field. That's not happening yet. Most of Amazon's digital music customers are currently people who are already buying CDs on the site, says Russ Crupnick, senior entertainment industry analyst for the market research firm NPD.

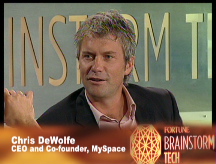

This is where MySpace Music, which launches later this month, comes into play. The joint venture with Universal, SonyBMG and Warner Music (WMG) will allow the social network's 120 million members around the world to stream the entire catalogues of these music giants for free. It gives Amazon access to an online community teaming with young music fans who patronize the iTunes store. Granted, many will remain loyal to Apple. After all, iTunes isn't just a store. It's the software iPod owners use to manage their music collections.

But Amazon is doing something that could persuade even the staunchest Apple fans to switch: it's beating iTunes' prices. Amazon sells most songs for 89 cents - 10 cents less than iTunes. It also offers a different album each day for $1.99. (The other day it was Radiohead's OK Computer.) On Friday, Amazon also puts five albums on sale for $5 each. There are plenty of other bargains on the site, too.

"We've discovered that customers love low prices, and we continue to figure out great ways to offer low prices," says Bill Carr, Amazon's vice president for digital media. "It gives people a great reason to come back and check out our site everyday."

This is the kind of innovative thinking that's been missing from Apple's other rivals. Some of the biggest names in media and technology - everybody from Microsoft (MSFT, Fortune 500) to Wal-Mart (WMT, Fortune 500) - have tried to steal Apple's music customers since it unveiled the iTunes store in 2003.

But none of them gave Apple loyalists a good reason to switch. Apple sold songs for 99 cents. So did everyone else. Apple sold songs with copy protection software so they could only be played on the iPod. Its competitors stocked their download stores with tunes wrapped in similar software that locked them into other portable devices. (You know, the ones that nobody really wants.)

No wonder they didn't get any traction.

Amazon wasn't so clueless. It was the first to get the four major record companies - Warner Music, Universal, SonyBMG and EMI - to abandon copy-protection software altogether. That meant its library of songs could be played on any portable player from the iPod to the Microsoft Zune.

Now Amazon is challenging iTunes in the social networking world. Both Amazon and iTunes can be found on Imeem, a music social network with 27 million members and deals with the four major labels that allow visitors to stream their entire catalogues for free. If Imeem users hear a song they like, they can click a link and go to either store to buy it. But MySpace Music promises to be much bigger. And iTunes won't be there.

Bezos has every reason to pound his chest. He doesn't get 120 million potential new customers every day. That's nothing to sniff at - especially when you are number two and you have a lot of catching up to do. ![]()

-

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More -

This group of companies is all about social networking to connect with their customers. More

This group of companies is all about social networking to connect with their customers. More -

The fight over the cholesterol medication is keeping a generic version from hitting the market. More

The fight over the cholesterol medication is keeping a generic version from hitting the market. More -

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More -

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More -

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More -

Once rates start to rise, things could get ugly fast for our neighbors to the north. More

Once rates start to rise, things could get ugly fast for our neighbors to the north. More