Credit still crunched; Treasurys bounce

Jittery investors wait for the Senate to vote on the bailout bill, but unease sends debt prices higher.

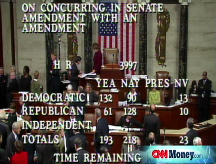

NEW YORK (CNNMoney.com) -- Credit markets remained choked Wednesday as investors waited to see if the Senate would pass a $700 billion bailout bill giving most Treasurys a boost.

The fiercely debated bailout bill, which the House of Representatives rejected Monday, could work to break the jam that has been hindering the flow of cash between banks and to consumers. With nobody lending cash, the economy is in jeopardy.

The Senate plans to vote on the rescue plan - with new provisions - Wednesday evening.

The bailout plan would allow the government to take severely devalued mortgage assets off the hands of beleaguered financial institutions, freeing them to resume lending activity.

Bailout doubt: However, market sentiment was growing that the bailout may not be the quick-fix for the credit markets that Wall Street had hoped. The skepticism about the bailout was not only keeping banks sitting on their cash, but also pushing Treasury prices higher.

"The bailout package, as we know at the moment, is not going to make banks more willing to lend to each other," said Michael Cheah, senior portfolio manager at AIG SunAmerica. "More and more people are coming to the realization that this $700 billion is merely addressing the symptoms of our problem."

The fundamental problems with the economy are "one, falling home prices, and two, falling confidence level in the market," said Cheah.

Home prices fell a record 16.3% in July from the same month a year ago, according to the Case-Shiller home price index released Tuesday. The decline in housing prices has degraded a lot of mortgage-based assets.

"Confidence is falling rapidly because a lot of what the government has done so far is either incoherent, inconsistent but more importantly ineffective," said Cheah. Strong opposition to the plan claimed taxpayers should not be bearing the brunt of Wall Street's blunders.

"Now people will be looking at the details of the bill," said William Larkin, portfolio manager at Cabot Money Management. "People are going to be looking at how this is going to help the guy on the street who is having trouble to pay its mortgage."

While Larkin does think a bailout will most likely be passed, he also said market psychology may remain grim and "you may get people on the Street on the defensive."

As skeptical as U.S. taxpayers may be of the bailout, other countries "are looking at the U.S. and saying the U.S. has been very aggressive with this banking problem," said Larkin. While a solution may still be murky, at least "we are in the process, trying to fix it," he added.

Market gauges: What little lending is happening is expensive for the borrower. When banks charge each other a higher premium to borrow, that cost trickles down to the consumer who might be looking for an auto loan, a mortgage or a school tuition loan.

One indicator of how willing banks were to lend to other banks, called the "TED spread," showed high prices of loans between banks. The TED spread measures the difference between 3-month Libor and the 3-month Treasury borrowing rates and is a key indicator of risk. The higher the spread, the bigger the aversion to risk.

On Wednesday, the spread retreated to 3.27%, after surging as high as 3.53% Tuesday, its highest level in more than 25 years, according to Bloomberg.com. On Sept. 5, the TED spread was only 1.04%.

Furthermore, the difference between the 3-month Libor and the Overnight Index Swaps dipped to 2.44%, just lower than a record high 2.46% spread Tuesday, according to data reported by Bloomberg.com.

The Libor-OIS "spread" measures how much cash is available for lending between banks, and is used by banks to determine lending rates. The bigger the spread, the less cash is available for lending.

The Libor, or the London interbank offered rate, is a daily average of what banks charge other banks to lend money in London.

The 3-month Libor rate, up to 4.15% Wednesday from 4.05% Tuesday, has been trending higher for some time as the European economy has been facing credit shortages and bank failures of its own. Since Sept. 15, the rate's acceleration has increased.

The overnight Libor rate dropped sharply to 3.79% Wednesday, according to data reported by Bloomberg.com. It hit an all-time high of 6.88% Tuesday, according to the British Banking Association, which has been keeping records since 1984.

The overnight bank-to-bank lending rate spiked Tuesday because Sept. 30 was the end of the fiscal quarter and companies needed cash quickly to make their balance sheets appear healthy.

"Going into the end of September, quarter end, money was tight and the Libor interest rate was going up," said Cheah. The "balance sheet as of Sept. 30 is just like a photo shoot, a click," he added, meaning that companies rush to primp their balance sheets at the last minute by borrowing cash.

Even thought the overnight Libor rate dropped off significantly, Cheah explained that it was not a signal that the credit markets were loosening. The 3-month Libor rate was a more accurate indicator of the status of the credit markets. For the 3-month Libor rate to have jumped overnight, even after the quarter ended, showed that banks were still hoarding cash.

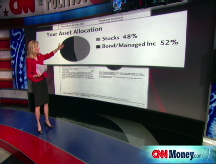

Treasurys: Investors use government bonds as a safe-haven to park their assets. As the next chapter of the bailout saga drags on Wednesday, bond prices mostly rallied.

The benchmark 10-year note rose 22/32 to 102-4/32 and its yield fell to 3.75% from 3.85% late Tuesday. Bond prices and yields move in opposite directions.

The 30-year bond rose 1-22/32 to 104-25/32 and its yield fell to 4.22% from 4.36%.

The 2-year note edged up 8/32 to 100-10/32 and its yield dipped to 1.85%.

The yield on the 3-month bill rose to 0.90% from 0.85% as prices ticked lower. The 3-month note is a popular asset for money markets looking for stability because it offers a safe place to park cash on a short-term basis.

FDIC steps in: With investors jittery and confidence in the banking system breaking down, the Federal Deposit Insurance Corporation announced Tuesday that it would increase the amount that the agency would insure. The FDIC is the agency that insures depositors in case of a bank failure.

Chairwoman Shelia Bair issued a statement asking that Congress allow her agency to increase the $100,000 limit per account, which was set in 1980. "To address this crisis of confidence, I do believe that it would be helpful for the FDIC to have the temporary ability to raise deposit insurance limits," she said. ![]()