Bonds lower as stocks advance

Treasurys fall as credit continues to loosen, but analysts remain cautious.

NEW YORK (CNNMoney.com) -- U.S. Treasury prices fell Thursday, as investors shifted funds to stocks throughout the world following rate cuts by Federal Reserve and other central banks.

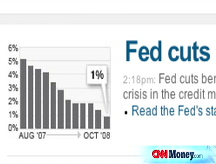

The Fed lowered its key funds rate to 1% on Wednesday, with banks in Hong Kong and Taiwan following suit Thursday. As stocks in Europe and Asia rose, investors were coaxed out from the shelter of low-risk, but low-yielding, government-backed securities.

"The bond market's reaction to the Fed is manifested in the Treasury market," said David Ader, head of government bond strategy at RBS Greenwich Capital.

Bonds: The benchmark 10-year note fell 21/32 to 100-16/32 and its yield rose to 3.93% from 3.85% late Wednesday. Bond prices and yields move in opposite directions.

The 30-year bond sank 21/32 to 103-22/32 and its yield rose to 4.28% from 4.23%. The 2-year note fell 2/32 to 99-27/32 and its yield rose to 1.58% from 1.54%.

However, the yield on the 3-month bill, which analysts use as a close gauge of investor confidence, fell to 0.40% from 0.61% on Wednesday as the price ticked higher.

Investors and money-market funds shuffle money into and out of the 3-month bill frequently, as they assess risk in the rest of the marketplace. A higher yield indicates that investors are slightly more optimistic.

Fed efforts: Many experts had expected the Fed to cut its key rate, since lending among banks remains tight. The rate cut was the latest move by the central bank to thaw frozen credit markets.

Over the past three days, the Fed has issued record amounts of commercial paper - short-term loans that businesses use to fund their daily operations. The market for this sort of debt had all but dried up, particularly for three-month paper, after the collapse of Lehman Brothers in mid-September.

On Wednesday, the Fed issued $62.6 billion in commercial paper with maturities of more than 80 days. That was just a bit below Monday's $67.1 billion issue, the largest amount purchased in a single day since the central bank began maintaining records in 2001.

For the first three days of this week, the central bank has issued $171.3 billion in paper.

If coordinated efforts by the Federal Reserve and the Treasury Department successfully stimulate the economy, and the economy turns around, it could eventually lead to higher Treasury yields and lower prices, due to inflation, according to Kenneth Naehu, managing director and head of fixed income at Bel Air Investment Advisors.

"That could cause [yields on 10- and 30-year Treasurys] to go higher," he said.

Credit gauges: Credit continued to show signs of loosening in the wake of the Fed's latest move.

The 3-month London Interbank Offered Rate, or Libor, a gauge of the interest rate banks charge each other to borrow money, fell to 3.19% from 3.42% Wednesday, according to Dow Jones. The overnight Libor rate fell for the fourth straight day to 0.73%, its lowest level since 2004, from 1.14%.

Lending rates have been trending downward for nearly two weeks. Libor is a daily average of what 16 different banks charge other banks to lend money in London. The higher the rates, the more expensive it is for banks to borrow money.

When the overnight Libor is cheaper than the Fed lending rate, it's easier for banks to borrow money from private sources, which keeps cash flowing through the economy.

Ader urged caution, however, saying "You're seeing some improvements in some spreads, but they still remain very wide... We are at the beginning of [a thaw] at best."

Two other key indicators of risk sentiment also showed that confidence in the market was improving.

After the Fed cut rates Wednesday, the Libor-OIS spread fell to 2.49 from 2.65 points the day before. The spread measures how much cash is available for lending between banks, and is used for determining lending rates. The smaller the spread, the more cash is available for lending.

Another indicator, the "TED spread," fell to 2.79 percentage points from 2.81 points on Tuesday. The TED spread measures the difference between the 3-month Libor and the 3-month Treasury bill, and is a key indicator of risk. The lower the spread, the more willing investors are to take risks. ![]()