Stocks stage rally

Wall Street charges an advance after a mixed morning as investors welcome Merck earnings and a surprise rise in pending home sales.

NEW YORK (CNNMoney.com) -- Stocks rallied Tuesday, erasing morning losses, as investors focused on the day's positive earnings reports and a surprise rise in a key measure of home sales.

The Dow Jones industrial average (INDU) added 141 points, or 1.8%.

The Standard & Poor's 500 (SPX) index gained 13 points, or 1.6%. The Nasdaq composite (COMP) gained 22 points, or 1.5%.

Stocks seesawed through most of the session before finding momentum in the afternoon, with commodity, tech, retail and housing stocks all rising. The financial sector was a notable decliner.

Better-than-expected results from drugmakers Merck and Schering-Plough, as well as homebuilder D.R. Horton, helped counter the barrage of mixed to gloomy corporate data. A surprise rise in the pending home sales index helped, too. But any gains were limited by continued worries about the economy.

"Between the home sales number and Merck you had a bit of good news," said John Wilson, market strategist at Morgan Keegan. "In this environment, any bit of good news helps."

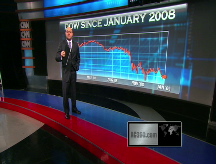

He said that stocks were also perhaps due for a bounce, after Wall Street suffered the worst January on record and the Dow touched a two-month low Monday.

Longer term, investors remain wary of the outlook for the economy and the gridlock in Congress that is delaying the passage of an economic stimulus package, Wilson said.

Job cuts, weak economic reports and a blistering start to the fourth-quarter earnings reporting period have been dragging on stocks this year.

"It seems like every day you come in and hear that a company is reporting weak results and cutting jobs," said Ryan Detrick, senior technical strategist at Schaeffer's Investment Research. "I think just the absence of some of that is going to be positive for investors."

Detrick said that by next week, the majority of the fourth-quarter corporate results will have been released and investors will know more fully what they are dealing with. And by next week, investors will have gotten past the labor market hurdles of this week.

After the close, Walt Disney (DIS, Fortune 500) reported weaker quarterly sales and earnings that missed expectations. Shares of the Dow component fell 3% in after-hours trading.

Wednesday preview: Payroll processing firm ADP releases its monthly private-sector employment report Wednesday morning before the market opens. Economists expect that 515,000 jobs were lost in January, after 693,000 were cut in December.

The report is something of a harbinger of the larger government report due Friday.

Wednesday also brings the weekly oil inventories report and the ISM reading on the services sector of the economy.

Kraft Foods (KFT, Fortune 500) reports earnings in the morning. The Dow component is expected to have earned 44 cents per share after earning 44 cents a year ago.

Autos: Sales at Ford Motor, GM, Honda, Nissan and Chrysler all plunged more than expected in January, with the auto industry seeing its worst monthly sales in 26 years.

Sales at Ford Motor (F, Fortune 500) fell 40% in January, missing forecasts for a drop of 30%. General Motors (GM, Fortune 500) sales tumbled 49% in January, versus forecasts for a drop of 38%.

Separately, GM said it was offering buyouts to all of its hourly workers in an attempt to cut costs and give nervous workers a way out. Chrysler made a similar announcement Monday.

Economy: Pending home sales rose 6.3% in December, according to a report from the National Association of Realtors released Tuesday morning. Sales rose as lower home prices and mortgage rates brought out buyers. Economists surveyed by Briefing.com thought sales would hold steady after sliding a revised 3.7% in the previous month.

Corporate results: Investors sorted through a mix of quarterly results Tuesday, including reports from Dow component Merck and package-delivery firm UPS.

Merck (MRK, Fortune 500) reported better-than-expected quarterly sales and earnings thanks to strong sales of its diabetes drugs. Fellow drugmaker Schering-Plough (SGP, Fortune 500) also reported higher quarterly earnings. Merck shares rose over 6% and Schering-Plough rose 8%.

D.R. Horton (DHI, Fortune 500) reported a smaller quarterly loss versus a year ago that was narrower than what analysts had forecast. Shares rallied 21%, joining a parade of homebuilder stocks that were surging on the pending home sales index.

UPS (UPS, Fortune 500) reported better-than-expected quarterly earnings on worse-than-expected quarterly sales. The company, seen as a proxy for the economy, said package volumes are down because of the recession and that it would be cutting costs going forward. Shares gained 6%.

Motorola (MOT, Fortune 500) reported a quarterly loss versus a year-ago profit on weaker sales. However, both earnings and sales results topped analysts' expectations. The telecom also warned that it will post a bigger-than-expected first-quarter loss, that it is suspending its dividend and that it is in search of a new chief financial officer. Shares fell 11%.

Citigroup (C, Fortune 500) issued its first progress report on how it's spending the $45 billion it received in government funds. The bank said it has approved the use of $36.5 billion to issue mortgages, make credit-card loans and buy troubled assets. Citi shares fell 5%.

Other big financial stocks slipped too, including Bank of America (BAC, Fortune 500), American Express (AXP, Fortune 500) and JP Morgan Chase (JPM, Fortune 500).

Corporations announced almost 8,000 job cuts Tuesday, includingPNC Financial (PNC, Fortune 500), which reported a big fourth-quarter loss and said it was cutting 5,800 jobs. Also, Liz Claiborne (LIZ, Fortune 500) said it was cutting 725 jobs. PNC shares fell 7% and Liz Claiborne shares rose 8%.

Market breadth was negative. On the New York Stock Exchange, winners beat losers three to two on volume of 1.35 billion shares. On the Nasdaq, advancers beat decliners five to four on volume of 2.12 billion shares.

Senate debate: After a narrow party-line approval in the House of Representatives last week, the economic stimulus package has moved to the Senate this week. The plan that is before the Senate would increase the deficit by $885 billion over the next ten years, according to a report from the Congressional Budget Office.

Bonds: Treasury prices rallied, lowering the yield on the benchmark 10-year note to 2.88% from 2.72% Monday. Treasury prices and yields move in opposite directions. Yields on the 2-year, 10-year and 30-year Treasurys all hit record lows last month.

Lending rates inched higher. The 3-month Libor rate rose to 1.23% from 1.22% Monday, according to Bloomberg.com. The overnight Libor rate rose to 0.31% from 0.28% Monday. Libor is a bank lending rate.

Other markets: In global trading, Asian markets were mixed, while European markets ended higher.

The dollar fell versus the euro and yen.

U.S. light crude oil for March delivery rose 70 cents to settle at $40.78 a barrel on the New York Mercantile Exchange.

COMEX gold for April delivery fell $14.70 to settle at $892.50 an ounce.

Gasoline prices rose 1 cent to a national average of $1.89 a gallon, according to a survey of credit-card swipes released Tuesday by motorist group AAA. ![]()